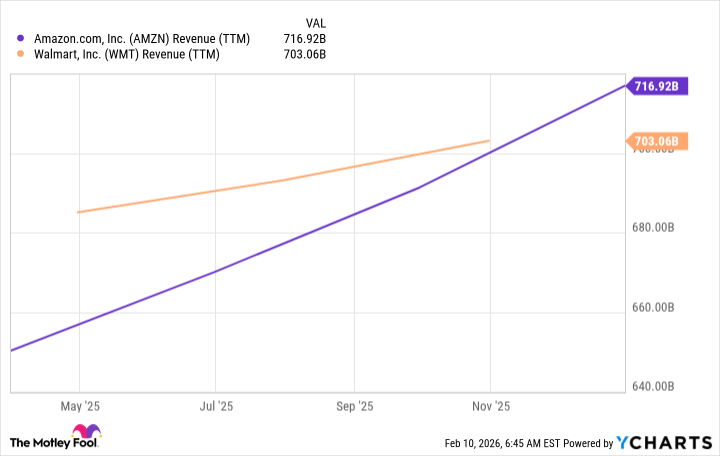

The figures, when they finally surfaced from the quarterly reports, were almost… understated. Amazon, it appears, has become the largest company in the world by sales. A rather vulgar achievement, perhaps, but one that has escaped the notice of all but the most diligent bean counters. Walmart, which had held the dubious honour since ousting ExxonMobil in 2001 – a time when oil barons still swaggered – has been relegated to second place. A quarter of a century is a long time to be top of anything, and the brief resurgence of the oil magnates merely delayed the inevitable.

It was, of course, going to happen eventually. One suspects the management at Walmart were not entirely surprised. A sort of dignified resignation, no doubt.

The Largest Company in the World

Amazon clocked in at nearly $717 billion in revenue, a figure that edged out Walmart’s trailing-12-month sales. A triumph of logistics and relentless expansion, certainly, but one can’t help but wonder if the sheer volume of parcels now crisscrossing the globe is a symptom of a deeper societal malaise.

Despite its frankly monstrous size, Amazon continues to report double-digit sales growth. An impressive feat, though one wonders if the company isn’t simply consuming its own tail. The growth isn’t limited to the fashionable distractions of artificial intelligence, either. Online store sales increased by a respectable 10%, advertising revenue jumped a rather exuberant 23%, and Amazon Web Services (AWS) saw a 24% increase. A total sales jump of 14% suggests a company that is, if not exactly invincible, then certainly very difficult to dislodge.

The AI business is, naturally, a significant contributor, driving interest in AWS cloud services. It represents the company’s greatest opportunities, though it remains a relatively small portion of the overall enterprise. Amazon, it seems, is still determined to experiment with the quaint notion of e-commerce and even, astonishingly, physical stores. The recent closure of the Amazon Go and Amazon Fresh stores suggests a degree of realism, while the planning of a new big-box store – half retail, half distribution – appears to be a gamble on the enduring appeal of sheer scale.

Can Walmart Take It Back?

Walmart will report its 2026 fiscal fourth-quarter results (ended January 31st) next week. To match Amazon’s revenue, it would require an additional $14 billion, or a 7.7% increase. To overtake it? A considerably larger leap. One imagines the board meetings are… animated.

Here is a record of Walmart’s sales growth over the last four quarters:

| Metric | Q4 25 | Q1 26 | Q2 26 | Q3 26 |

|---|---|---|---|---|

| Sales growth YoY | 4.2% | 2.5% | 4.8% | 5.8% |

It seems unlikely, then, that a vigorous competition is on the horizon. Walmart appears destined to remain in second place. A comfortable, if somewhat ignominious, position.

One wouldn’t interpret this as a vote of no confidence in Walmart, but rather as an affirmation of Amazon’s relentless efficiency. It is winning across multiple segments and possesses substantial ongoing opportunities. And, given the stock’s recent dip following the fourth-quarter report, now might be a propitious moment to acquire a few shares. A small indulgence, perhaps, but one that might prove… rewarding.

Read More

- Gold Rate Forecast

- Securing the Agent Ecosystem: Detecting Malicious Workflow Patterns

- DOT PREDICTION. DOT cryptocurrency

- Silver Rate Forecast

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- NEAR PREDICTION. NEAR cryptocurrency

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- USD COP PREDICTION

2026-02-13 13:14