Advanced Micro Devices, a name whispered in the halls of speculative finance, presents a case study in the precariousness of projected returns. The stock, currently exhibiting a fluctuating trajectory – a rise of approximately 71% since the commencement of 2025, countered by a subsequent descent of 22% from its peak in late October of the same year – embodies the inherent instability of valuations predicated on future performance. One observes a pattern: an initial ascent, followed by a gradual, almost inevitable, regression toward a mean that seems perpetually out of reach. It is a dance, not of progress, but of deferred expectation.

The pursuit of artificial intelligence dominance, a field now considered the sole arbiter of corporate viability, finds AMD trailing behind Nvidia, a competitor whose success appears less a result of innovation and more a function of… acceptance. The emergence of Broadcom as another contender only serves to further constrict the pathways to profitability. One wonders if the very notion of ‘competition’ is not merely a bureaucratic fiction designed to mask a preordained hierarchy. The management, of course, remains optimistic, issuing pronouncements of future success, but these statements feel less like predictions and more like mandatory affirmations, required for continued operation within the system.

The question, then, is not whether AMD will succeed, but rather, what constitutes ‘success’ in a landscape governed by opaque algorithms and the whims of capital expenditure. The company anticipates a compounded annual growth rate of 60% in its data center division, a figure that, while impressive in isolation, feels strangely disconnected from the realities of market forces. The projected spending of Amazon, Meta Platforms, and Alphabet – exceeding $500 billion in capital expenditures for 2026 – represents a potential boon, yet also a terrifying dependence on the largesse of entities whose motivations remain inscrutable.

Historically, AMD has occupied a secondary position in the AI realm, functioning primarily as an alternative – a shadow – to Nvidia’s offerings. To achieve true success, it must somehow transcend this designation, becoming not merely a substitute, but a necessity. The projected 60% CAGR, if realized, would undoubtedly bolster the stock price. But one is left with the nagging suspicion that such growth is contingent upon factors entirely beyond the company’s control – a complex web of approvals, permissions, and the silent consent of unseen authorities.

The Illusion of Holding

The fourth-quarter results revealed a partial movement towards the anticipated 60% CAGR, a progress that feels less like an achievement and more like a temporary reprieve. A 39% increase in revenue from the data center segment is, admittedly, an improvement over the previous quarter’s 22%, but it remains a considerable distance from the promised target. To hold onto the stock, then, is to embrace a state of perpetual anticipation, a waiting for a validation that may never arrive. It is a comfortable stagnation, a bureaucratic limbo where one is neither rewarded nor punished, simply… processed.

The Superiority of the Established

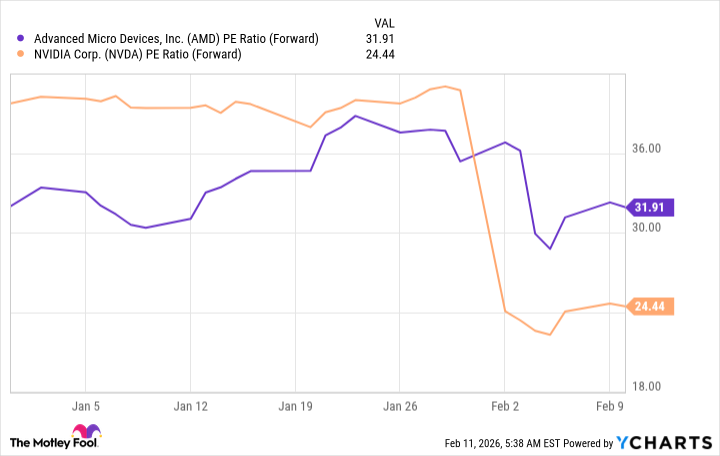

Even assuming a successful turnaround, the question persists: why choose AMD over Nvidia? The latter, already excelling in the AI space, presents a far more straightforward investment proposition. Its growth rate surpasses that of AMD, and its valuation appears, comparatively, reasonable. To invest in AMD is to embrace uncertainty, to wager on potential rather than proven performance. It is a gamble, not on intelligence, but on the possibility of escaping the established order.

At 24 times forward earnings, Nvidia appears almost… lenient. AMD, in contrast, demands a greater leap of faith. One is reminded of a complex form, requiring endless revisions and approvals, while the other is a simple, pre-stamped document. Which would you choose?

My assessment falls somewhere between cautious holding and reluctant selling. I acknowledge the possibility of a turnaround, but I require concrete evidence before committing further capital. Even if such a transformation were to occur, Nvidia remains the stronger, more secure investment. It is the established authority, the one that has already navigated the labyrinth and emerged unscathed. And in a world governed by such opaque systems, safety, however illusory, is a privilege one cannot afford to dismiss.

Read More

- Building 3D Worlds from Words: Is Reinforcement Learning the Key?

- Gold Rate Forecast

- Securing the Agent Ecosystem: Detecting Malicious Workflow Patterns

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Wuthering Waves – Galbrena build and materials guide

- The Best Directors of 2025

- Games That Faced Bans in Countries Over Political Themes

- TV Shows Where Asian Representation Felt Like Stereotype Checklists

- 📢 New Prestige Skin – Hedonist Liberta

- SEGA Sonic and IDW Artist Gigi Dutreix Celebrates Charlie Kirk’s Death

2026-02-14 23:32