AMD (AMD), the eternal bridesmaid to Nvidia (NVDA), has always been like the second violin in an orchestra—important, but not exactly getting the roses at the end of the night. But hey, even second fiddles can play a sweet tune when the timing’s right. And now, with earnings set to drop on Aug. 5, AMD stock might just be ready to hit a high note—or at least a kazoo solo.

But before we get too carried away imagining a parabolic rise for AMD, let’s take a step back and ask ourselves: Is this stock the next blockbuster or just another B-movie sequel? Let me don my market-watcher hat (a fedora, naturally) and guide you through this financial farce.

AMD’s Diversity: The Blessing That’s Also a Curse

AMD is like that guy at the party who insists on bringing five different snacks instead of perfecting one dish. Sure, it makes him look versatile, but deep down, we all know he’s no Gordon Ramsay. While Nvidia focuses solely on GPUs—the crown jewels of AI computing—AMD spreads itself thin across CPUs, GPUs, embedded processors, and more. It’s like they’re trying to conquer the tech buffet without mastering any single course.

This diversity, however, isn’t all bad news. If AI spending were to suddenly dry up faster than a martini glass at a Mel Brooks cocktail hour, AMD would likely fare better than its GPU-obsessed rival. Their other business units could keep the ship from sinking entirely. But—and here’s where I break the fourth wall, folks—let’s not kid ourselves. The chip industry is as cyclical as a carousel ride, and if the market turns sour, even AMD’s “safer” status won’t save it from tumbling faster than a pie off a waiter’s tray.

Now, here’s some good news for Team AMD: They’re projecting robust growth for Q2, with revenue expected to reach about $7.4 billion—a whopping 35% increase year-over-year. Impressive, right? But hold your applause, dear reader, because Nvidia is strutting into the scene with an anticipated 50% growth rate. Poor AMD—it’s like showing up to a sword fight armed with… well, a butter knife.

Still, if AMD delivers a guidance beat so strong it knocks your monocle off, there’s a chance its stock could soar higher than Moses on Mount Sinai. Stranger things have happened in this zany market theater.

Priced Like a Blockbuster, Plays Like an Indie Film

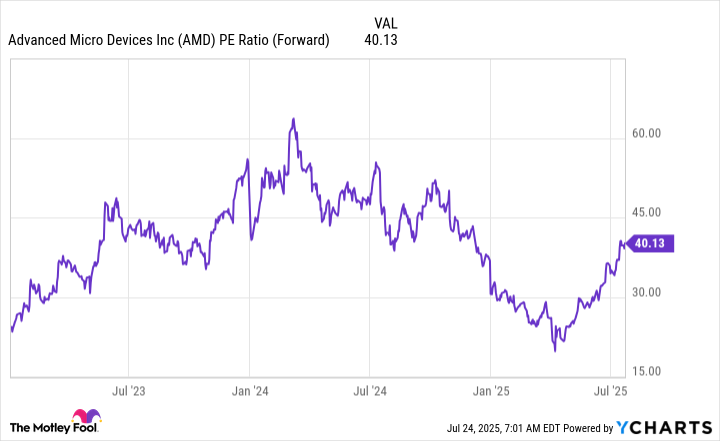

Here’s the rub, folks: Despite playing second fiddle to Nvidia, AMD trades at a premium price tag of 40 times forward earnings. That’s like paying Broadway prices for a community theater performance. Meanwhile, Nvidia—growing faster and flashier—is trading at roughly the same valuation. So why, pray tell, would investors choose AMD over Nvidia?

I’ll tell you why: They wouldn’t. At least, not unless they’re betting on a world where AI suddenly becomes less cool than dial-up internet. Sure, AMD might weather a downturn slightly better, but data center revenue accounts for nearly half of its total sales. Hardly the safety net you’d expect from a “safer” investment.

And while I don’t have a crystal ball to predict how the market will react on Aug. 5, I do know this: Nvidia is like the star quarterback, and AMD is the backup kicker. Both are valuable, sure, but only one gets the glory. If AMD reports blowout numbers, Nvidia will probably piggyback on the hype train anyway, given their adjacency in the tech kingdom.

So, dear investor, consider this my sage advice wrapped in a slapstick routine: Unless AMD pulls off something truly miraculous, stick with Nvidia. Because sometimes, being close to first place is still light-years away from winning the race 🎭.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- ETH PREDICTION. ETH cryptocurrency

- 9 Video Games That Reshaped Our Moral Lens

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- The Weight of Choice: Chipotle and Dutch Bros

2025-07-28 13:12