Right, let’s talk American Express. American Express (AXP +2.17%). Honestly, when you think “dividend stock,” it’s not the first name that springs to mind, is it? More likely, it’s…well, something boringly reliable. But here we are. As of mid-January, the yield is… modest. Around 0.9%. Don’t get excited. But, and this is where it gets interesting, they’re not exactly shy about returning cash to shareholders. Which, let’s be real, is always a good look.

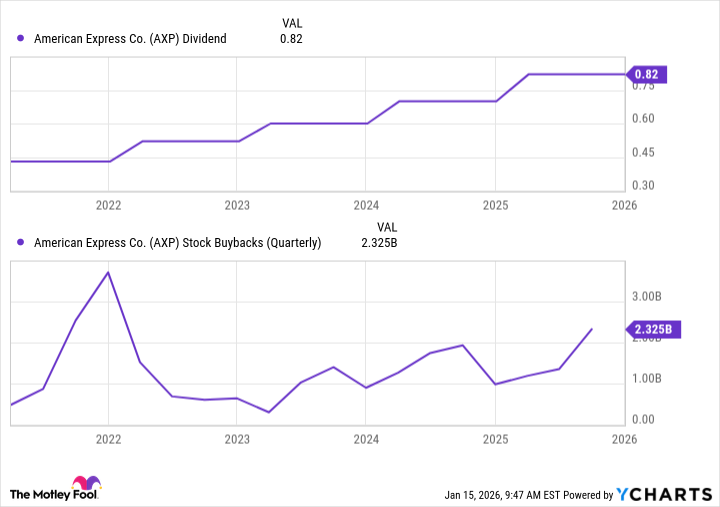

They’ve been rather aggressive with those annual dividend increases and share repurchases. Over the last four payouts, we’re talking $0.82 a quarter, $3.28 annually. That’s a 17% jump from last year. 17%! And 90% higher than it was five years ago. They’re practically throwing money at us. (Don’t tell my accountant I said that.)

And it’s not just dividends. They’ve been buying back shares like they’re going out of style. $2.3 billion in the last quarter alone. 7.3 million shares vanished. Poof. Over $25 billion in the last five years. It’s…a statement, isn’t it? Like, “We have money. Lots of it.” Which, admittedly, is reassuring.

Let’s Be Honest About Why This Works

Here’s the thing. You don’t have to worry about them suddenly running out of funds. In the third quarter, that $0.82 dividend represented just 19% of their diluted earnings per share. $4.14 a share. They’re expecting full-year EPS between $15.20 and $15.50. So, yeah, they can afford it. They’re basically printing money, and then…sharing a little. It’s a surprisingly generous impulse, really.

They trail Visa and Mastercard in overall cards and acceptance, but that’s deliberate. Amex isn’t trying to be everything to everyone. They’ve positioned themselves as the luxury card. Perks, prestige, the whole shebang. It’s a clever strategy, honestly. People will pay for the feeling of exclusivity. And they do. Handsomely.

People are willing to shell out enormous annual fees for those perks. It’s essentially a subscription service. A very expensive one, admittedly. But guaranteed income is…comforting. Plus, Amex operates its own payment network and issues its own cards. That means they get a cut from transactions, interest, and merchant fees. Visa and Mastercard just run the network. Someone else does the dirty work. Amex does it all. It’s exhausting, frankly, but profitable.

Why I’m Actually Considering Buying Some

Amex is attracting a younger crowd, which is…smart. Around 64% of new accounts are millennials or Gen Z. And those customers are spending 25% more than everyone else. 25%! It’s like they’re trying to make up for lost time. Or maybe they just have better taste.

So, between the shareholder-friendly moves, the premium brand, the solid cash flow, and the long-term potential… it’s a compelling package. A blue-chip stock that’s actually… interesting. I’m not saying run out and mortgage your house, but… it’s worth a look. Honestly, I might just buy a few shares myself. Don’t tell anyone I said that. I have a reputation to maintain.

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2026-01-18 22:22