Amazon (AMZN) and Alphabet (GOOG) (GOOGL) sit comfortably atop the global corporate hierarchy, two of the wealthiest titans the world has ever seen. Amazon ranks fifth, Alphabet just ahead at fourth. Conventional wisdom-often synonymous with laziness-claims that as companies swell in size, their capacity for rapid growth inevitably stalls. Yet, both of these behemoths continue to outpace the market, offering investors a peculiar blend of stability and excitement. It’s as if, just when you think you’ve figured them out, they surprise you again. But, of course, the pressing question remains: which one deserves your precious capital today?

Economic Winds: The Subtle Hand Behind the Curtain

Both Amazon and Alphabet, despite their lofty positions, are at the mercy of one inconvenient truth: the economy. Amazon, with its vast e-commerce empire, stands poised to suffer should the consumer pull back. In fact, when the inevitable economic slump arrives-and we all know it will-expect Amazon’s sales figures to mirror a falling soufflé. In Q2, a staggering 60% of Amazon’s revenue came from North American commerce, with another 22% trickling in from abroad. A delicate balance, indeed, where one gust of economic misfortune could spell disaster.

Alphabet, though it cloaks itself in the digital fog of search engines and algorithms, is no less exposed. The lion’s share of Alphabet’s revenues-$71.3 billion in Q2, to be precise-comes from its advertising platform. A sudden market shift could cause advertisers to tighten their purse strings, with Alphabet feeling the pinch in a manner only a truly global ad juggernaut can. With total Q2 revenues at $96.4 billion, Alphabet too finds itself riding the economic rollercoaster, though perhaps in a slightly more refined carriage.

Both companies will thrive when the economic sun shines brightly, yet when the clouds gather, expect their revenue growth to stall. And yet, Amazon has a certain trick up its sleeve-a little card it keeps hidden in its well-tailored pocket.

In the world of investing, revenue is charming, but profits are what make the heart race. And here, Amazon’s real ace in the hole is its cloud computing division, Amazon Web Services (AWS). Though its consumer-facing business accounts for a bulk of the revenue, AWS brings in over half of Amazon’s operating profits. In Q2, AWS alone accounted for 53% of Amazon’s operating profits, despite contributing only 18% to its overall revenue. It’s like that quiet, unassuming guest at a dinner party who turns out to be the one with all the interesting stories. Cloud computing, unlike the volatile whims of consumer shopping, is a subscription-based service with lasting power. When times are tough, businesses still need their cloud services, making AWS a less temperamental revenue stream.

Alphabet too has a cloud service, but its Google Cloud is, let’s be honest, a bit of an underdog in comparison to AWS. And while Alphabet’s advertising business is a behemoth in its own right, the operating margins from its ads business far surpass those of Amazon’s commerce divisions. In short, Google Cloud is a passenger in this race, and AWS is already cruising ahead with the wheel in hand.

It’s a fine edge to walk, but Amazon, with its broader revenue diversification and the unwavering support of AWS, seems to have the stronger footing in this comparison.

Winner: Amazon

Growth Rates: A Slow Dance of Giants

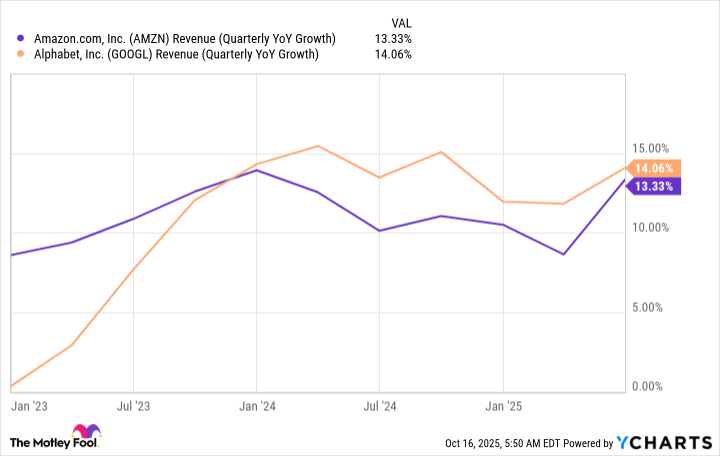

When it comes to growth rates, comparing Amazon and Alphabet is a task akin to comparing two professional dancers in a well-rehearsed waltz. There’s little to separate them. Alphabet may have had a slight edge in recent quarters, but the difference is so minuscule, it hardly warrants a second glance. After all, we’re talking about growth here, not miracles.

