So, Amazon dropped a $200 billion hint that they’re serious about AI. The stock market’s reaction? Let’s just say it wasn’t a standing ovation. It was more of a polite golf clap followed by a mass exodus. For context, they turned $717 billion in revenue into $77.7 billion in profit last year. Which is good! But now they want to spend roughly the GDP of a small country on servers. Investors are understandably doing the math and wondering if this is less “The Social Network” and more “Waterworld.”

Look, it’s always a little scary when a company decides to invest heavily in something. It’s like agreeing to host Thanksgiving; you hope it’ll be great, but you’re bracing for potential kitchen fires and passive-aggressive family members. But here’s the thing: sometimes, not investing is the bigger disaster. It’s like showing up to a costume party in your everyday clothes. Technically you’re there, but you’re not really participating.

And Amazon, surprisingly, isn’t completely terrible at this whole infrastructure thing. They’re actually getting a return on their AI investment, which, in the tech world, is roughly equivalent to finding a unicorn that pays taxes.

Amazon is Losing Market Share (and Its Cool Points)

Let’s be blunt: Amazon can’t afford to not spend this money. It’s like realizing you’ve been using Comic Sans for your resume. You have to address it, even if it’s painful.

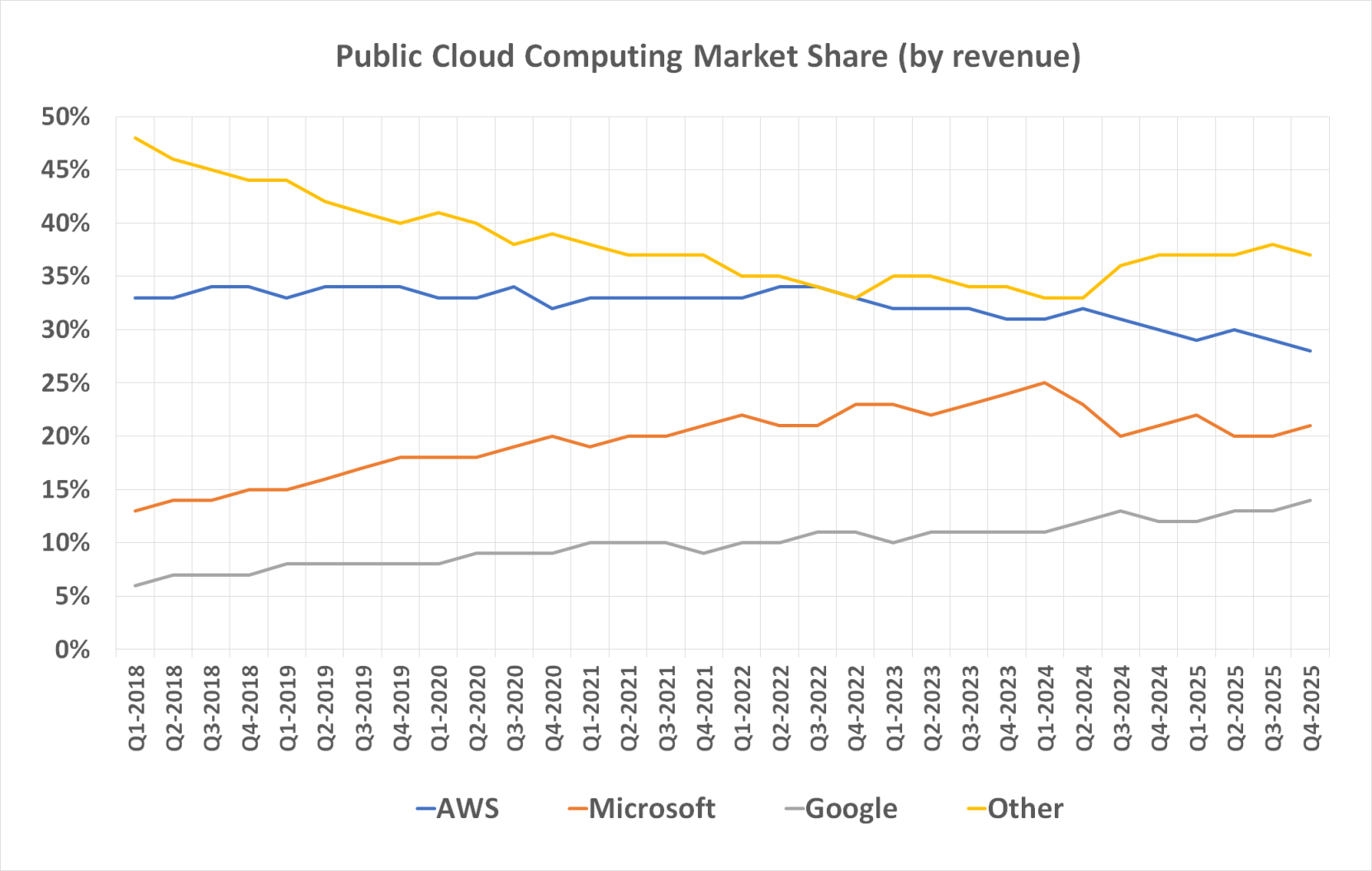

As the chart below illustrates, Amazon Web Services (AWS) is slowly but surely relinquishing its cloud dominance to Microsoft and Alphabet’s Google. As of last quarter, AWS’s share dipped to a multiyear low of 28%. It’s like watching the cool kids at school start hanging out with other cool kids. You try not to notice, but it stings.

AWS revenue is still up nearly 24% year-over-year, and operating income is up 17%. But growth is slowing, and profit margins are shrinking. Investors don’t like that. It’s like ordering a fancy avocado toast and realizing it’s mostly just toast. You’re not mad, you’re just…disappointed.

Will the Investment Be Worth It for Amazon?

Unlike Apple, Oracle, and Microsoft, Amazon has a decent track record of actually making money off its AI investments. Which is…refreshing. It’s like finding a politician who keeps their promises. You almost don’t believe it.

Their Trainium and Inferentia AI chips are competitive with Nvidia’s hardware at a fraction of the price. It’s like finding a designer handbag at a thrift store. You’re not asking questions, you’re just taking it.

Amazon Bedrock, which helps cloud customers build AI apps, is apparently a “multibillion-dollar annualized run rate business,” according to CEO Andy Jassy. Customer spend grew 60% quarter over quarter. Which is…a lot. It’s like accidentally winning the lottery. You’re not sure what to do with all the money, but you’re not complaining.

Look, Amazon’s shareholders would probably prefer the company hoard cash like dragons. But this investment isn’t likely to be a total disaster. It’ll position them to compete in an AI data center market that’s expected to grow at a ridiculous 35.5% annually through 2034. It might crimp profit margins, but that’s a better alternative than becoming Blockbuster in the age of Netflix.

Read More

- Building 3D Worlds from Words: Is Reinforcement Learning the Key?

- Gold Rate Forecast

- Securing the Agent Ecosystem: Detecting Malicious Workflow Patterns

- Wuthering Waves – Galbrena build and materials guide

- The Best Directors of 2025

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Games That Faced Bans in Countries Over Political Themes

- Top 20 Educational Video Games

- The Most Anticipated Anime of 2026

- Most Famous Richards in the World

2026-02-14 21:22