The company known as Altria Group – a name whispered with a mixture of reverence and apprehension in the halls of finance – finds itself in a most peculiar predicament. For years, this purveyor of tobacco has skillfully masked the waning affections of its clientele with ever-increasing prices, a practice not unlike a magician attempting to conceal a dwindling supply of rabbits. Now, alas, even this artful deception seems to falter, and revenue, that most fickle of mistresses, begins to slip through its grasp.

One might expect, in such circumstances, a corresponding decline in the market’s estimation. Yet, observe the paradox! The share price, contrary to all logical expectation, has ascended since the dawn of this year. A most curious spectacle, indeed! The stock, valued at a modest price-to-earnings ratio of twelve, prompts a question: is this a treasure overlooked, or merely a gilded cage?

Altria and the Allure of the Dividend

In the annals of corporate survival, few tales rival the endurance of Altria. Consider, if you will, the pronouncements of the Surgeon General in 1964, a declaration of the dangers inherent in the company’s primary offering. Between declining patronage and the substantial settlements levied against it, one might reasonably conclude that Altria’s stock would long ago have succumbed to its fate.

However, the contrary has proven true. Both the stock itself, and, more impressively, its dividend, have, for the most part, flourished. The annual payout, currently at $4.24 per share, yields a generous 6.8%. A most consistent performance, stretching back to 1989, save for a brief period of prudence from 2007 to 2009.

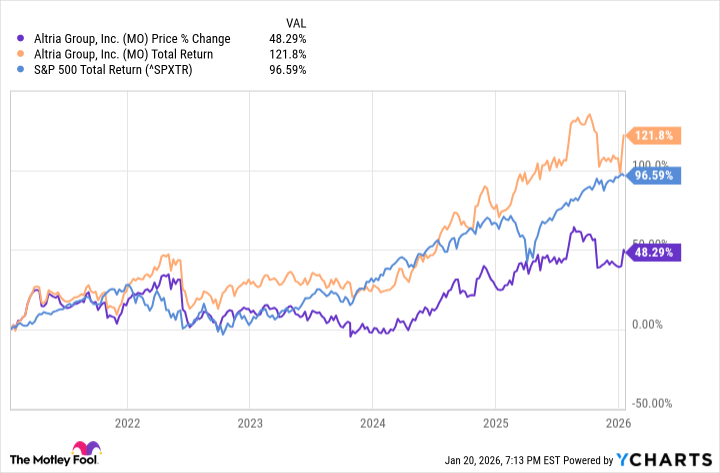

More recently, however, the performance has been…mixed. While it has managed to surpass the returns of the S&P 500 when dividends are included, the stock itself has lagged considerably behind. A performance not unlike a courtier who bows deeply while subtly relieving himself of a burdensome obligation.

The root of this trouble, it would seem, lies in Altria’s persistent inability to find a successor to its dwindling tobacco empire. The company, in a display of ambition that borders on the reckless, invested a staggering $12.8 billion in Juul, an e-cigarette manufacturer. That venture, plagued by lawsuits and regulatory censure, has proven to be a most regrettable indulgence. It has since traded that stake for intellectual property and ventured into NJOY.

And let us not forget the foray into the realm of cannabis, with a $1.7 billion investment in Cronos Group. Today, that company’s market capitalization barely exceeds $1 billion. A cautionary tale, if ever there was one, of chasing fleeting fancies.

These miscalculations have taken their toll, and sustaining the dividend, that beacon of shareholder satisfaction, is becoming increasingly arduous. Over the past twelve months, the company generated approximately $9.2 billion in free cash flow, sufficient to cover the $6.9 billion in dividend payments, but leaving precious little for other endeavors.

Unless Altria can conjure a reversal of fortune, this generous payout may prove unsustainable, and shareholders, accustomed to a steady stream of income, may find themselves adrift.

Is Altria a Bargain, or a Fool’s Errand?

Given these considerable challenges, a prudent investor might well be justified in overlooking Altria, despite its seemingly low valuation.

The 6.8% dividend yield, on the surface, appears alluring. However, the persistent inability to maintain revenue levels, despite ever-increasing prices, is a troubling sign. Moreover, the billions squandered on ill-fated ventures have left the company with limited resources. The rising dividend, therefore, consumes a disproportionate share of its free cash flow.

It is not entirely beyond the realm of possibility that Altria might succeed with e-cigarettes or cannabis. Nor can we entirely dismiss the notion that tobacco consumption might stabilize. However, unless conditions improve dramatically and soon, this is unlikely to be a stock worth acquiring, even at its current, deceptively attractive, valuation. It is, in short, a comedy of errors, and one best observed from a safe distance.

Read More

- Gold Rate Forecast

- Securing the Agent Ecosystem: Detecting Malicious Workflow Patterns

- NEAR PREDICTION. NEAR cryptocurrency

- DOT PREDICTION. DOT cryptocurrency

- Wuthering Waves – Galbrena build and materials guide

- USD COP PREDICTION

- Silver Rate Forecast

- EUR UAH PREDICTION

- USD KRW PREDICTION

- Games That Faced Bans in Countries Over Political Themes

2026-01-24 04:32