Dear Diary,

Let me just rant about Palantir (PLTR) for a moment. Yes, it’s the 22nd largest company in the world with a $426 billion market cap. No, I’m not impressed. Not when its 945% rally since 2024 feels like a champagne supernova with a hangover waiting to happen.

Units of Patience Lost: 3. Hours Spent Googling “Is AI Even Real?”: 4.5.

The truth? Palantir’s 132x price-to-sales ratio is a red flag waving so hard it could start a wildfire. For context, companies growing *faster* than Palantir are trading at *cheaper* multiples. Classic case of “buy the thesis, not the math.”

Which is why I’m here to whisper a heretical thought: Advanced Micro Devices (AMD) might just steal Palantir’s thunder in five years. Let’s dissect this with the precision of a scalpel and the enthusiasm of someone who’s never lost money on a crypto rug pull.

- AMD’s market cap? A humble $260 billion. Its P/S ratio? A dainty 9. Palantir, meanwhile, is playing Jenga with a 132x multiple.

- AMD’s Q2 2025 revenue? Up 32% to $7.7 billion. Its client and gaming segment? Growing at 69% YoY. That’s not just growth-it’s a stampede.

Now, let’s talk catalysts. First: the AI-capable PC market, which is expected to balloon 4.5x by 2030. AMD, with 24% PC CPU market share (up 2.8pp since 2024), is primed to nibble into Intel’s lunch. Second: the 2028 gaming console cycle. Microsoft and Sony? They’ve been outsourcing their custom chips to AMD for years. Rumor has it they’re staying loyal.

Remember when AMD raked in $5 billion from current-gen consoles in 2021? Imagine that multiplied by the next-gen hype cycle. It’s like getting a front-row ticket to a money-printing machine.

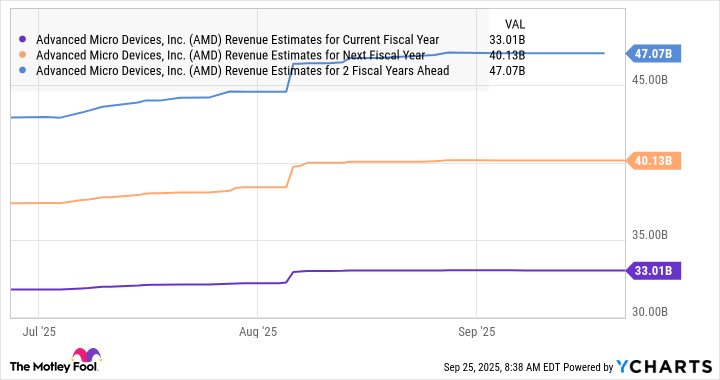

Then there’s the data center segment, now 41% of AMD’s revenue. Its Epyc CPUs are AI inference darlings, and its upcoming GPUs are plotting to steal Nvidia’s crown. If AMD can grow revenue at 15% annually post-2027, we’re looking at $72 billion in 2030. Multiply that by the tech sector’s 9.2x P/S, and voilà: a $662 billion market cap. Palantir, eat your heart out.

So here’s my activist investor pitch: AMD is the undervalued darling of the AI revolution. Palantir’s party is overpriced, and the guest list is getting shorter. Time to bet on the chipmaker, not the data magician.

Units of Confidence Gained: 1. Hours Left to Second-Guess This Decision: ∞.

AMD to the future. 🚀

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- 20 Films Where the Opening Credits Play Over a Single Continuous Shot

- Gold Rate Forecast

- 50 Serial Killer Movies That Will Keep You Up All Night

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- ‘The Substance’ Is HBO Max’s Most-Watched Movie of the Week: Here Are the Remaining Top 10 Movies

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- Top gainers and losers

- 20 Movies to Watch When You’re Drunk

- 10 Underrated Films by Ben Mendelsohn You Must See

2025-09-28 12:05