Advanced Micro Devices, or AMD as the cognoscenti call it, began 2026 with a flourish, a veritable burst of optimism. But, as is so often the case with promising ventures, the wheels, shall we say, have encountered a pebble or two. The recent quarterly pronouncements – February 3rd, mark the date, for those inclined to meticulous record-keeping – appear to have ruffled a few feathers amongst the shareholder class.

The ensuing sell-off, a predictable dance of panic and profit-taking, has left AMD down nearly 5% this year. A modest decline, perhaps, but a noticeable one when compared to the exuberant leap of the PHLX Semiconductor Sector, which has bounded ahead by a rather impressive 15.5%. One is left to ponder, is this a moment for the cautious to observe, or for the discerning investor to… intervene?

A Discount, Not a Disaster

The market, it seems, reacted to AMD’s latest report with the sensitivity of a countess discovering a smudge on her glove. A drop of over 17%, despite the company’s rather robust growth in both revenue and earnings! A peculiar reaction, wouldn’t you agree? AMD anticipates a 32% revenue increase in the current quarter, reaching $9.8 billion. A sum that, let’s be honest, would make even a seasoned bureaucrat blush. Gross margins are projected to improve to 55%, a solid two-percentage-point gain. It’s as if the market was hoping for alchemy, not accounting.

The company exceeded Wall Street’s expectations, naturally. But investors, those insatiable creatures, always crave more. They were anticipating a rocket launch, not a steady climb. The stock had, after all, enjoyed a rather spectacular run of 83% in the past year. A surge that, in retrospect, was bound to attract a few profit-takers. It’s a simple truth: fortunes are often built on the impatience of others. This temporary dip, however, presents an opportunity. At 31 times forward earnings, the price is, shall we say,… reasonable. A bargain, even, for a company with such prospects.

The AI Windfall and the Illusion of Progress

AMD’s success isn’t a matter of mere chance, you understand. It’s a confluence of shrewd engineering and a timely embrace of the artificial intelligence craze. Their data center and client/gaming segments are booming, fueled by the insatiable demand for CPUs and graphics cards. The proliferation of AI in everything from server farms to personal computers is a veritable gold rush, and AMD has a shovel. They’re supplying the Epyc server processors and Instinct graphics accelerators that power these AI endeavors, and their Ryzen PC processors are gaining traction in the consumer market.

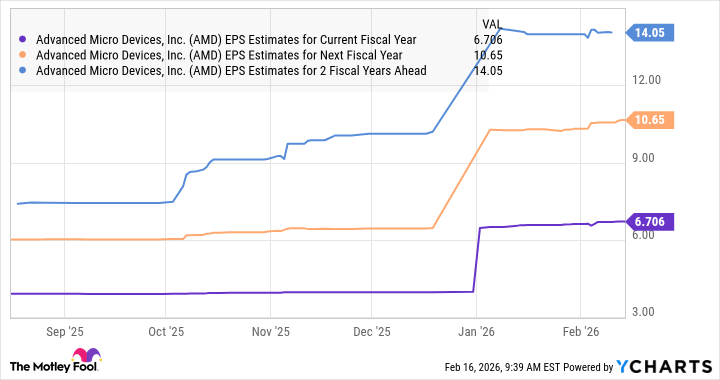

The ramp-up of their latest AI data center processors has boosted margins, a delightful development. The improvement in product mix explains the anticipated increase in gross margin. Analysts forecast a 60% earnings increase in both 2026 and 2027, a figure that puts the S&P 500 to shame. It’s a testament to their ingenuity, or perhaps, a reflection of the market’s willingness to pay a premium for anything remotely connected to the AI buzzword.

Last year, AMD delivered $4.17 per share in earnings. The chart, as any astute observer will note, suggests this figure is poised to more than triple in just three years. Assuming a modest 22 times earnings multiple – in line with the S&P 500 – and $14.05 per share in earnings, the stock could reach $309. A 51% increase from current levels. A handsome return, wouldn’t you agree? Of course, one must remember that markets are rarely predictable. But the potential rewards, in this instance, appear to outweigh the risks. This AI stock, with its soaring earnings growth, is likely to be rewarded with an even higher multiple. A calculated gamble, perhaps, but one worth considering.

In conclusion, while the market may occasionally exhibit moments of irrational exuberance or undue pessimism, a discerning investor will always seek out opportunities hidden in plain sight. And AMD, at its current valuation, appears to be just such an opportunity. A company poised to capitalize on the AI revolution, and a stock that, with a little luck and a lot of ingenuity, could deliver a substantial return.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Crypto Chaos: Is Your Portfolio Doomed? 😱

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- ‘Bad Guys 2’ Tops Peacock’s Top 10 Most-Watched Movies List This Week Again

- 20 Movies That Glorified Real-Life Criminals (And Got Away With It)

- MicroStrategy’s $1.44B Cash Wall: Panic Room or Party Fund? 🎉💰

- Is Taylor Swift Getting Married to Travis Kelce in Rhode Island on June 13, 2026? Here’s What We Know

2026-02-19 00:52