As the second week of August unfurls its weary wings, the crypto market capitalization has soared past $4 trillion, a figure so staggering it might make even the most stoic accountant weep into his abacus. 📈 With spirits buoyed and bullish dreams inflating faster than a politician’s promises, there emerges an alarming chasm between longs and shorts-those eternal foes locked in their Sisyphean struggle.

Alas, dear reader, not all is sunshine and moon-based memes. Some altcoins stand precariously close to the abyss, where liquidations loom like creditors at a bankrupt duke’s door. Should prices defy the fervent prayers of leveraged traders, chaos shall ensue. Let us examine these hapless tokens with the detached amusement of aristocrats watching peasants squabble over turnips. 🍠

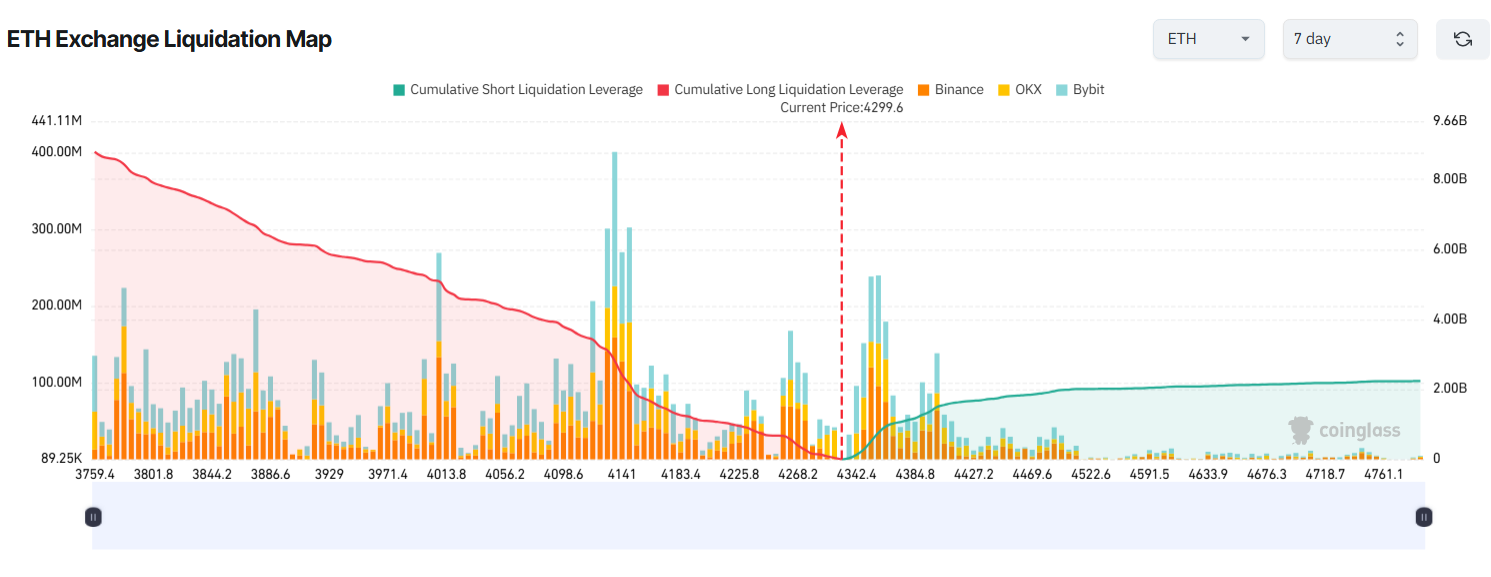

Ethereum (ETH): The Overconfident Aristocrat

Ah, Ethereum-the darling of the digital age, strutting about as though it owns the blockchain manor. Its 7-day liquidation map reveals a perilous imbalance, with longs piling up like guests at a free buffet. These reckless souls have bet their fortunes on ETH continuing its ascent above $4,300, as if such things were ordained by celestial decree. ✨

