Quantum computing, that peculiar child of theoretical physics and venture capital, has once again found itself perched atop the investment zeitgeist like a confused meerkat wondering why everyone’s suddenly taking pictures. It promises to solve problems we haven’t even bothered to define yet (like: how many permutations of sock arrangements exist in a drawer of seventeen mismatched ones?), and yet it remains stubbornly pre-commercial – a glorious, glowing prototype of tomorrow, orbiting just out of reach, like a satellite made of hope and helium-3.

And so, we investors stand, blinking in the soft blue light of potential, trying to decide which horse to back in a race where the track hasn’t been built, the horses are made of superpositioned ions, and the finish line is somewhere around the year 2030, give or take a regulatory delay or quantum decoherence event. It’s not so much investing as it is placing bets on theology with VC money.

But! If there is one slightly less blind way to navigate this fog, it is to follow the breadcrumbs dropped by those who not only have more money than sense but also more engineers than small countries. Enter Amazon (AMZN), a company that began by selling books and now, in its spare time, runs the digital nervous system of half the planet. Amazon, in a move that may or may not have involved a whiteboard and a coffee ring named Greg, has quietly invested in IonQ (IONQ), a pure-play quantum outfit that has somehow avoided turning itself into a puff of mathematical regret. This is not a controlling stake, mind you – we are not witnessing a hostile takeover by a trillion-dollar e-commerce platform armed with delivery drones and existential dread – but rather a small, polite nod of approval.

A Tiny Stake, A Large Implication

Amazon’s holdings in IonQ – just over 850,000 shares as of the last 13F filing – amount to approximately 0.3% of the company. This is the financial equivalent of saying “I like your hat” at a party rather than “Let’s move in together.” But coming from Amazon, whose technical due diligence process is rumored to involve solving the Riemann Hypothesis over lunch, even a polite nod carries weight. It suggests that somewhere in a windowless room in Seattle, a team of analysts didn’t laugh the IonQ pitch straight into the Puget Sound. That, in itself, is a victory.

