The market’s a dirty business. Promises get broken like cheap glass, and hope is a sucker’s bet. But every now and then, something glints in the shadows. AMD, they say, could be it. A 348% climb in five years? Sounds like a tall tale, the kind you hear in back alleys. But the numbers, they’re… persistent. If they hold, it’s a once-in-a-decade play. Those don’t come around often, not unless you’re willing to look past the smoke and mirrors.

They had a decent run last year, 77% up. Not bad for a company trying to navigate a battlefield dominated by giants. But that’s just the opening act. The real question is whether they can keep the momentum going.

AMD’s Gamble in the AI Stakes

For years, AMD was the understudy, allowed to exist because the big boys – Intel, then Nvidia – didn’t want the hassle of a monopoly charge. A polite fiction. Nvidia owned the high ground in graphics and, increasingly, in the new religion of Artificial Intelligence. AMD was the alternative, the slightly cheaper option for those who couldn’t afford the premium. It was a precarious existence.

Now, they’re trying to change the script. Claiming improvements, a shot at the AI crown. It’s a long shot, like betting on a nag with three legs, but they’re making a play. And a supply chain crunch? That’s a gift, a chance for those overlooked to step into the spotlight. Cheaper isn’t always worse. Sometimes, it’s just… different.

They’re projecting a 60% compounded annual growth rate in data centers. A bold claim, putting them on par with Nvidia’s recent surge. But data centers aren’t the whole story. They still rely on gaming and client business, a bigger piece of the pie than Nvidia’s. And then there’s Xilinx, the acquisition, a wildcard in the hand. Each segment is expected to grow, but at a slower pace. Still, overall, they’re aiming for a 35% climb over the next five years. If that happens, the stock could, theoretically, hit $1,000. A pretty number. Too pretty, maybe.

Is it realistic? That’s the question that keeps me awake at night.

The Price of Hope

I’ll give management the benefit of the doubt on the growth projections. They see further down the road than I do. But correlating stock price to revenue? That’s where things get murky. The market doesn’t reward logic, it rewards perception. And right now, AMD is already priced for a party.

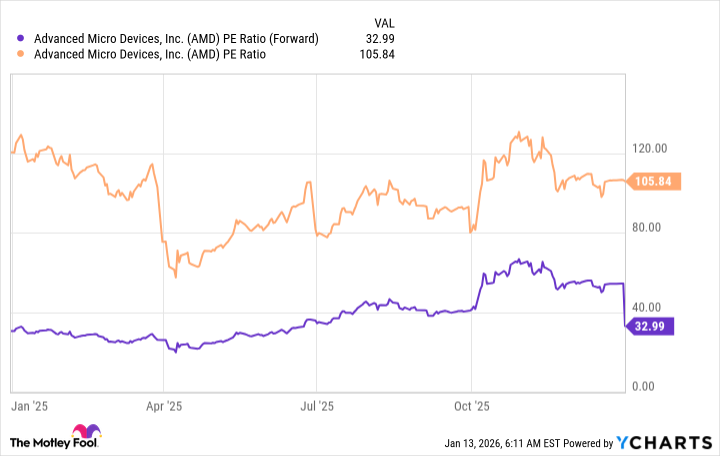

A forward earnings valuation of 33 times isn’t cheap. It means a lot of the good news is already baked in. There’s a limit to how much optimism the market will swallow.

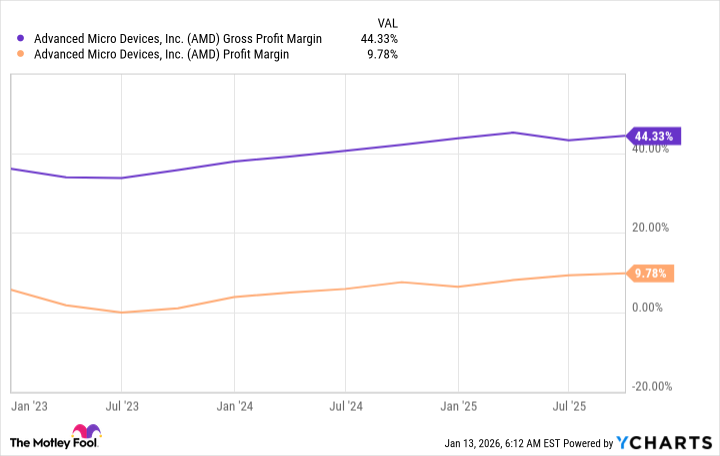

But there’s another angle: margin expansion. AMD has room to improve, to squeeze more profit out of every chip.

Nvidia’s margins are obscene – 70% gross, 53% profit. AMD’s are… modest. Can they close the gap? Probably not entirely. But a 10 percentage point increase in gross margin, translated to the bottom line? That could add fuel to the fire, push the stock even higher. It’s a long shot, but it’s a possibility.

I’m not sure how it will play out. The market is a fickle mistress. But I’m confident AMD will be a force to be reckoned with. A good stock to own, if you can stomach the ride. It won’t be a smooth one, but then, nothing worthwhile ever is.

Read More

- Top 15 Insanely Popular Android Games

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- EUR UAH PREDICTION

- Silver Rate Forecast

- Gold Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2026-01-18 20:14