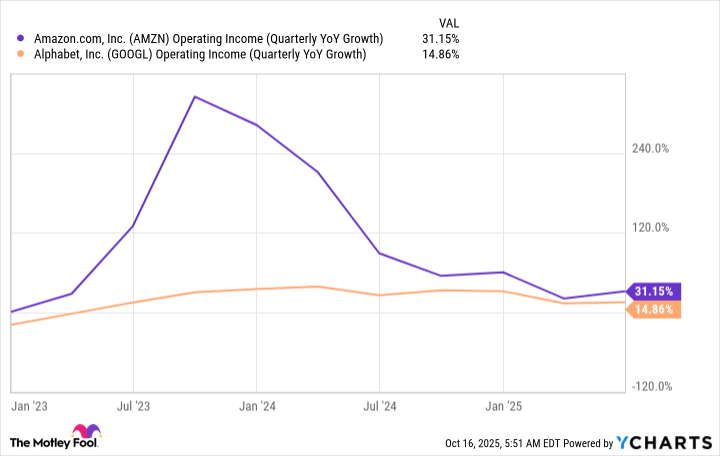

Now, for the Amazon faithful, they know the real story lies not in revenue growth, but in profit growth. And here, Amazon shines like a freshly polished coin. Its operating profits have expanded far more swiftly than Alphabet’s, and with its high-margin businesses-AWS and advertising services-growing at a clip that Alphabet’s advertising arm can only dream of, this pattern is likely to continue.

Winner: Amazon

Value: The Beauty of a Bargain

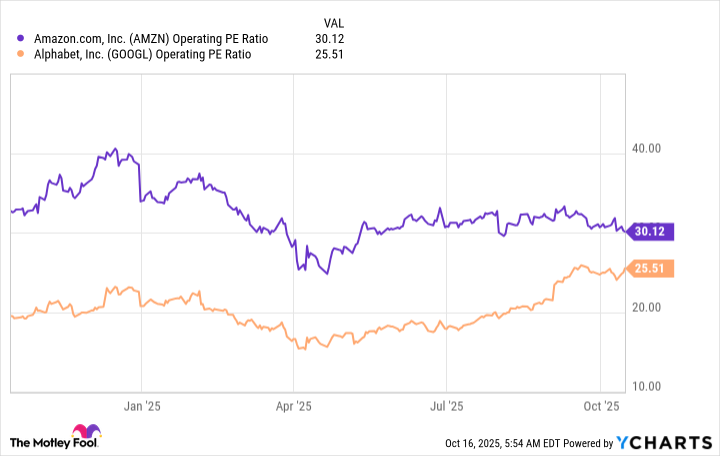

And now, dear reader, we come to the final question: is Amazon’s superior growth worth its premium price? Certainly, Amazon has been a bit of a diva in the market, demanding a hefty price-to-earnings (P/E) ratio. But this metric is hardly the end-all-be-all, for Amazon’s extensive investment portfolio distorts the picture, leaving its true valuation somewhat obscured. Instead, a more insightful measure would be the price-to-operating profit ratio, where things get even more interesting.

Winner: Alphabet

Ah, but here’s the twist in the tale-only six months ago, Alphabet was the undisputed bargain of the two. But now, that gap has narrowed, leaving Alphabet still trading at a slight discount, though not enough to crown it the clear winner in this comparison. While Alphabet is a fantastic investment, and its value proposition remains sound, Amazon’s relentless growth and resilience in the face of adversity make it, ever so slightly, the better choice-though not by much.

So, as we draw this comparison to a close, consider this: both stocks are fine investments, like two rare vintages of wine. But if you’re looking for a bottle that promises both complexity and longevity, Amazon’s the one you’ll want to keep on your shelf. 🍷

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- Games That Faced Bans in Countries Over Political Themes

- ‘Zootopia+’ Tops Disney+’s Top 10 Most-Watched Shows List of the Week

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

2025-10-21 13:23