One might reasonably assume that a company with a $2.4 trillion market cap has priced itself into the stratosphere. Yet here we are, confronted with a curious contradiction: Amazon (AMZN), that most modern of empires, may yet prove cheaper than a poorly tailored waistcoat. For what is value, if not a matter of perspective? The stock’s price tag, while ostentatious, masks a subtler truth-one that gleams only when viewed through the prismatic lens of macroeconomic alchemy.

AWS: The Crown Jewels of Digital Dominion

To speak of Amazon as merely a “retail titan” is to mistake a palace for its doorman. The company’s true genius lies in its duality: a merchant of goods by day, a merchant of data by night. While the masses marvel at its warehouses, the discerning eye turns to AWS, that most elegant of subdivisions, where the alchemy of cloud computing transforms bytes into gold. Here, in this shadow kingdom, Amazon’s real wealth is forged-not by trucks or fulfillment centers, but by lines of code and server farms.

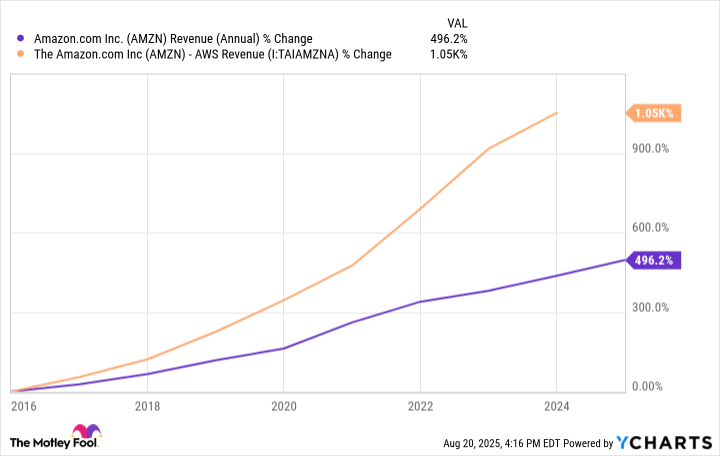

The past decade has witnessed AWS’s revenue surge by over 1,000%, a crescendo drowned out only by the polite clatter of e-commerce growth at a pedestrian 496%. One might say the former dances while the latter shuffles. Since 2020, AWS has leapt another 150%, while the online store, that dowdy cousin of innovation, has managed a mere 26%. Profitability? Ah, there the disparity becomes almost poetic. Last quarter, AWS contributed the lion’s share of operating income, its margins as sharp as a well-tied cravat. E-commerce, by contrast, resembles a gentleman’s waistcoat-comfortable, but lacking in panache.

But let us not mistake present grandeur for future certitude. AWS, with its 30% global market share, holds the keys to a kingdom still in the process of being built. It is a colossus with its boots on the ground and its eyes on the stars. The next phase of growth? Artificial intelligence, of course-the digital opium of our age. For every neural network trained, for every algorithm refined, AWS stands as the indispensable midwife. With AI spending set to expand by over 30% annually, one might say Amazon’s future is written not in ink, but in binary.

Thus, the paradox remains: a stock priced for perfection may yet deliver more than its detractors dare to dream. For in the realm of macro strategy, as in the theater of fashion, the most expensive illusion is often the most enduring. Amazon’s AWS, that most refined of subsidiaries, ensures the stock’s price will remain, in the long term, as elusive as a well-kept secret. 🧠

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Top 15 Insanely Popular Android Games

- ETH PREDICTION. ETH cryptocurrency

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- Games That Faced Bans in Countries Over Political Themes

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- When Wizards Buy Dragons: A Contrarian’s Guide to TDIV ETF

2025-08-24 17:01