In the kaleidoscopic dance of quarterly earnings, where numbers pirouette and stumble like drunken acrobats, one behemoth has begun to falter-at least in the eyes of those who mistake speed for grace. Amazon, that sprawling leviathan of cloud computing, e-commerce, and logistical wizardry, recently shed 10% of its stock value after revealing slower growth in its AWS division. A gasp rippled through Wall Street’s crowded theater, but let us not confuse the fluttering curtain with the play itself. For beneath this apparent stumble lies a story far richer than any single act could convey.

Consider, dear reader, the curious paradox of Amazon-a company so vast it seems to stretch beyond the horizon of comprehension yet remains tethered to the whims of short-term traders. Its cloud division may have grown by a mere 17.5% last quarter (to $30.9 billion), lagging behind Microsoft Azure’s flamboyant 34%, but such figures are as deceptive as shadows on a sundial. To focus solely on them is to miss the forest for the trees-or rather, to squint at one tree while ignoring the entire orchard.

A Cloud That Never Fully Disperses

Is Amazon falling behind in cloud computing? Ah, what a delightfully loaded question! It is true that Microsoft, hand-in-glove with OpenAI, has been spending like a prodigal heir at an auction house, leaving Amazon’s AWS looking almost parsimonious by comparison. Yet, let us not forget Anthropic-the second-largest AI startup, whose valuation whispers near $200 billion. This rising star has tethered itself firmly to AWS, funneling billions into its coffers and ensuring that Amazon’s lead in the cloud remains more than ornamental.

And so, while Microsoft nibbles at its heels, AWS continues to reign supreme, basking in the reflected glow of artificial intelligence’s insatiable appetite. With operating income of $43 billion over the past year and projections soaring toward $100 billion by decade’s end, one might say Amazon’s cloud is less a transient puff and more a permanent fixture in the financial firmament.

The Alchemy of Margins

But wait-there is more to this tale than silicon and servers. Let us turn our gaze to Amazon’s original heartbeat: e-commerce and its Prime subscription service, that siren song luring millions into its gilded embrace. North American sales still hum along at double-digit growth rates, swelling to $100 billion last quarter alone. Meanwhile, international operations-spanning Western Europe, Japan, India, and other far-flung realms-have reached $150 billion in trailing revenue.

Advertising services, growing at a sprightly 22%, serve as the alchemist’s fire transforming these raw materials into gold. Operating margins in North America now hover around 7%, with international margins trailing slightly at 3.4%. But here lies the intrigue: as moonshot projects like Alexa and Project Kuiper either mature or fade into oblivion, these margins will expand further. By 2030, I foresee North American margins scaling to 15%, with international margins reaching 10%-a transformation as gradual and inevitable as dawn overtaking dusk.

The Crown Jewel of Capitalism?

Which brings us to the pièce de résistance: why Amazon, and not Nvidia or Palantir, stands poised to wear the crown of capitalism by 2030. First, consider the twin engines propelling Amazon forward-cloud computing and e-commerce. Together, they form a juggernaut straddling industries as effortlessly as a colossus spans continents. Even as revenues approach $670 billion, there remains ample room for growth, particularly when coupled with margin expansion.

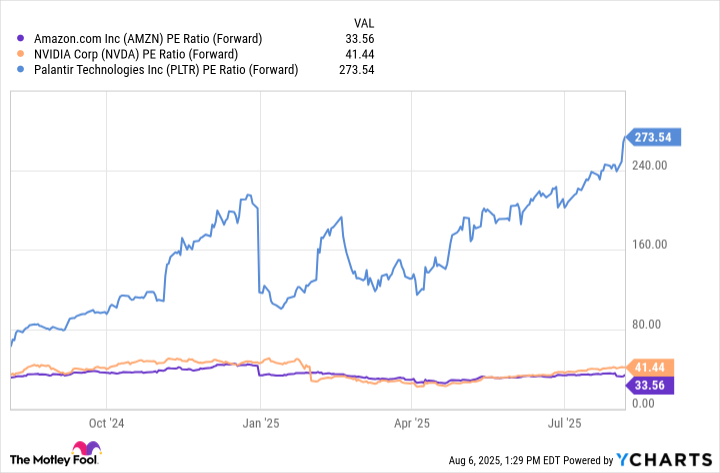

Second, Amazon is both customer and competitor to Nvidia, devouring its chips while simultaneously crafting its own Trainium processors. Each quarter, these homegrown marvels shoulder more of the computational burden, subtly eroding Nvidia’s dominion. And third, Amazon’s valuation-a forward P/E ratio of 33-appears downright modest beside Nvidia’s 41 or Palantir’s stratospheric 278. Such disparities suggest that Amazon’s ascent is not merely probable but preordained.

Thus, my fellow enthusiasts, we find ourselves at the threshold of an extraordinary epoch. While Nvidia and Palantir may dazzle with their pyrotechnics, Amazon moves with the quiet inevitability of tectonic plates shifting beneath our feet. To invest in Amazon today is to bet on a future where subtlety triumphs over spectacle-a wager as wise as it is poetic. 🌟

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- Gay Actors Who Are Notoriously Private About Their Lives

- ETH PREDICTION. ETH cryptocurrency

- Games That Faced Bans in Countries Over Political Themes

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- The Best Actors Who Have Played Hamlet, Ranked

- Banks & Shadows: A 2026 Outlook

2025-08-10 10:12