In the world of commerce and cloud computing, Amazon (AMZN) stands as a colossus. Its stock has multiplied like the rings of an ancient tree, each year adding another layer of value for those who dared to hold on. And yet, one cannot help but wonder whether this titan of e-commerce and artificial intelligence still carries within it the seeds of greatness-or merely the echoes of past triumphs.

The rise of Amazon Web Services (AWS), its crown jewel, has been nothing short of miraculous. The service now commands a $123 billion annual revenue run rate, growing at 17% in its most recent quarter. It is easy to admire such numbers, much as one admires the stars from a quiet village at night-distant, brilliant, untouchable. Yet, behind this glittering facade lies the humdrum reality of operational challenges, cost overhauls, and the relentless march of competition.

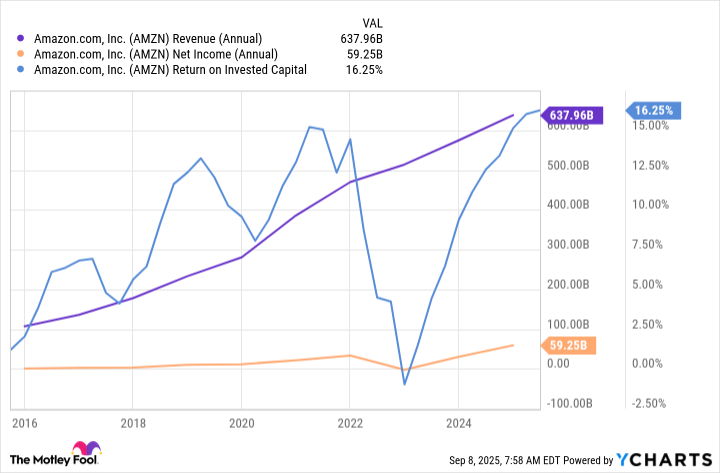

One might say that Amazon’s story resembles that of a man who builds a grand estate only to find himself forever repairing the roof. In 2022, the company stumbled under the weight of higher interest rates, reporting a net loss for the year. But adversity, they say, breeds resilience. Amazon took this moment to restructure its fulfillment network, trimming costs with the precision of a gardener pruning a stubborn hedge. These efforts have borne fruit, restoring profitability and positioning the company for what some call “long-term success.” Long-term success, however, is a phrase often spoken by those who do not know how long the term truly is.

A Powerhouse Beset by Shadows

Amazon’s dominance in e-commerce is undeniable. With over 200 million Prime members, the company has created a loyal customer base that returns again and again, lured by discounts, convenience, and the occasional thrill of Prime Day. Yet, there is something faintly tragic about the spectacle of millions of people flocking to buy goods online while the human connections once fostered by local markets fade into memory.

Meanwhile, AWS continues to dazzle, offering AI tools that promise to revolutionize businesses-if only those businesses knew how to use them. Amazon itself employs AI to streamline operations, finding faster routes for deliveries and reducing inefficiencies. One imagines a fleet of delivery vans moving through city streets like clockwork, their drivers unaware of the algorithms dictating every turn. Efficiency, after all, is a cold comfort when measured against the warmth of spontaneity.

A Valuation Both Reasonable and Elusive

At 35 times forward earnings, Amazon’s stock seems reasonably priced-a far cry from the lofty multiples of years past. But valuations are slippery things, much like reflections on water. They shift and shimmer, promising clarity yet revealing little more than the observer’s own hopes and fears. Investors look ahead, imagining profits yet unseen, while the present moment slips quietly away.

And so we arrive at my prediction-or perhaps it is more accurate to call it a hope. Amazon, I believe, could be a millionaire-maker stock once again. A modest investment of $50,000 fifteen years ago would now be worth over a million dollars. Such tales inspire dreams of wealth, yet they also carry a whisper of caution. For every fortune made, countless others are lost, scattered like leaves in an autumn wind.

It is wise, then, to temper ambition with prudence. Diversification, that old refrain of financial advisors, remains sound advice. Spread your investments across companies, sectors, and strategies. Let Amazon take its place among them if you wish-but do not let it consume your entire portfolio, lest you find yourself clinging to a single leaf while the forest grows around you.

If Amazon does indeed help you reach millionaire status, consider it a gift of fate rather than a certainty of calculation. Life, like the market, is full of unrealized potential. We plan, we predict, and yet the future arrives bearing surprises both cruel and kind 🌌.

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ETH PREDICTION. ETH cryptocurrency

- ‘Zootopia+’ Tops Disney+’s Top 10 Most-Watched Shows List of the Week

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- The Best Actors Who Have Played Hamlet, Ranked

- Games That Faced Bans in Countries Over Political Themes

2025-09-09 11:18