It’s been a… let’s call it ‘interesting’ few months for those observing Amazon (AMZN 0.39%). The stock briefly flirted with new all-time highs in January – a fleeting moment of optimism, like spotting a perfectly sensible hat in a crowded marketplace – before commencing a rather more determined descent. Currently, it’s down around 14% year-to-date, a statistic which, when you consider the sheer scale of Amazon, is approximately equivalent to losing a small moon.

The prevailing narrative, of course, involves the company’s capital expenditure. Let’s delve into that, shall we? And then, if you’re still with me – which, frankly, is a statistically improbable event – I’ll explain why those of us who occasionally dabble in the art of financial speculation view this dip as an opportunity. A rather good one, actually.

Why Amazon’s $200 Billion Bet Isn’t Entirely Insane

Prior to Amazon’s recent earnings pronouncements, Wall Street, in its collective wisdom, anticipated capital expenditures of around $150 billion for the current year. Amazon, however, had other ideas. It announced plans to spend $200 billion. A rather substantial sum, really. Enough to build a small country, or perhaps a very elaborate system of paperclips. (The logistics of a paperclip-based nation are surprisingly complex, involving intricate trade agreements and a dedicated Ministry of Fastening.) This, naturally, caused a degree of consternation among those who prefer their investments to be… predictable.

The concern, quite understandably, is that this spending will impact free cash flow. Amazon is pouring money into GPUs (sourced from Nvidia, naturally, the purveyors of silicon dreams), designing its own custom silicon (a process best described as ‘highly ambitious’), and constructing AI data centers (which, let’s face it, are essentially very large, very cold warehouses for numbers). The combination of increased spending and potentially reduced cash flow is what’s currently prompting a degree of selling pressure.

However, investors are overlooking a crucial detail. Amazon Web Services (AWS) generated $35.6 billion in revenue during the fourth quarter – a 24% year-over-year increase. This is the highest growth AWS has seen in 13 quarters. And the backlog? A staggering $244 billion – up 40% year-over-year. That’s a lot of cloud computing. (It’s also enough to obscure the sun, should Amazon ever decide to weaponize its data centers. Which, admittedly, would be a rather dramatic move.)

AWS is a high-margin business for Amazon. While the e-commerce side of things can be subject to seasonal fluctuations and the whims of consumers (who, let’s be honest, are often irrational), AWS remains remarkably resilient, consistently generating operating margins in the mid-30% range. This consistency provides Amazon with a significant degree of financial flexibility – allowing it to reinvest in the business, as it’s currently doing. A virtuous cycle, if you will. Or, perhaps, a slightly less virtuous circle.

Beyond LLMs: The Anthropic Factor

One of the key drivers of AWS’s recent resurgence is its relationship with Anthropic. Anthropic’s Claude model is heavily integrated into the AWS ecosystem, particularly within a product called Amazon Bedrock. (Bedrock, in this context, refers to the foundational layer of AI, not actual geological formations. Although, one could argue that data centers are a kind of artificial geology.)

Furthermore, Anthropic is leveraging Amazon’s custom Trainium and Inferentia chips. By partnering with a leading enterprise AI system and designing its own infrastructure, Amazon is quietly building a cost-efficient, vertically integrated AI stack. This allows it to move beyond the realm of basic chatbots and address the needs of sophisticated, data-heavy enterprise workflows. (Which, incidentally, often involve spreadsheets. The unsung heroes of the modern age.)

A Buying Opportunity? (Probably)

It seems to me that most investors are overlooking the fact that Amazon is already reaping the benefits of its AI-related investments. Doubling down on infrastructure spending makes complete sense. While there may be a time lag between initial capital outlay and a meaningful return on investment, the evidence suggests that AWS is becoming more than just a capacity service. The combination of Anthropic and custom silicon represents strategic assets for Amazon’s AI ecosystem.

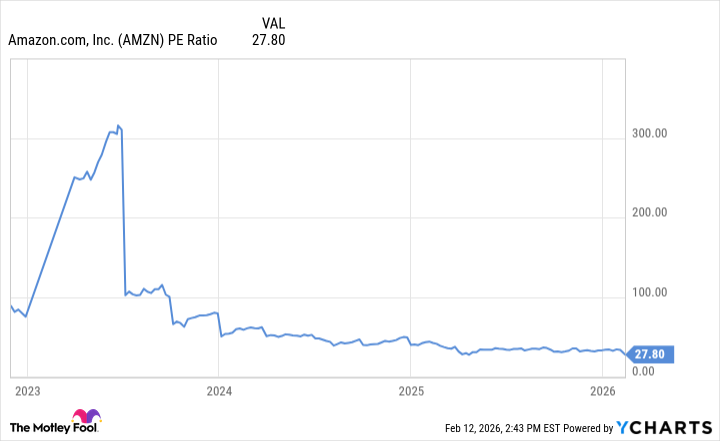

The recent software bear market has brought Amazon’s stock to its cheapest levels during the entire AI revolution, based on price-to-earnings (P/E) trends. (Which, of course, are notoriously unreliable indicators of future performance. But they look good in a chart.)

I believe Amazon is a rather sensible buy at this price point. The stock is heavily discounted relative to the company’s upside potential, making it a compelling opportunity to buy and hold as the AI movement continues to benefit the hyperscaler. (A ‘hyperscaler’ being a company that scales things to an almost frightening degree. Like a particularly ambitious ant colony.)

Read More

- Building 3D Worlds from Words: Is Reinforcement Learning the Key?

- Securing the Agent Ecosystem: Detecting Malicious Workflow Patterns

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The Best Directors of 2025

- Games That Faced Bans in Countries Over Political Themes

- TV Shows Where Asian Representation Felt Like Stereotype Checklists

- 📢 New Prestige Skin – Hedonist Liberta

- SEGA Sonic and IDW Artist Gigi Dutreix Celebrates Charlie Kirk’s Death

- Top 20 Educational Video Games

2026-02-17 07:13