It’s probably not the latter.

Back from the dead

If you’re thinking, “Wait, wasn’t AMC the stock that made Reddit users into stock market influencers?” you’re not alone. During the pandemic, AMC became the poster child for meme stocks, with r/WallStreetBets fans pumping it like it was the final season of a bingeable series. GameStop, BlackBerry, and Bed Bath & Beyond were also in the mix—though the latter is now a cautionary tale about what happens when you bet on a company that sells bath towels.

And it worked… for a while. These stocks soared, sometimes beyond even the most optimistic predictions. But as we all know, the party eventually ended. Bed Bath & Beyond went bankrupt. GameStop? Still around, but its stock is like a broken toaster—still technically functional, but not exactly a marvel.

So why is AMC suddenly trending again? Could it be the Q2 earnings report dropping this Friday? Or is it the “successful closing of comprehensive refinancing transactions” that’s supposed to “strengthen the balance sheet”? Let’s just say, if this were a Netflix series, the trailer would have a lot of “mysterious music” and zero answers.

Before you jump on board, here’s the deal.

The only change is for the worse

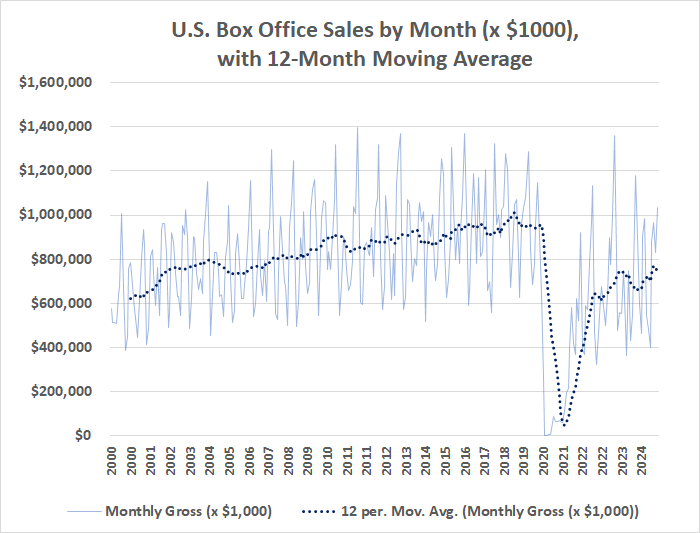

If there’s a “robust box office recovery,” someone forgot to send the memo to Hollywood. Box office sales are still below pre-pandemic levels, and the industry hasn’t exactly been churning out blockbusters like it’s 2019. Sure, Jurassic World: Rebirth and Wicked did well, but let’s not pretend they’re the new Avengers. The truth is, fewer movies have that “must-see” appeal, and even those that do are quickly moved to streaming—because nothing says “exclusive” like a 30-day theater window.

And don’t get me started on streaming. Movies like Happy Gilmore 2 are now only available on Netflix, which is like giving a goldfish a luxury car. Meanwhile, AMC’s financials? Let’s just say they’re as stable as a Jenga tower built by a toddler.

Oh, and the recent refinancing? It’s mostly debt restructuring, which is like rearranging deck chairs on the Titanic. The company’s also issuing more shares, which is great for dilution and bad for existing shareholders. It’s like getting a raise but having your salary split among 100 coworkers.

Not an investment

lots of drama, no resolution. Even if Friday’s report beats expectations, it’s not a game-changer. It’s more like a “surprise” ending that leaves you wondering, “Why did I even care?”

Analysts are expecting a loss of $0.76 per share, which is a slight improvement. But let’s be real—this is the financial equivalent of a “maybe next time” from a teacher.

🎬

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- ETH PREDICTION. ETH cryptocurrency

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- HSR Fate/stay night — best team comps and bond synergies

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

2025-07-31 15:06