Folks, gather ’round-this is the tale of AMD (AMD), a scrappy underdog trying to elbow its way into the $1 trillion club by 2030. That’s right, folks, we’re talking about joining the big leagues with Apple and Microsoft. But before you start imagining ticker tape parades for AMD, let me tell ya-it ain’t exactly like betting on Seabiscuit here.

Currently worth around $265 billion, AMD would need to grow by 277% in just five-and-a-half years. For those keeping score at home, that means churning out an annual growth rate of roughly 27%. Now, I know what you’re thinking: “Twenty-seven percent? That sounds as likely as Moses getting Wi-Fi on Mount Sinai!” But hold your horses-or should I say GPUs-for there *is* method to this madness.

AMD’s Jack-of-All-Trades Gambit: A Blessing or Curse?

Let’s cut to the chase: AMD doesn’t put all its eggs in one basket. It dabbles in everything from graphics processing units (GPUs) to central processing units (CPUs). Sure, it goes toe-to-toe with Nvidia (NVDA) when it comes to GPUs for AI training and gaming-but then it veers off into CPUs for laptops, desktops, and even embedded processors thanks to its acquisition of Xilinx. Variety may be the spice of life, but can it also season stock portfolios?

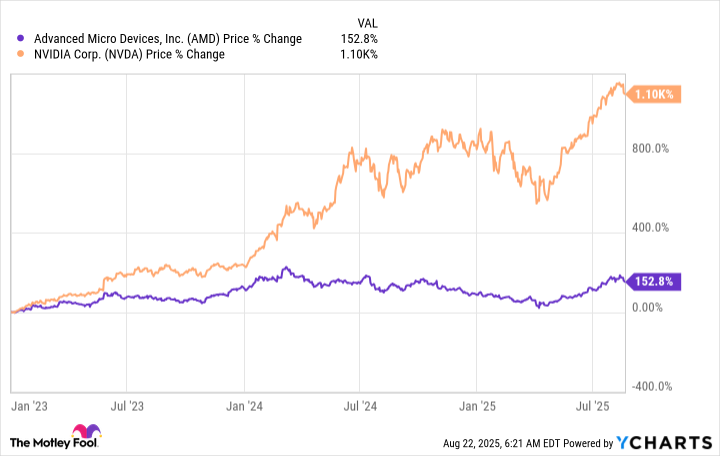

Here’s where things get tricky. While Nvidia laser-focuses on GPUs like some kind of tech-world samurai, AMD spreads itself thinner than butter over too much bread. Is this diversification genius or folly? Well, if the data center market crashes harder than a pie factory explosion, AMD might not feel the sting as acutely as Nvidia. On the flip side, while Nvidia rides high on booming demand, AMD lags behind like Charlie Chaplin chasing a runaway train.

But hey, nobody ever accused AMD of being boring. Even if it hasn’t delivered blockbuster returns like Nvidia, owning AMD shares could still make you grin ear to ear-if you play your cards right.

China: The Missing Ingredient in AMD’s Recipe for Success?

Ah, China-the land of ancient wisdom, delicious dumplings, and… regulatory headaches! During Q2, AMD took a hit after losing its export license to China-a blow that hurt almost as much as stubbing your toe during a tap dance routine. And yes, poor Nvidia got smacked too. But wait! There’s hope yet: AMD has reapplied for its license, fingers crossed tighter than shoelaces on prom night.

The catch? Both companies will have to cough up a 15% export tax if approved. Ouch! Still, regaining access to Chinese markets could turbocharge AMD’s sluggish 14% data center growth back to warp speed. Remember, their client and gaming segment soared 69% year-over-year in Q2. Embedded sales slipped slightly, but overall, AMD grew by 32%, which handily beats our magical 27% target.

Looking ahead, management forecasts a slower 21% revenue bump next year-not quite Mission Impossible, but close enough. If China opens its doors wider, though, those numbers could climb faster than a monkey up a coconut tree.

So, dear reader, can AMD maintain a blistering 27% compound annual growth rate through 2030? Let’s face it: that’s asking a lot. Picture Sisyphus pushing his boulder uphill while juggling flaming torches. Yet, with projected revenue growth hovering near 20%, it’s no slouch either. In short, AMD might not reach $1 trillion, but it could still deliver market-beating returns. And who knows? Maybe someday they’ll throw confetti instead of silicon wafers. 🎉

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- Games That Faced Bans in Countries Over Political Themes

- ‘Zootopia+’ Tops Disney+’s Top 10 Most-Watched Shows List of the Week

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- When Wizards Buy Dragons: A Contrarian’s Guide to TDIV ETF

2025-08-27 13:03