Ladies and gentlemen, gather ’round, because today we’re talking about a stock that’s not just climbing the charts-it’s tap-dancing its way to the $3 trillion club. Yes, you heard me right, folks. Amazon (AMZN), the same company that started as an online bookstore back when people still used dial-up internet, could soon be rubbing shoulders with the likes of Nvidia, Microsoft, and Apple. And if that doesn’t make you want to grab your monocle and start trading like it’s 1929, I don’t know what will.

- Nvidia: $4.4 trillion (because apparently GPUs are the new gold).

- Microsoft: $3.8 trillion (Bill Gates probably has this number tattooed somewhere).

- Apple: $3.3 trillion (Steve Jobs’ ghost is probably fist-bumping in heaven).

Now, Amazon’s market cap stands at $2.36 trillion as of this writing-August 12th, for those keeping score at home. That means its stock needs to rise by roughly 27% to hit the magical $3 trillion mark. Is it possible? Absolutely. Is it probable? Let’s find out together, shall we?

AWS: Where AI Meets “Aye-Aye, Captain!” ⚓

Ah, Amazon Web Services (AWS). It’s not just a cloud; it’s practically a thunderstorm of innovation. AWS is the world’s largest cloud platform, offering everything from data storage solutions to tools for building software applications. But here’s the kicker-it’s also becoming the go-to playground for AI developers. Why? Because AWS has chips-Trainium 2 chips, to be precise. These little silicon wonders offer up to 40% better price performance than their competitors. Imagine being able to train your AI models faster while saving money. Sounds like a deal even Ebenezer Scrooge would approve of!

But wait, there’s more! AWS also offers Bedrock, a smorgasbord of ready-made large language models (LLMs) for developers. One standout is Nova, Amazon’s very own foundation model. This bad boy isn’t just customizable; it’s practically begging to be tinkered with. Developers can pre-train Nova with additional data, extending its capabilities far beyond what third-party models allow. It’s like giving your AI a PhD without all the pesky student loans.

In Q2 of 2025, AWS raked in $30.8 billion-a drop in the bucket compared to Amazon’s total revenue of $167.7 billion but growing at a blistering 17% year-over-year clip. CEO Andy Jassy recently dropped some hints during a shareholder call, mentioning that AWS’s AI business is already generating revenue at a multi-billion-dollar annual run rate. Triple-digit growth, anyone? Cue the confetti cannons!

Retail Therapy: Amazon Style 💼

Let’s talk retail, shall we? Sure, AWS might be the profit powerhouse, responsible for 57% of Amazon’s operating income last quarter, but let’s not forget the bread-and-butter e-commerce business. Retail is where Amazon shines brightest-or at least tries to shine through the haze of razor-thin margins.

To boost efficiency, Amazon sliced its U.S. logistics network into eight regions in 2023. Now, products in fulfillment centers are tailored to specific geographic areas. Orders travel shorter distances, reaching customers quicker and cutting costs. In Q2 alone, package travel distance dropped by 12%, and touches per package fell by 15%. Fewer touches mean fewer opportunities for things to go wrong, which is great news for everyone except clumsy delivery drivers.

Oh, and did I mention AI? Of course I did. Amazon’s Project Private Investigator uses AI and computer vision to spot defective products before they reach customers. Meanwhile, Rufus, the AI shopping assistant on Amazon.com, helps shoppers compare products and make decisions faster. Think of Rufus as your digital best friend who never judges you for impulse-buying yet another air fryer.

All these efforts have paid off handsomely. Amazon reported earnings per share (EPS) of $1.68 in Q2, smashing Wall Street’s expectations by 26%. And guess what? Beating analysts’ estimates has become something of a hobby for Amazon-they’ve crushed quarterly forecasts by an average of over 20% since 2024 began. If this were a movie, Amazon would be the underdog boxer winning every round against heavyweight champions.

The Road to $3 Trillion: Paved with Chips and Algorithms 🛣️

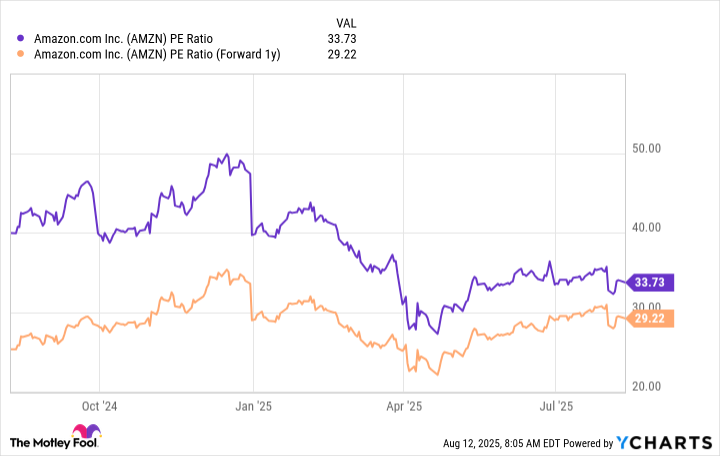

So, how close is Amazon to joining the $3 trillion elite? Based on trailing 12-month EPS of $6.55, Amazon trades at a P/E ratio of 33.7-slightly above the Nasdaq-100’s 32.9. Not bad, right? Looking ahead, Wall Street expects Amazon to deliver $7.54 in EPS by 2026, translating to a forward P/E of 29.2. To maintain its current valuation, Amazon’s stock would need to rise by 15.4% over the next 18 months, pushing its market cap past $2.72 trillion.

But here’s the twist ending worthy of a Mel Brooks film: Amazon’s historical P/E ratio averages 38.5. If the stock climbs back to that level, investors could see an additional 14% upside without factoring in further EPS growth. Add in Amazon’s knack for beating estimates, and voilà-you’ve got yourself a recipe for $3 trillion success, possibly as early as 2026.

Folks, remember this: investing is part science, part art, and part wild guessing game. But if you ask me-and why wouldn’t you?-Amazon looks poised to join the $3 trillion club sooner rather than later. So, strap in, hold tight, and maybe buy a few shares while you’re at it. After all, fortune favors the bold… and the slightly reckless. 😉

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- Gay Actors Who Are Notoriously Private About Their Lives

- Games That Faced Bans in Countries Over Political Themes

- 9 Video Games That Reshaped Our Moral Lens

2025-08-15 12:11