Amazon. (AMZN 0.41%). The stock hasn’t exactly been a rocket ship lately. Down a bit over 5% since the start of 2026. A small tragedy, really. It was doing okay in 2025, but then came the earnings report. A perfectly normal earnings report, actually. The market, though, decided to have a little fit. Ten percent down. Now it’s about twenty percent off its peak, which was, briefly, just under $260. So it goes.

Could it get back there by the end of the year? That $260. A round number. People like round numbers. Let’s have a look.

Amazon’s Earnings: Not Terrible, Not Wonderful

The ten percent sell-off after the earnings announcement? Mostly noise. Amazon projected $206 to $213 billion in revenue for the quarter. Operating income around $21 to $26 billion. They hit $213.4 billion. Up fourteen percent year over year. Operating income came in at $25 billion. Perfectly acceptable. The numbers themselves weren’t the problem. It’s always something else, isn’t it?

Amazon Web Services – AWS – grew twenty-four percent. Best rate in over three years. That’s good. They’re building their own chips. Revenue climbing in the triple digits. Very good. The future, it seems, is custom silicon. We’re all just along for the ride.

The issue wasn’t the performance. It was the spending. Amazon plans to spend $200 billion on capital expenditures this year. A massive increase from the $132 billion they spent over the last twelve months. The market didn’t like that. It rarely does. They’re spending money on… things. The future, probably. Or maybe just more things.

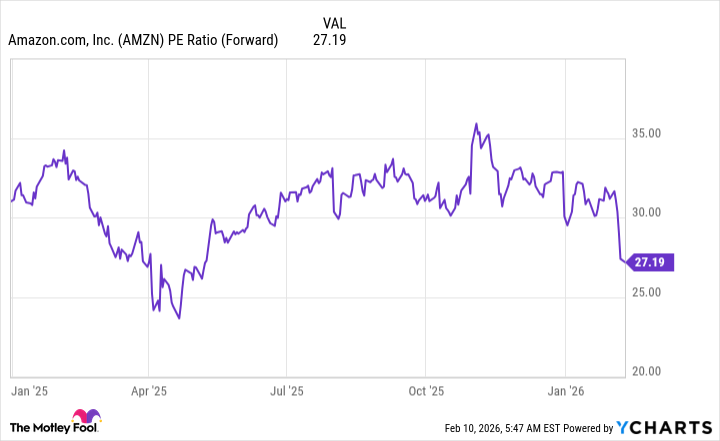

The stock used to trade at around 30 times forward earnings. Now it’s in the mid-20s. A discount. A small one, but a discount nonetheless. People are skeptical. About AI, about spending, about everything, really.

I suspect this dip is driven by a lack of faith. A general malaise. If AWS continues to grow, though, don’t be surprised to see the stock recover. And then some. The market is in a “show me” mood. They want results. Solid returns. Understandable, really. It’s their money.

That will take time. It always does. But if Amazon can deliver expectation-beating quarters throughout the year, I have no doubt the stock will climb back to its peak. And maybe even break through $260. A new high. A small victory in a meaningless universe. But if AWS growth falters? Well, then the stock could go the other way. It’s a simple equation, really. And so it goes.

Read More

- Building 3D Worlds from Words: Is Reinforcement Learning the Key?

- Gold Rate Forecast

- Securing the Agent Ecosystem: Detecting Malicious Workflow Patterns

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The Best Directors of 2025

- TV Shows Where Asian Representation Felt Like Stereotype Checklists

- Games That Faced Bans in Countries Over Political Themes

- 📢 New Prestige Skin – Hedonist Liberta

- Most Famous Richards in the World

- SEGA Sonic and IDW Artist Gigi Dutreix Celebrates Charlie Kirk’s Death

2026-02-15 12:42