Amazon, that vast, sprawling emporium of everything and nothing, did not, shall we say, dance for its investors last year. A mere 5% ascent while the S&P 500 frolicked at 18%? A pitiable showing, truly. But then, the market is a fickle beast, prone to whims and irrational exuberances. A sag, a temporary descent into the shadows, is not necessarily a harbinger of doom, but rather…an opportunity. A chance to examine the beast more closely, to sift through the digital dust and discern a glimmer of future yield. And yield, my friends, is what concerns a sensible man.

1. The Holiday Season: A Frenzy of Packages and Lost Souls

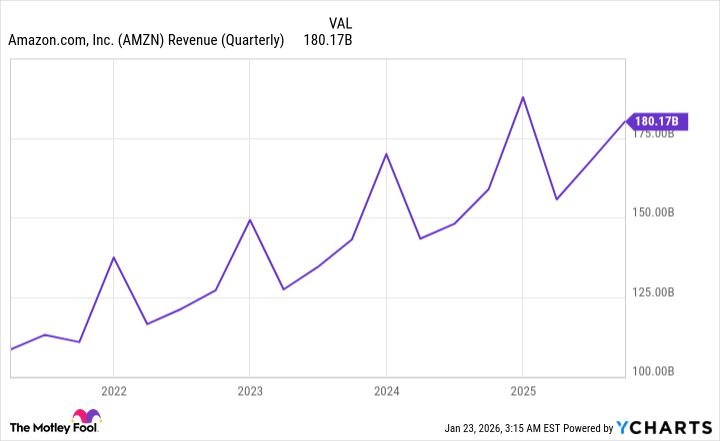

The fourth quarter, you see, is when the great annual spending ritual takes place. A time of frantic acquisition, of desperate attempts to fill the void with material possessions. The charts, predictably, exhibit a peculiar undulation, a yearly rise and fall mirroring the collective madness. One might almost suspect a cosmic influence, a celestial alignment that compels humanity to…purchase.

Reports, emanating from the Visa oracle, speak of a 4.2% increase in holiday spending, with e-commerce enjoying a particularly robust 7.8% surge. Amazon, that leviathan of online commerce, controls a rather alarming 40% of the U.S. market. A fact that should, naturally, pique the interest of any discerning investor. One can almost hear the coins clinking, the digital registers humming with the weight of countless transactions. And yet, amidst this frenzy of consumption, one wonders…what are we all buying? What emptiness are we attempting to fill?

Visa further informs us that physical retail still accounts for a stubborn 73% of total spending. A comforting thought, perhaps, for those who cling to the antiquated notion of shops. But for Amazon, it represents a vast, untapped territory, a sea of potential customers yet to be lured into the digital fold. A challenge, certainly, but one that Amazon, with its relentless efficiency and uncanny ability to anticipate our every desire, is undoubtedly prepared to meet.

2. AWS: Clouds of Data and the Promise of Artificial Intelligence

The truly fascinating aspect of Amazon’s enterprise, however, lies not in the mundane realm of package delivery, but in the ethereal world of Amazon Web Services, or AWS. A cloud, you see, is a rather apt metaphor. A vast, amorphous collection of data, suspended in the digital ether, accessible to all who possess the proper incantations (or, in this case, a valid credit card). And within this cloud, a new intelligence is stirring. Artificial intelligence, they call it. A rather grandiose term, perhaps, for a collection of algorithms and code, but one that holds the promise of…well, of something. Something vaguely unsettling, perhaps, but undeniably lucrative.

Amazon is pouring an astonishing $125 billion into AWS’ AI development, a sum that would make even the most extravagant of Tsars blush. They claim it is an investment in the future, a strategic move to dominate the cloud computing market. But one cannot help but wonder…what are they building in those digital server farms? What secrets are hidden within the code? And what will be the ultimate cost of this relentless pursuit of artificial intelligence?

The CEO, a Mr. Jassy, speaks of a “huge shift” over the next 10 to 20 years, as more and more clients flock to the cloud and embrace the AI tools available there. A bold prediction, certainly, but one that, given Amazon’s track record, is not entirely implausible. A growth runway, he calls it. A rather sterile term, perhaps, for a journey into the unknown.

3. A Price That Does Not Offend the Eye

Amazon, despite its impressive performance, has not enjoyed the same exuberant ascent as some of its competitors. Investors, it seems, are harboring doubts about its AI ambitions. A perfectly reasonable skepticism, perhaps, given the inherent unpredictability of artificial intelligence. But it also presents an opportunity. The stock currently trades at a price-to-earnings ratio of 33. Not exactly a bargain, to be sure, but not entirely unreasonable, given the company’s dominance and potential. A price that, shall we say, does not offend the eye. A modest valuation, in a world of inflated bubbles and speculative frenzy. A quiet corner of sanity, in a sea of madness.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- All weapons in Wuchang Fallen Feathers

- Where to Change Hair Color in Where Winds Meet

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Top 15 Celebrities in Music Videos

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- Macaulay Culkin Finally Returns as Kevin in ‘Home Alone’ Revival

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

2026-01-27 20:02