As a seasoned crypto investor with over a decade of experience navigating the volatile waters of digital assets, I find myself cautiously optimistic about Bitcoin‘s future. The recent price predictions by analysts suggest a potential short-term downturn, with some even forecasting a crash to $60,000. However, I’ve learned that Bitcoin’s journey is anything but linear, and it often defies expectations in the most surprising ways.

Based on predictions by notable Bitcoin experts, it’s possible that the value of Bitcoin could plummet to around $60,000 within the next few months. The progress of Bitcoin has slowed down lately, and its significant increases in value might not be as robust as they seem.

Multiple experts forecasted a positive 2025 trend for Bitcoin, yet they also warned of a temporary, significant drop in its value in the near future. After this dip, they expect another bullish phase to emerge.

Will the Price of Bitcoin Crash

As a crypto investor, I’ve been closely following the Bitcoin price predictions made by Ali Martinez, a well-respected analyst in our field. However, I must admit that the forward momentum of Bitcoin’s price has taken a noticeable downturn lately, which has stirred doubts about whether the $110,000 target for New Year’s Eve remains attainable.

Some top experts believe that Bitcoin’s price may continue falling due to insufficient buyer interest at various levels and the ongoing oversupply in the market.

According to Tone Vays, our Monday trading will commence below the $95,000 mark. He likened this situation to sliding into a range near $92,000, warning that we’re approaching dangerously close to it. This could potentially trigger a major market crash, as going too low might even open the door to such a collapse, similar to Pandora opening her box. The odds of a drop to around $73,000 have grown substantially, he cautioned. Tone Vays emphasized that we’re currently teetering at the last line of support.

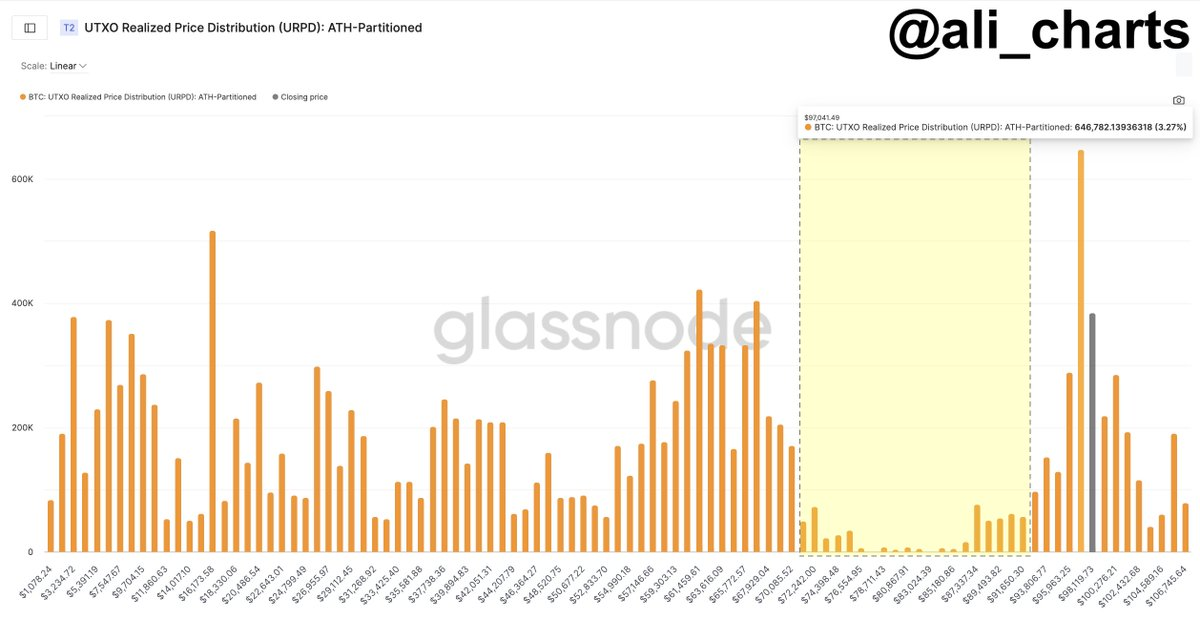

Over the last seven days, Bitcoin’s value has been holding steady within a critical region, roughly spanning from $93,800 to $97,000. A fall below this zone might trigger a swift decline towards the $70,000 mark, as there appears to be little resistance underneath it. Regrettably, Bitcoin’s price is currently teetering at the lower boundary of this range.

He also noted several trends that clearly reflect a growing nervousness in the Bitcoin community. For example, investors sent more than $3 billion in BTC to exchanges in the last week, as Bitcoin whales have limited their exposure. The ETFs, normally a source of immense returns, have also witnessed outflows exceeding $1 billion.

Even bullish predictions for the future still contain a hint of pessimism. For example, analysts from the Into the Cryptoverse podcast compared Bitcoin to the price movements of Invesco QQQ in the 90s. It shot up in a very similar manner to BTC this year, crashed dramatically, and then rose again to completely outpace this first bull market.

According to Thomas Lee, the CEO of Fundstrat Capital and a CNBC contributor, he predicts that Bitcoin will be approximately $250,000 in a year. However, since Bitcoin is extremely volatile, Mark Newton, our technician, suggests a slight downturn in its cycle early next year, which could potentially bring the price of Bitcoin down to around $60,000 before reaching the predicted $250,000 mark.

In essence, leading financial managers remain confident and optimistic about Bitcoin’s price trajectory, as evidenced by their bullish forecasts. For instance, Bitwise projected that BTC could surge to $200,000 by 2025, with steady growth. Pantera Capital went a step further, predicting an impressive leap to $740,000 by the year 2028.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- PENGU PREDICTION. PENGU cryptocurrency

- 30 Best Couple/Wife Swap Movies You Need to See

- All 6 ‘Final Destination’ Movies in Order

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- Clair Obscur: Expedition 33 – Every new area to explore in Act 3

- All Hidden Achievements in Atomfall: How to Unlock Every Secret Milestone

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

- ANDOR Recasts a Major STAR WARS Character for Season 2

2024-12-27 23:10