Every quarter, the financial world indulges in a ritual as old as SEC Form 13F-a document that reveals which hedge funds bought or sold stakes in companies. It’s less thrilling than a supernova, but slightly more informative than watching paint dry. Recently, this bureaucratic rite unveiled Bill Ackman’s new bet on Amazon (AMZN), a move that suggests the man either has a time machine or an unusually optimistic spreadsheet.

Ackman’s Pershing Square operates like a culinary minimalist: fewer ingredients, more flavor. While other funds scatter investments like nervous squirrels hoarding acorns, Pershing Square focuses on what it calls “high-conviction” positions. (This is finance-speak for “we’re betting the ranch, but with better spreadsheets.”) Amazon now shares shelf space with Alphabet in Ackman’s portfolio-a pairing that makes sense only if you view AI as the 21st century’s answer to alchemy.

But why Amazon? Why not chase the latest AI startup peddling vaporware with a 10-page pitch deck? Let’s dissect this like a particularly ambitious biologist dissecting a frog, except the frog is worth $1.8 trillion and runs on algorithms.

Amazon: The AI Fortress No One Saw Coming

Pershing Square’s portfolio reads like a shopping list from a parallel universe where Uber, Chipotle, and Hertz belong together. (The unifying theme? Companies so deeply embedded in daily life that their logos have achieved minor deity status.) Amazon, though, is the ultimate Swiss Army knife: e-commerce, cloud computing, and now AI, which it’s adopting with the enthusiasm of a cat discovering laser pointers.

AMZN”>

Layered atop AWS’s growth, these innovations could create “durable, complementary cash flows.” Translation: Amazon’s ecosystem might soon resemble a black hole, sucking in revenue from every corner of the tech universe without ever needing to ask nicely.

The $3 Trillion Mirage-Or Inevitability?

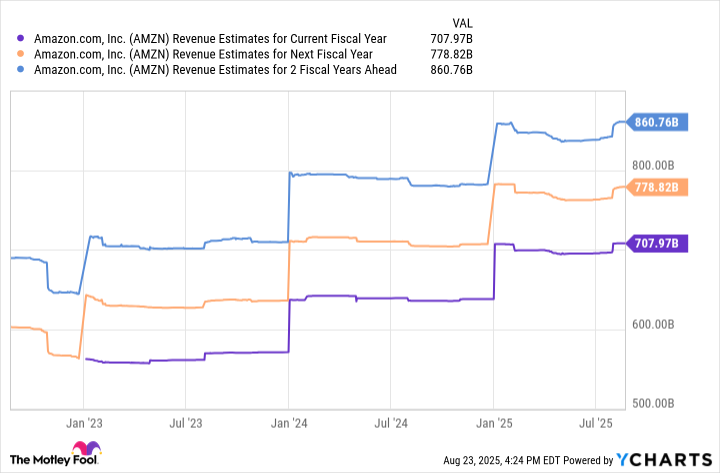

Wall Street’s consensus estimates suggest Amazon’s revenue will grow steadily through 2027. If the company maintains its current price-to-sales ratio, it’ll hit $3.2 trillion in market cap by 2028. This doesn’t require miracles-just the financial equivalent of a tortoise racing a snail and both wearing jetpacks.

Amazon’s transformation from “online bookstore” to “AI über alles” is less a pivot than a full-body cartwheel into the future. Its valuation hinges on the idea that AI infrastructure will become as essential as oxygen-ubiquitous, invisible, and occasionally sentient. If AWS keeps growing and its AI bets pay off, $3 trillion isn’t a stretch; it’s a conservative estimate written by an accountant with a calculator.

In the grand cosmic ledger of improbable things-like a universe fine-tuned for carbon-based lifeforms and a company surviving Jeff Bezos’s space tourism phase-Amazon hitting $3 trillion feels less like a gamble and more like gravity. 🚀

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ETH PREDICTION. ETH cryptocurrency

- ‘Zootopia+’ Tops Disney+’s Top 10 Most-Watched Shows List of the Week

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- The Best Actors Who Have Played Hamlet, Ranked

- Games That Faced Bans in Countries Over Political Themes

2025-08-27 16:54