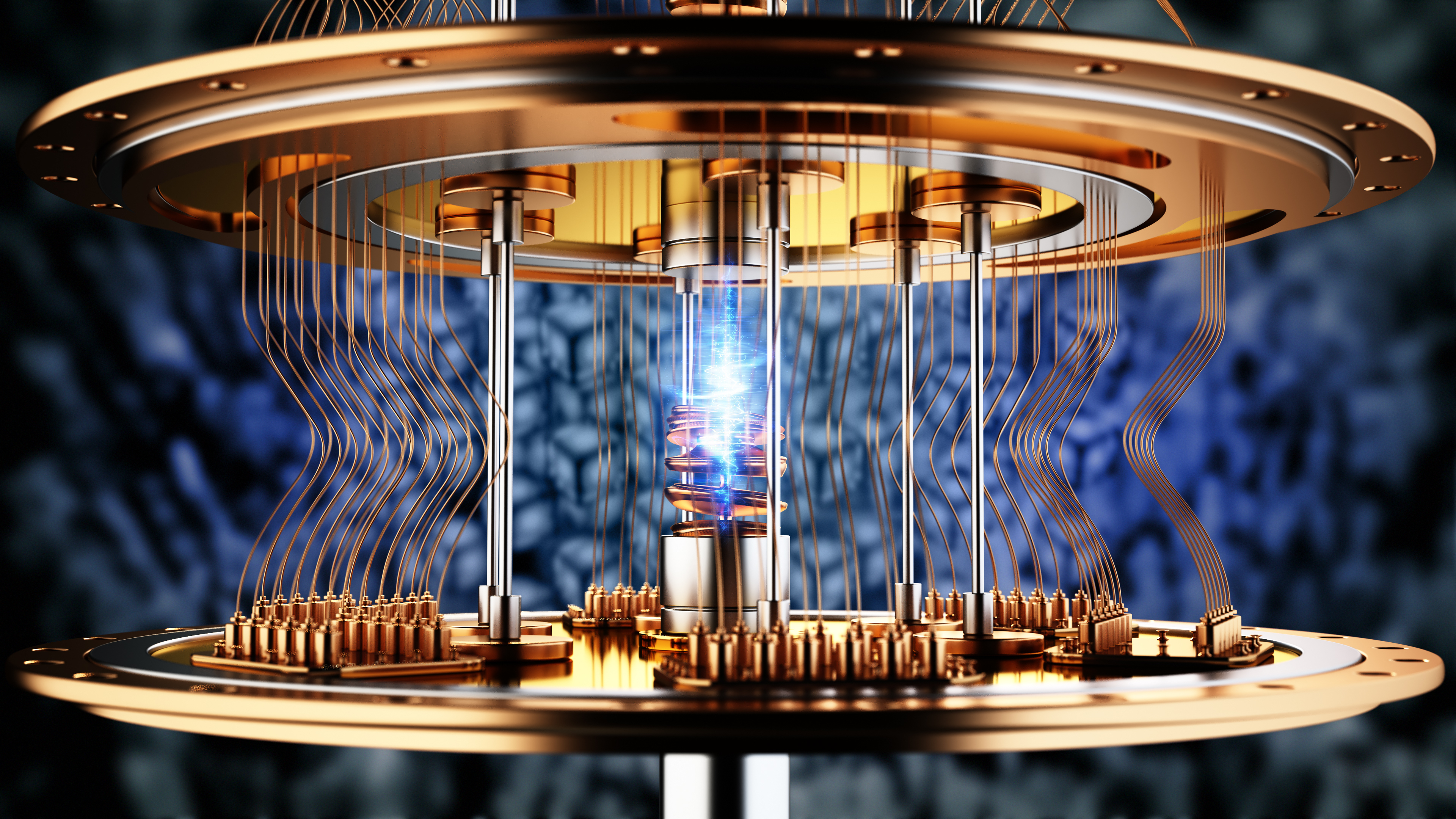

Now, IonQ isn’t just another startup promising to change reality with a whitepaper and a vision board. It has chosen a path less traveled: trapped-ion quantum computing. Where others attempt to freeze particles to within a billionth of a degree of absolute zero (an effort so extreme it makes keeping a lettuce crisp for more than two days seem trivial), IonQ levitates individual ions with lasers and manipulates them at room temperature – or at least, the temperature of a very well-air-conditioned basement. It’s like doing surgery with chopsticks while the patient floats three feet off the ground. Technically elegant, inherently accurate, and significantly less prone to melting down (literally and metaphorically).

Accuracy, as it turns out, is the Everest of quantum computing. Speed is nice, but if your computer gives you the answer “42” to every question, it’s not much help when you’re calculating bond yields. IonQ currently holds two world records in quantum fidelity – a metric so important it should probably have its own national holiday – making it, in the narrow but vital category of “not being completely wrong,” a leader.

This, combined with Amazon’s quiet endorsement, makes IonQ not just a speculative dart throw, but a reasonably well-lit bench on which to sit while the rest of the industry stumbles around in the dark, waving superconducting qubits like glow sticks at a physics rave.

The Five-Year Nap

Now, let us speak frankly: buying IonQ today is not an investment. No, it is an act of faith – faith that by 2030, the company will not only exist but will be pulling in $1 billion in revenue and turning a profit, as CEO Peter Chapman has gently implied. This is a long time to wait. Five years is enough for three technological revolutions, two recessions, and at least one entirely new social media platform that nobody uses. It is also enough time for your portfolio to undergo a full cardiac event every time the market sneezes.

The stock has already risen about 90% since September, which is remarkable for a company that currently produces fewer actual profits than a lemonade stand in a desert. This surge may be the dawn of a new era – or it may simply be the market misreading a press release as a paradigm shift. The line between visionary momentum and irrational exuberance is thinner than the wafer in a quantum photolithography process.

If you do invest, you must adopt the mindset of a geological surveyor: patient, slightly dusty, and accustomed to waiting millions of years for results. You are not here for the daily fluctuations – those are the wind rustling the leaves. You are here for the tectonic shift, the slow, inevitable grind of innovation beneath the surface. Success will not be measured by the stock price on any given Tuesday, but by the number of quantum records IonQ breaks, the partnerships it forms, and whether its technology actually, you know, works.

Because in the end, the quantum race isn’t about who gets there first – it’s about who doesn’t vanish in a puff of incorrect assumptions. And if history teaches us anything, it’s that the future rarely arrives on schedule, but it almost always brings luggage. 🌀

Read More

- Building 3D Worlds from Words: Is Reinforcement Learning the Key?

- Securing the Agent Ecosystem: Detecting Malicious Workflow Patterns

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The Best Directors of 2025

- Games That Faced Bans in Countries Over Political Themes

- TV Shows Where Asian Representation Felt Like Stereotype Checklists

- 📢 New Prestige Skin – Hedonist Liberta

- Most Famous Richards in the World

- SEGA Sonic and IDW Artist Gigi Dutreix Celebrates Charlie Kirk’s Death

2025-10-19 12:42