The current enthusiasm for all things ‘artificial’ continues unabated, naturally. McKinsey, with that firm’s characteristic optimism, now predicts a staggering seven trillion dollars will be devoted to data centres by 2030, all in the service of this digital deity. One might ask if such expenditure is entirely rational, but then, rationality rarely governs these frenzies. Nvidia, Broadcom, Micron – the usual suspects are already positioning themselves to benefit, and one observes a rather vulgar scramble for advantage. However, it is to Advanced Micro Devices, or AMD as it is known, that a more discerning eye might turn.

A Temporary Discomfiture

AMD recently released its fourth-quarter results, which, while perfectly respectable, failed to ignite the sort of ecstatic response one might expect in these inflationary times. The market, it seems, demands miracles, and a mere fifteen per cent increase in profits is apparently insufficient. The stock, predictably, suffered a decline of seventeen per cent, a rather dramatic spasm that has, naturally, created an opportunity for those of us who prefer to buy when others are weeping.

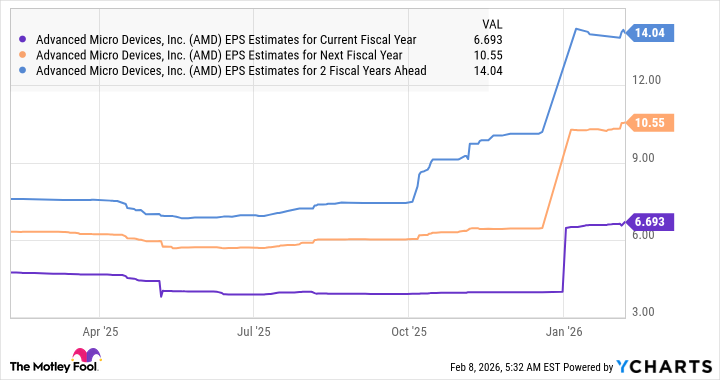

One observes that AMD anticipates a revenue increase of thirty-two per cent in the current quarter, coupled with a gross margin of fifty-five per cent. These are not insignificant figures, and suggest a company in robust health. Adjusted earnings rose to $4.17 per share in 2025, and analysts, ever eager to please, predict further gains. One suspects their optimism is not entirely disinterested, but the numbers themselves are difficult to dismiss.

The truly interesting aspect, however, is AMD’s potential beyond the immediate horizon. It is not merely a manufacturer of graphics cards, but a designer of central processing units as well, applicable to a wide range of applications, from data centres to personal computers and, increasingly, embedded systems. The company confidently anticipates its addressable market to swell from $200 billion to a frankly improbable $1 trillion by 2030. Such projections are, of course, subject to revision, but they indicate a company with ambitions that extend beyond mere quarterly profits.

The company now expects revenue to grow at a rate exceeding thirty-five per cent annually through 2030, with earnings per share potentially reaching $20. A perfectly plausible outcome, assuming, of course, that the world does not descend into chaos before then.

A Modest Proposal

Currently trading at just over $200 per share, AMD’s price/earnings-to-growth ratio stands at a rather attractive 0.65, according to Yahoo! Finance. This suggests that the market has, for the moment, undervalued the company’s potential. Even if earnings growth slows to a mere twenty per cent in 2029 and 2030 – a distinctly pessimistic scenario – the company could indeed reach $20 per share by the end of the decade, in line with its own expectations.

Multiplying this projected earnings figure by the forward earnings multiple of 26 enjoyed by the tech-laden Nasdaq-100 index – a rather generous assumption, admittedly – suggests a stock price exceeding $500. One might, therefore, cautiously suggest that AMD could become a ‘multibagger’ – a vulgar term, but one that accurately reflects the potential upside. A perfectly acceptable risk, particularly for those of us who appreciate a little speculation in these increasingly predictable times. The opportunity, as they say, is present. Whether it will be seized is, as always, another matter.

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- EUR UAH PREDICTION

- DOT PREDICTION. DOT cryptocurrency

- Silver Rate Forecast

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2026-02-12 17:02