The scent of burning silicon and broken promises hangs heavy in the air. Everyone’s chasing the AI dragon, convinced this time it’s different. They’re throwing money at anything with a vaguely neural network-shaped shadow. And AMD? They’re supposed to be the scrappy underdog, the long-shot bet. Let’s be clear: this isn’t about hope. It’s about numbers. Cold, hard, brutally honest numbers. And frankly, the current valuation…it’s a goddamn fever dream.

For years, AMD has been playing second fiddle to Nvidia, a glittering, overhyped behemoth. Then there’s Broadcom, quietly building an empire of custom chips while the rest of us are blinded by GPU flash. AMD management keeps muttering about a “comeback.” A comeback? In this market? That’s cute. But they’ve been tinkering, rearranging the deck chairs on the Titanic, and now they claim 2026 is the year they finally break free. I need more than promises. I need a goddamn reason.

The Diversification Delusion

AMD’s got a broader portfolio than Nvidia, sure. They’re not entirely reliant on data centers, which is smart. They’ve got gaming, embedded systems…it’s a patchwork quilt of revenue streams. Some analysts call this “diversification.” I call it spreading yourself thin. It’s like trying to fight a war on multiple fronts with a rusty butter knife. It might work, but the odds are stacked against you. They’re claiming 47% of revenue from data centers, 43% from gaming/OEM, and 10% from embedded. It’s…acceptable. But it’s not exactly a foundation for world domination.

They’re trying to convince us this makes them safer if the AI bubble bursts. Maybe. But let’s not pretend data centers aren’t still a huge chunk of their business. A major downturn there would still leave a crater in their earnings. They’re walking a tightrope over a pit of despair, and frankly, I’m not sure they have a safety net.

And now they’re projecting a 60% compound annual growth rate (CAGR) for their data center division over the next five years. 60%! Are you KIDDING me? That’s the kind of hockey-stick projection that sends red flags waving like maniacs. Their other divisions? A measly 10% CAGR. They want to morph into Nvidia 2.0. It’s a bold vision, bordering on delusional. In 2031, they dream of a complete transformation. We’ll see about that.

Q3 data center revenue rose 22% year over year. It’s a start. But they’ve got a long, brutal climb ahead of them. A 60% CAGR is a different universe. Can they pull it off? I’m not holding my breath.

The Double or Die Scenario

Okay, let’s play the numbers game. A doubled stock price puts AMD at $500 a share. To justify that, they need a market multiple. Let’s say 50. Significantly lower than the current P/E of 120, which is artificially inflated by an $800 million inventory write-down caused by Trump’s export restrictions to China. (Seriously, the geopolitical chaos is enough to drive a sane man to drink.) A P/E of 50 at $500 requires $10 in earnings per share (EPS). Current analyst estimates for 2026? A pathetic $5.36 to $8.02. They’re miles off.

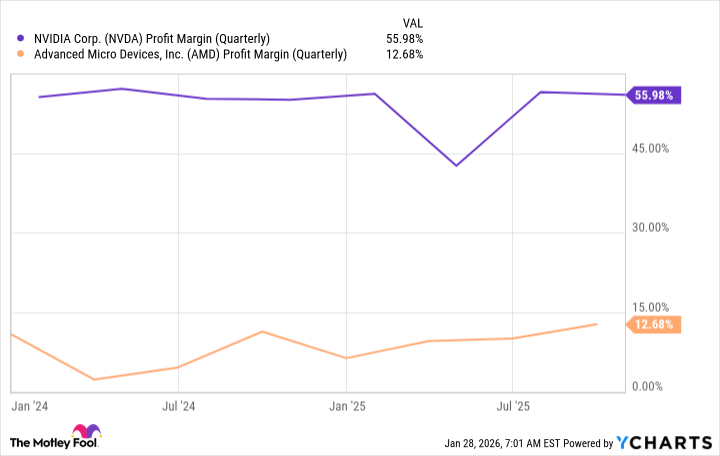

They need to dramatically improve profit margins. And that, my friends, is where the real battle lies. Their current margins are…embarrassing compared to Nvidia’s. It’s like comparing a rusty pickup truck to a goddamn spaceship.

Double their profit margin and, maybe, just maybe, the stock has a shot. But it’s a colossal undertaking. They haven’t proven they can compete with Nvidia in the GPU space. Not yet. And until they do, this whole thing feels like a long-shot gamble. I’m waiting for the Q4 results on February 3rd. That report might change my mind. It might not. I’m perfectly content to remain skeptical. Patience, after all, is a virtue. Especially in this godforsaken market.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- Wuchang Fallen Feathers Save File Location on PC

- QuantumScape: A Speculative Venture

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- 9 Video Games That Reshaped Our Moral Lens

2026-02-02 00:14