Picture, if you will, the “Magnificent Seven” – Wall Street’s answer to a particularly ambitious cricket team. Among them loom Alphabet, Amazon (AMZN), Apple (AAPL), Meta Platforms, Microsoft, Nvidia, and Tesla, each a colossus striding across their respective domains like particularly well-tailored giants. These are the sorts of firms that make one’s portfolio quiver with anticipation, boasting market caps that could make a small island nation blush with envy.

Now, let us consider Amazon and Apple – two names as familiar as a butler’s discreet cough at a dinner party. Both have constructed empires so vast, one might mistake them for modern-day Babels. Amazon, that indefatigable peddler of everything from garden gnomes to cloud storage, and Apple, the orchard-keeper of digital delights, have each woven tapestries of customer loyalty so intricate, they make Persian rugs look like child’s finger-painting.

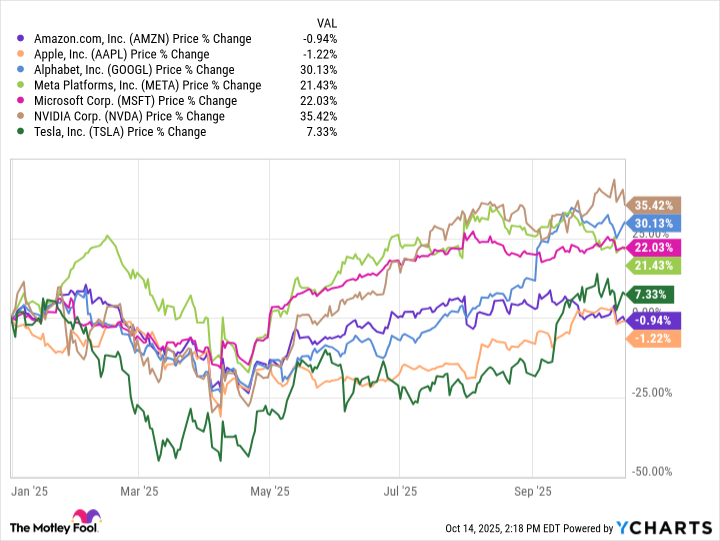

Yet not all is peaches and cream in this particular garden party. These two have been the wallflowers of the Magnificent Seven this season, twiddling their thumbs while their peers waltz about in the black. As we approach the final quarter of 2025, the question arises: which of these blue-chip bluestockings deserves a place in one’s portfolio?

Amazon: The E-commerce Maestro

Is Amazon a marketplace or a cloud-cuckoo castle? Why not both? Imagine if Mr. Darcy’s library contained not books, but servers humming with digital delight.

The e-commerce wing, of course, remains Amazon’s calling card – those ubiquitous blue vans more common than sparrows in a London park. Q3 brought £167.7 billion in sales, with North America contributing a sprightly £100.1 billion (up 11%) and international sales a dashing £36.8 billion (16% growth). Alas, like a gentleman’s valet who insists on polishing shoes that don’t exist, operating expenses devoured £127.8 billion, leaving a mere £9.3 billion in profit.

Ah, but then there’s AWS – the cloud computing equivalent of a perfectly mixed martini. With £30.8 billion in sales and expenses of £20.7 billion, this division poured forth £10.16 billion in profit, like a butler pouring sherry at precisely 5:05 PM. Dominating 30% of the cloud market (Microsoft Azure trails at 20%, Google Cloud at 13%), AWS is the sort of infrastructure that makes modern business possible without requiring one to build a data center in the back garden.

At a forward P/E of 32.8, Amazon shares might seem pricier than a Savile Row suit. But consider this: at year’s dawn in 2024, that ratio stood at 50 – a veritable Rolls-Royce price tag. Now, it’s more akin to a well-tailored second-hand Bentley.

Apple: The Orchestrator of Elegance

Where Amazon resembles a bustling bazaar, Apple operates like a Mayfair art gallery – all sleek lines and whispered appreciation. The iPhone remains its pièce de résistance, but the real magic? That would be the services division, where profits flow like champagne at a wedding.

Fiscal Q3 2025 saw product revenue of £66.6 billion (with £43.6 billion in expenses, yielding a respectable 36% margin). But services! A mere £6.7 billion in expenses against £27.42 billion in revenue – that’s a 75% margin, darling! No need for factories or shipping containers when your App Store and iCloud float like swans upon the digital pond.

Q3 brought a welcome 10% revenue bump to £94 billion, with EPS rising 12% to £1.57. The newly-released iPhone 17 line boasts improved batteries and cameras – charming upgrades, though lacking the revolutionary flair of yesteryear’s touchscreen or Face ID. One might call it progress, albeit delivered with a yawn.

Apple’s forward P/E hovers near 31 – a figure as symmetrical as a well-trimmed mustache.

The Verdict: A Portfolio Manager’s Dilemma

Both firms are titans, to be sure – members of the Magnificent Seven who’d make fine additions to any portfolio. Amazon’s cloud division grows like ivy on a cathedral, while Apple’s services profit margin could make a Victorian banker weep with joy.

Consider the metrics: Amazon’s price-to-sales ratio of 3.2 makes Apple’s 8.3 look positively profligate. Yet Apple doles out a modest £1.04 annual dividend (0.4% yield), while Amazon remains stingy as a miser’s mouse.

If forced to choose, however, this humble scribe would plump for Amazon. The cloud computing market, expected to balloon from £752.4 billion to £2.39 trillion by 2030 (a 20.4% CAGR), represents not merely growth but a veritable technological revolution. AWS stands poised to benefit like a well-positioned punter at Ascot.

Thus concludes our little financial farce. Both stocks deserve admiration, but Amazon’s cloud ambitions shine brightest in this particular opera bouffe. 🎩

Read More

- Gold Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- Silver Rate Forecast

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2025-10-17 11:29