In the land where the dollar once reigned alone, a new coin glimmers in the pockets of nearly 50 million Americans—14.3% of the population, if you’re counting (and who isn’t?). The River report, with all the solemnity of a census and none of the poetry, declares the U.S. the world’s bitcoin capital. Meanwhile, 32 American public companies, clutching their digital wallets like Dostoevsky’s gamblers, hoard bitcoin as a treasury asset—totaling a market cap that would make even Gatsby blush: $1.26 trillion.

Bitcoin Ownership Demographics and Corporate Adoption

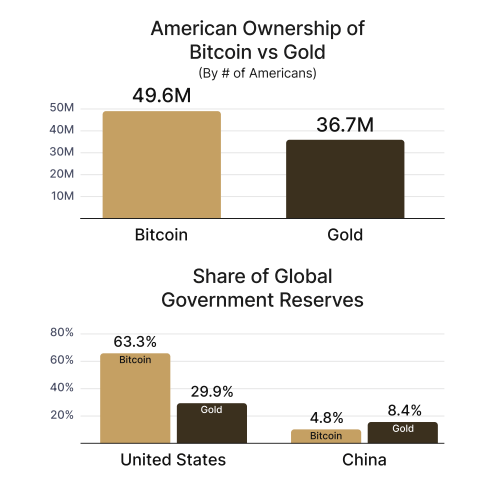

According to the River report, nearly 50 million Americans—14.3% of the nation—have embraced bitcoin (BTC). This is not just a number; it’s a chorus of digital pioneers, each convinced they’re ahead of the next gold rush. The U.S. outpaces North America’s average by more than three percentage points, because why settle for average when you can be exceptional (or at least think you are)?

The report, with a straight face, credits “access and culture”—as if Americans needed another excuse for risk-taking. The country’s “deep-rooted” entrepreneurial spirit and love for financial freedom have made bitcoin less a currency and more a rite of passage. No accreditation required; just bring your optimism and a Wi-Fi connection.

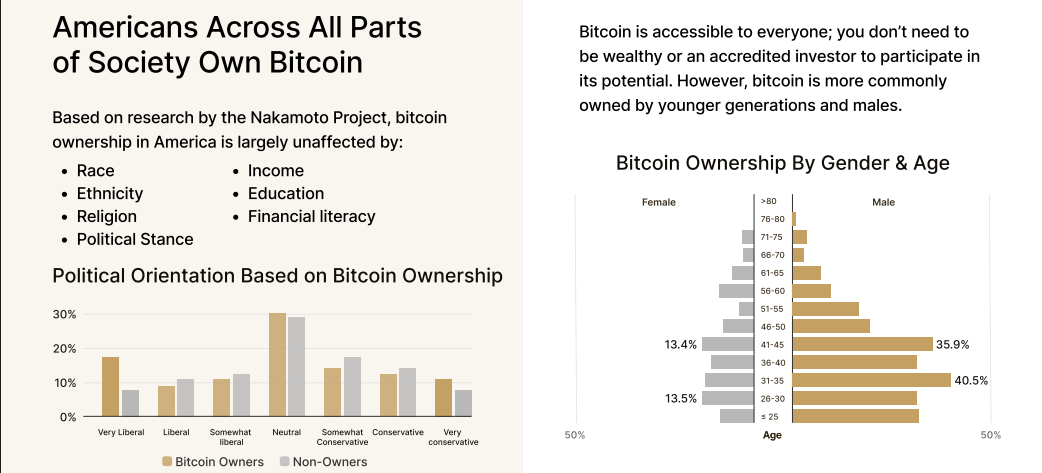

Apparently, ideology, race, ethnicity, or religion don’t drive this digital gold rush—just good old-fashioned FOMO. Males and younger Americans lead the charge, perhaps because they still believe in magic internet money. Corporations, not to be outdone by individuals, are now treating bitcoin as a legitimate treasury asset—because nothing says “fiscal responsibility” like volatility.

“Thirty-two American public companies, representing a combined market capitalization of $1.26 trillion, hold Bitcoin as a treasury asset. These companies account for 94.8% of all Bitcoin owned by publicly traded firms worldwide,” the River report intones, as if reading from scripture—or maybe just their quarterly earnings call.

ETF Adoption and Bitcoin’s Broader Impact

The arrival of bitcoin ETFs in early 2024 opened the floodgates for individual investors and pension funds alike. Now, more than half of America’s 25 largest hedge funds and investment advisors hold bitcoin via ETFs—because nothing says “safe retirement” like a rollercoaster ride through crypto markets.

Bitcoin isn’t just an asset; it’s a philosophical debate with a price ticker. Is it better than gold? Is it the answer to economic uncertainty? Or is it just another chapter in America’s love affair with speculation? Meanwhile, over 20,000 Americans have found jobs in more than 150 bitcoin-related companies—proof that if you can’t mine gold, you might as well mine code.

On the mining front, the U.S. now commands 36% of global hashrate—more than twice China’s share. Since 2020, America’s hashrate dominance has surged over 500%, because when Americans do something, they do it loudly—and with plenty of electricity. ⚡️💸

Would you like me to explain or break down any part of this code?

Read More

2025-05-23 02:09