Now, Amazon, that behemoth of online commerce and cloud-based whatnots, has been experiencing a bit of a wobble, hasn’t it? Shares, after a rather sprightly start to the year, have taken a bit of a tumble, a most undignified descent, one might say. Investors, it appears, are in a bit of a fluster. The question, naturally, is whether this presents a golden opportunity for the discerning shareholder, or merely a case of catching a falling knife – a distinctly unpleasant experience, that.

Why the Fuss, You Ask?

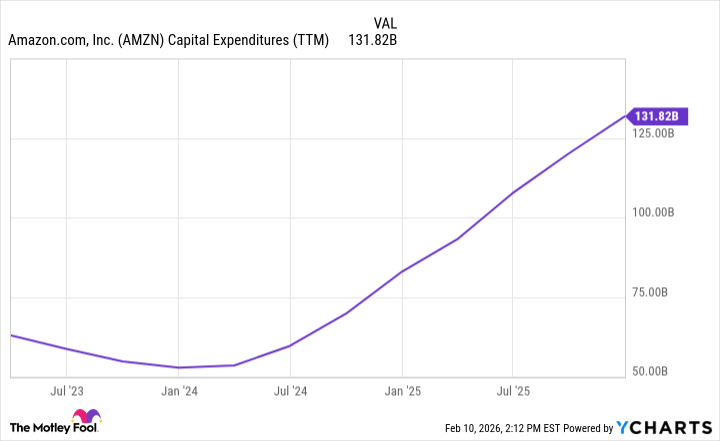

It seems our friends at Amazon have been rather enthusiastically parting with the company’s funds, a process known, rather mundanely, as capital expenditure. A perfectly sensible activity, one would think, except that they’ve been doing it on a scale that’s caused a bit of a stir. The reason? Artificial Intelligence, naturally. The demand for this modern marvel has prompted a veritable spending spree – building data centres, designing silicon chips, and acquiring GPUs from Nvidia – a most ambitious undertaking, what!

The latest earnings report revealed a planned expenditure of some $200 billion – a sum that caused a collective gasp amongst the financial cognoscenti. Wall Street, it seems, had been anticipating a mere $150 billion. A rather substantial difference, wouldn’t you agree? It’s enough to give a chap the vapors, really.

Is All This Spending Utterly Mad?

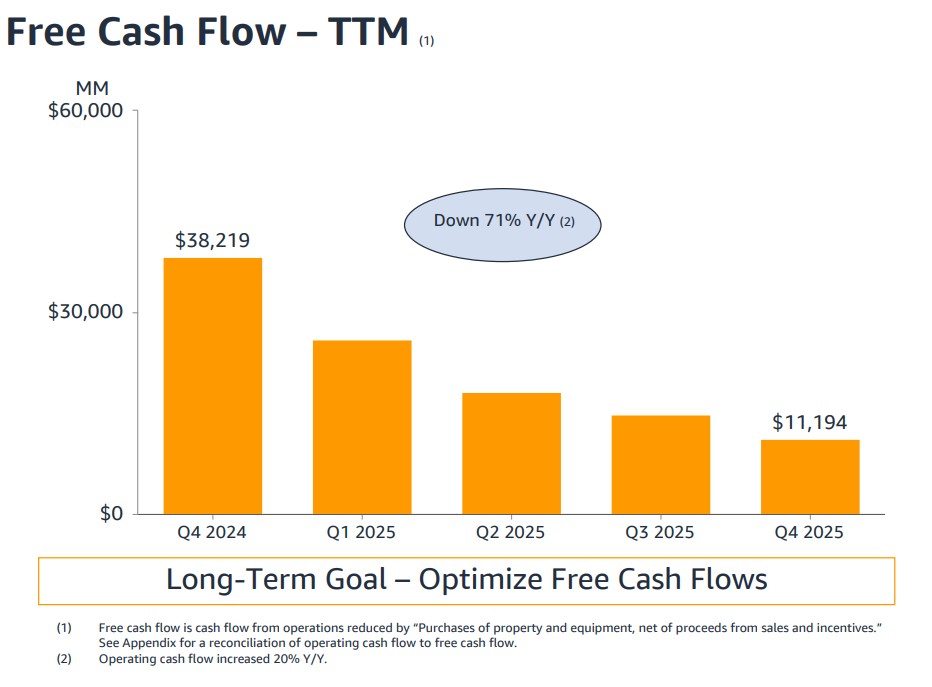

The chart, as you can see, rather neatly illustrates the current predicament. A rising tide of investment, unfortunately, seems to be accompanied by a slowing of cash flow. A distinctly awkward situation, and one that has understandably caused a few furrowed brows. However, one mustn’t leap to conclusions, you know. A bit of patience is often rewarded.

What the more excitable investors seem to be overlooking is the rather robust performance of Amazon Web Services. Sales and profits are consistently on the upswing, a most encouraging sign. This allows the company to indulge in these ambitious AI projects without completely emptying the coffers. A clever bit of financial engineering, one might say.

Building data centres, designing custom chips, and even investing in Anthropic – it all adds up to a vertically integrated AI operation. A decidedly savvy move, and one that should, in the long run, reduce costs and boost earnings. When you think it through, it’s rather ingenious, really. A temporary dent in cash flow, perhaps, but the long-term gains are difficult to deny.

Should One Plunge In, Then?

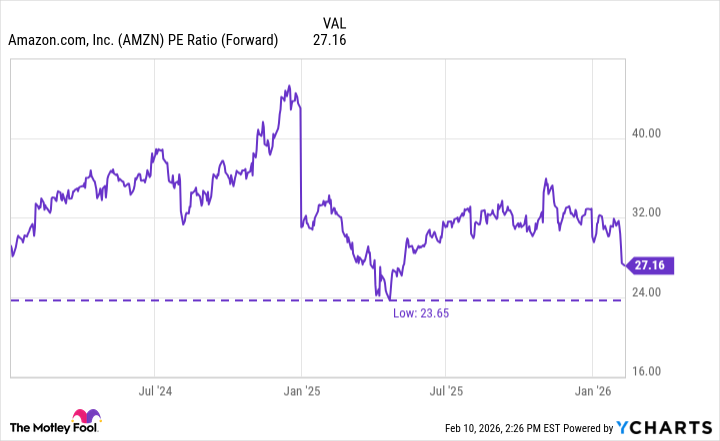

As of this moment, Amazon’s price-to-earnings ratio is hovering at a rather low level, especially considering the current AI frenzy. A most attractive proposition, wouldn’t you say? And with AWS sales reaccelerating and profits looking decidedly healthy, the decision to continue investing in AI infrastructure seems perfectly sensible.

While one can certainly understand the concerns about execution risk, Amazon has, in my humble opinion, already done a remarkably fine job of mitigating those worries. The company, you see, is not entirely devoid of competence. A rather pleasant surprise, that.

Therefore, I’d venture to suggest that the recent sell-off is somewhat overdone, and the stock looks like a decidedly good buy. A no-brainer, one might even say. For the long-term investor, it’s a capital proposition, and a jolly good one at that. A spot of bother, perhaps, but nothing a bit of shrewd investment can’t remedy.

Read More

- Gold Rate Forecast

- Securing the Agent Ecosystem: Detecting Malicious Workflow Patterns

- NEAR PREDICTION. NEAR cryptocurrency

- Wuthering Waves – Galbrena build and materials guide

- DOT PREDICTION. DOT cryptocurrency

- USD COP PREDICTION

- Silver Rate Forecast

- EUR UAH PREDICTION

- USD KRW PREDICTION

- Games That Faced Bans in Countries Over Political Themes

2026-02-14 02:22