According to Coinglass, should ETH suffer a mere 7% decline to $4,000, longs could lose over $5 billion-a sum so vast it might fund several small nations’ defense budgets. Conversely, a rise to $4,600 would see shorts losing a comparatively modest $2 billion. But beware! For some whisper that liquidity flows almost exclusively into ETH, leaving other altcoins parched like forgotten houseplants. Should buying pressure wane, ETH may tumble faster than a debutante’s reputation after one too many glasses of champagne. 🍾

“Should Ethereum plummet to $3,600,” muses investor Marzell, “over $7 billion in long positions would vanish-a veritable feast for exchanges hungry for trading fees. And while liquidity gushes toward ETH, other coins languish, suggesting Ethereum might be preparing to shoulder the burden of balancing the crypto cosmos against Bitcoin’s looming dominance.” One wonders whether ETH knows what it has signed up for. 🌌

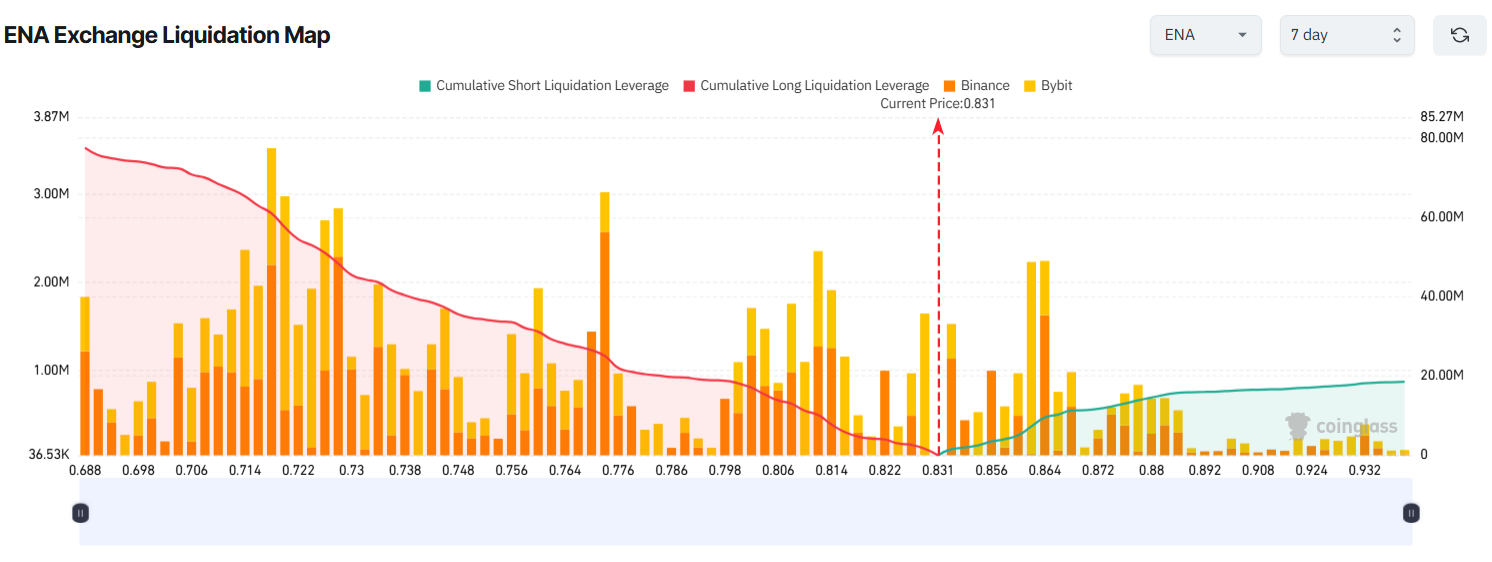

Ethena (ENA): The Upstart Parvenu

And now we turn our gaze to Ethena (ENA), the brash newcomer whose USDe stablecoin has reached a $10 billion market cap, elbowing aside lesser peers to claim third place behind USDT and USDC. Thanks to the GENIUS Act passing in July, ENA finds itself basking in the glow of bullish sentiment, its price ascending from $0.50 to $0.80 faster than you can say “regulatory approval.” 🚀

