Now, I reckon there’s a sight of folks on Wall Street these days who fancy themselves seers, predictin’ the future with charts and graphs. But I’ve found, after a good many years observin’ human nature, that the future ain’t somethin’ you predict, it’s somethin’ that happens to you. And American Express, that venerable institution, has been havin’ a right good time lately, climbin’ upwards like a determined mountaineer. Over two hundred and ten percent in five years, they say. Why, that’s enough to make a fella think he’s struck gold, though I suspect most of the gold is bein’ held by a select few. The S&P 500, bless its heart, managed a respectable climb, too, around eighty-one percent, but Amex left it in the dust, lookin’ like a tired mule.

Naturally, this raises the question, and a sensible one at that: Can this climb continue? Is there still steam in the engine, or are we lookin’ at a puff of smoke and a stalled contraption? Folks get skittish when somethin’ rises too high, fearin’ a tumble. And rightly so. But let’s have a look under the hood, shall we?

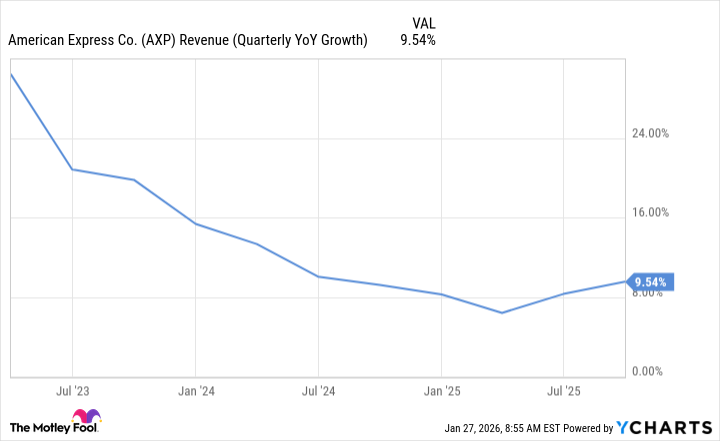

A Slower Pace, But Still Movin’

Now, Amex ain’t growin’ at the breakneck speed it once did, that’s true. The days of easy money are generally behind us, and that’s a fact. But it’s still growin’, and in these times, that’s somethin’ of a miracle. Double-digit growth, they say, while other businesses are lookin’ like they’ve lost their way in a fog. That’s resilience, that is. If the economic winds shift and blow a bit more favorably, why, this company might just pick up even more speed. Though I wouldn’t wager the farm on it.

They’re tradin’ at a price-to-earnings ratio of 24, which, considerin’ the growth they’re showin’, seems reasonable enough. A higher price, you’d expect a more vigorous climb, naturally. But it’s actually a touch lower than the S&P 500 average of 27. So, one could argue, and not without some justification, that there’s still a bit of a rally left in this here stock. Though Wall Street has a habit of defyin’ logic, so don’t go bettin’ your boots on it.

What About the Road Ahead?

Now, there’s been a bit of a wobble lately, a two percent dip year-to-date. Seems some folks are gettin’ their britches in a twist over talk of a ten percent cap on credit card interest rates. A government puttin’ its nose into the free market… now that’s a sight to behold. It’s enough to make a sensible man wonder what’s next. This proposed legislation could certainly slow things down for companies like Amex, makin’ them a bit more careful about who they extend credit to. A bit of prudence never hurt anyone, mind you.

But here’s the rub: President Trump is talkin’ about this cap bein’ for just one year. A temporary inconvenience, if you will. For long-term investors, that’s hardly a cause for panic. Though governments have a funny way of extendin’ temporary measures, so keep your eyes peeled.

Now, Amex has a solid brand, steady growth, and a valuation that ain’t entirely out of reach. Even with its recent climb, it remains a good stock to consider. It might stumble a bit this year, thanks to all the political fuss, but it could still be a worthwhile investment for the long haul. It ain’t a guarantee, mind you, but in this world of uncertainty, a bit of sensible investment is always a good thing. Just don’t go expectin’ miracles.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Crypto Chaos: Is Your Portfolio Doomed? 😱

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- 17 Black Actresses Who Forced Studios to Rewrite “Sassy Best Friend” Lines

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- The Best Single-Player Games Released in 2025

- Where to Change Hair Color in Where Winds Meet

2026-01-29 12:42