Right, so everyone’s clutching their pearls about Amazon. AMZN, if you’re keeping score. It’s been…underperforming. Let’s just say that. For a stock that was supposed to buy us all private islands, a 22% gain over five years? Honestly, the S&P 500 has been having more fun. 87%. I mean, seriously? It’s like watching a thoroughbred try to win a race in flip-flops.

Wall Street’s thrown a bit of a tantrum after the last earnings report. Apparently, Amazon’s decided to spend a lot of money. Like, enough to make even Jeff Bezos wince. They’re talking about burning through free cash flow in 2026. Which, naturally, sends everyone into a frenzy. It’s always the money, isn’t it? Always.

But here’s the thing. And I’m going to level with you, because frankly, I’m tired of the hand-wringing. I think they’re missing the point. And possibly the decade. This isn’t a disaster; it’s a strategic move. A rather expensive one, admittedly, but…potentially brilliant. So, let’s talk about why everyone else is wrong, and why I’m cautiously optimistic. (Cautiously, because let’s be real, the market is a chaotic beast.)

Capital Expenditures and the Long Game (or, Where the Money’s Actually Going)

Amazon Web Services – AWS, for those of you playing along at home – is suddenly very popular. And for good reason. All these AI start-ups? They’re throwing money at AWS like it’s going out of style. Anthropic, in particular, is a big spender. Billions, darling. Billions. They need data centers. Lots and lots of data centers. And building those isn’t cheap. It’s like trying to build a skyscraper out of hopes and dreams…and a whole lot of concrete.

Last quarter, AWS revenue jumped 24% to $35.6 billion. And they’re expecting even more growth in 2026. Which means…more spending. Amazon plans to shell out a whopping $200 billion on capital expenditures this year. Up from $132 billion last year. And $83 billion the year before. It’s…aggressive. I’ll give them that. Investors are panicking because it’s more than Amazon’s 2025 operating cash flow of $140 billion. Negative free cash flow in 2026? The horror! But honestly? I think it’s a sign of ambition. A willingness to invest in the future. It’s what you should be doing. Unless you’re content with mediocrity, of course.

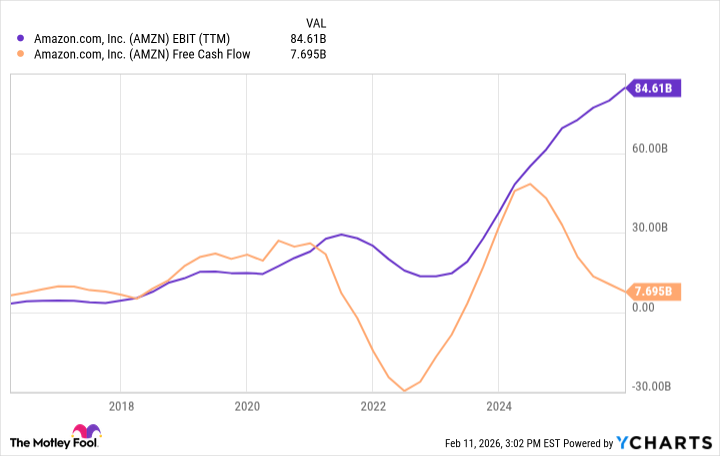

Remember the pandemic? Amazon needed to invest in cloud and delivery infrastructure to keep up with demand. Free cash flow took a hit. But then it bounced back. Spectacularly. I’m betting on a repeat performance. It’s just…slightly more expensive this time. Everything is, isn’t it?

Amazon: Still Cheap (If You Can Stomach the Volatility)

Right now, Amazon’s free cash flow is heading south, thanks to all this data center construction. But operating earnings are soaring, hitting a record $85 billion over the last 12 months. Which is…encouraging. It’s a good sign that the core business is still healthy. AWS revenue is up, and retail operations are becoming more efficient. Both trends should continue in 2026, fueled by the AI build-out and the growth of high-margin businesses like advertising. Consolidated operating margin was 11.8% in 2025. I’m expecting that to climb to 15% – or even higher – over the next decade. Optimistic? Perhaps. Realistic? I’d like to think so.

Once these AI investments are complete, free cash flow should start to catch up with operating earnings. If Amazon can grow its consolidated revenue by 15% a year over the next three years (it grew 14% last quarter, with accelerating AWS growth), the business will be doing over $1 trillion in revenue by the end of the decade. A trillion. Let that sink in. A 15% profit margin on that? That’s $150 billion in bottom-line earnings. Double what they’re making now. So, ignore the short-term hit to free cash flow. Follow the trend. And watch Amazon crush it for your portfolio over the next five years. (Disclaimer: I’m not a financial advisor. Just a slightly cynical observer with a vested interest.)

Read More

- Building 3D Worlds from Words: Is Reinforcement Learning the Key?

- Securing the Agent Ecosystem: Detecting Malicious Workflow Patterns

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The Best Directors of 2025

- Games That Faced Bans in Countries Over Political Themes

- TV Shows Where Asian Representation Felt Like Stereotype Checklists

- 📢 New Prestige Skin – Hedonist Liberta

- Most Famous Richards in the World

- SEGA Sonic and IDW Artist Gigi Dutreix Celebrates Charlie Kirk’s Death

2026-02-15 20:24