The relentless flow of data from corporations and government agencies presents a familiar problem for those of us tasked with managing capital: discerning signal from noise. It is not merely the volume of information that is troubling, but the ease with which important details can be obscured. Recent filings offer a case in point.

Institutional investors, those managing substantial sums, are required to disclose their holdings quarterly via Form 13F. This provides a snapshot, albeit delayed, of where money is being deployed. It is a useful, if imperfect, indicator. What often goes unnoticed is that these filings also reveal the positions of large corporations themselves, entities not typically associated with speculative ventures.

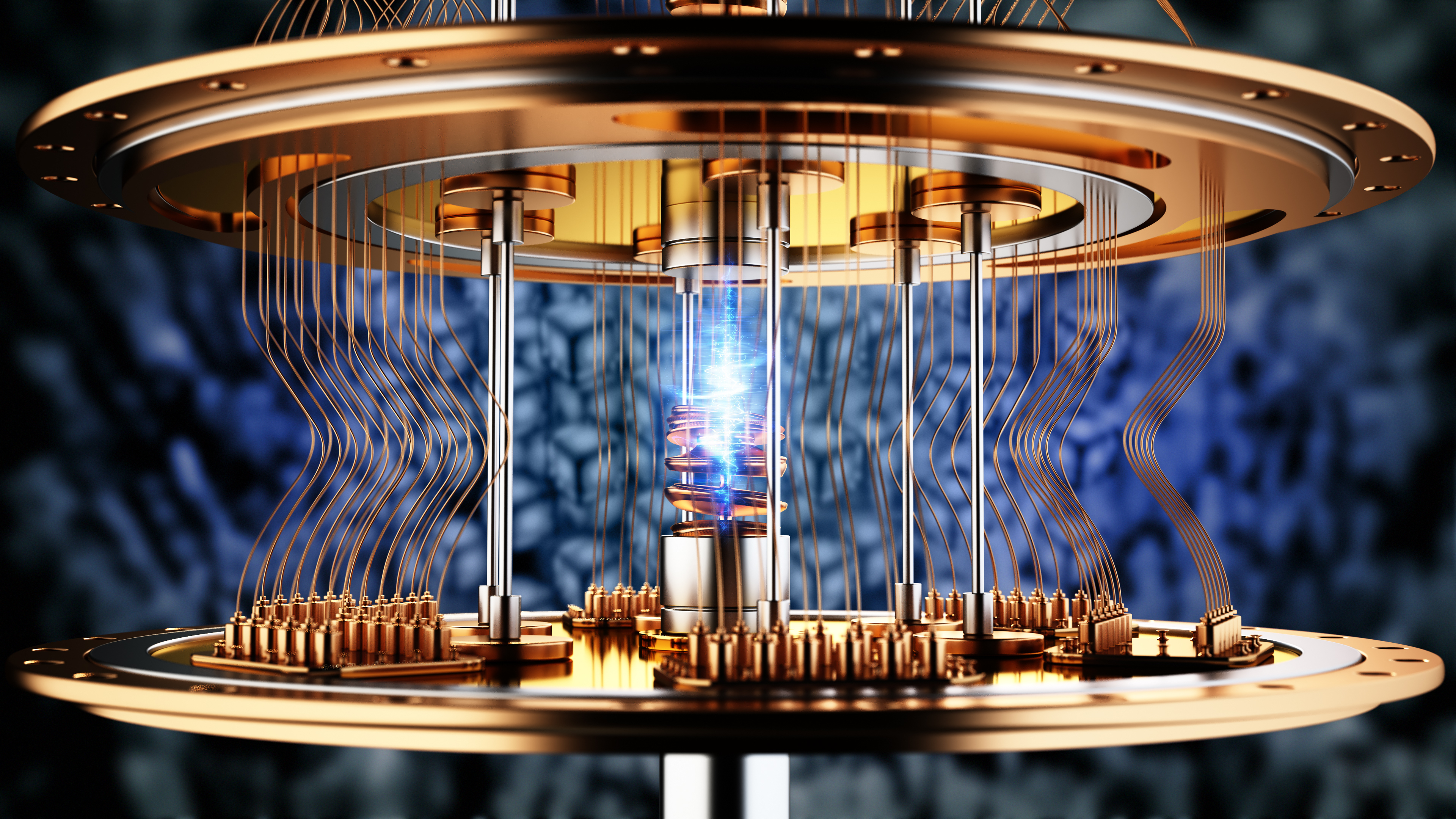

Amazon, primarily known for its retail dominance and cloud infrastructure, maintains a substantial investment portfolio. While this represents a relatively small fraction of its overall business, it is prudent to observe where they are choosing to allocate capital. Their recent activity regarding IonQ, a quantum computing firm, warrants closer scrutiny.

IonQ has captured the imagination of many, fueled by promises of revolutionary computing power. The potential market, estimated in the hundreds of billions, is often cited. This, of course, is the standard practice: first inflate the potential, then justify the present losses. The current enthusiasm is further amplified by the “fear of missing out,” a particularly virulent strain of investor irrationality. Trailing returns for IonQ and its competitors have been, frankly, absurd. Brand-name clients and collaborations – including Amazon’s own Braket service – have added to the illusion of progress.

JPMorgan Chase’s recent commitment to a substantial security and resiliency initiative has provided another boost. However, it is essential to remember that a stated intention and actual deployment of capital are distinct matters.

Amazon’s purchase of a small stake in IonQ, while noteworthy, is overshadowed by a prior transaction. They previously divested their entire holding in the company. This suggests a tactical maneuver – locking in gains and re-entering at a lower price – rather than a fundamental conviction in IonQ’s long-term prospects. It is a pattern we have witnessed repeatedly with these “next big thing” technologies.

History offers a sobering lesson. Each successive wave of innovation – the internet, mobile computing, and now quantum computing – has been accompanied by a period of excessive optimism, followed by a painful reckoning. The problem is not the technology itself, but the unrealistic expectations that are invariably attached to it. Quantum computers, despite the hype, remain in their infancy. Revenue generation is minimal, and profitability is years away, if ever. This necessitates continuous capital raising, often through share dilution, which inevitably harms existing shareholders.

Furthermore, Amazon, Microsoft, and Alphabet are all developing their own quantum processing units. This suggests they view quantum computing not as a field to be outsourced, but as a strategic asset to be controlled internally. The barrier to entry, while significant, is not insurmountable for companies with their resources. This poses a direct threat to pure-play firms like IonQ, whose leadership position is far from secure.

Amazon’s re-entry into IonQ’s stock is likely to generate further excitement. However, investors would be wise to approach this with a healthy dose of skepticism. The pursuit of innovation is commendable, but it must be grounded in reality. The current valuation of IonQ, and its peers, appears to be based more on hope than on substance. A prudent portfolio manager must prioritize capital preservation and seek investments that offer a reasonable margin of safety. In this instance, that margin is conspicuously absent.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- Top 15 Celebrities in Music Videos

- Top 20 Extremely Short Anime Series

- Where to Change Hair Color in Where Winds Meet

- 20 Films Where the Opening Credits Play Over a Single Continuous Shot

- Top gainers and losers

- 50 Serial Killer Movies That Will Keep You Up All Night

- 20 Must-See European Movies That Will Leave You Breathless

2026-02-16 12:13