Yet, dear reader, let us not grow too attached to this meteoric rise. ENA’s liquidation map shows longs far outweighing shorts, setting the stage for potential disaster. Should ENA retreat to $0.70, longs face losses exceeding $70 million; however, a climb to $0.90 would inflict only $16.5 million in pain upon shorts. Optimists dream of $1.50, but skeptics warn of profit-taking lurking in the shadows of $0.80-$0.90. A classic tale of hubris and humility awaits. 😏

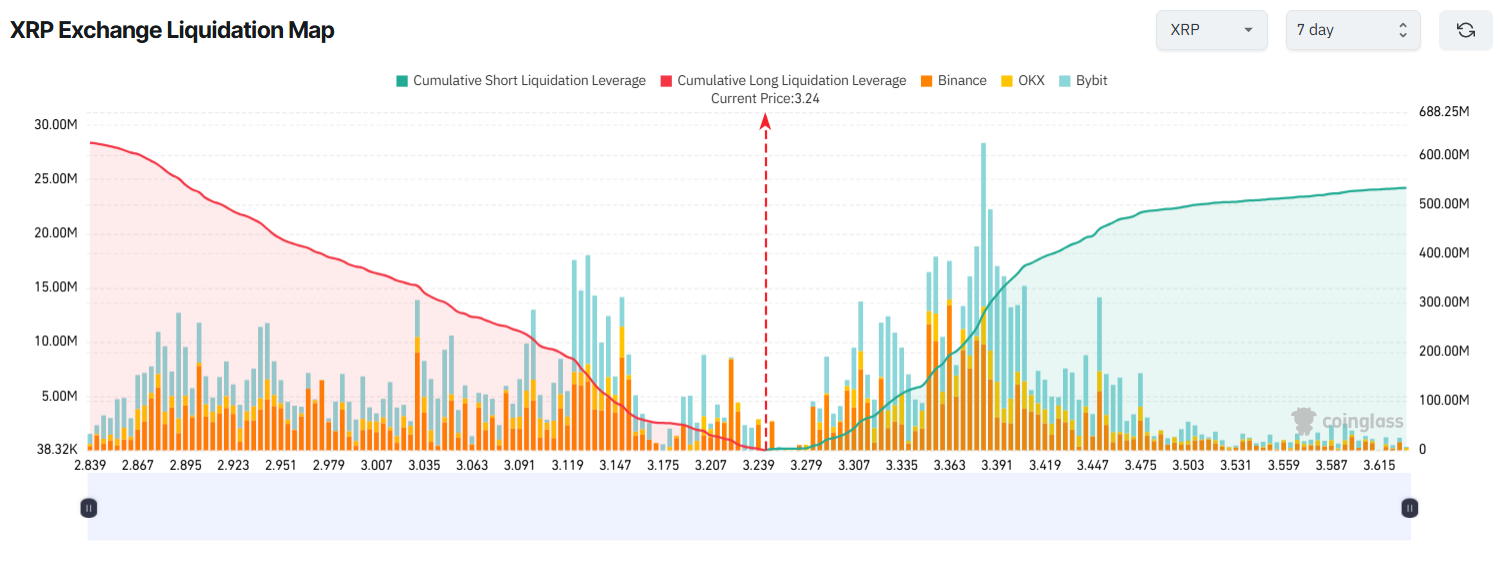

XRP: The Cautious Pessimist

Finally, we arrive at XRP, the gloomy Cassandra of the crypto world. Unlike its brethren, XRP’s liquidation map tilts decidedly bearish, reflecting traders’ grim expectations. Perhaps they’ve been spooked by Ripple’s recent unlocking of 1 billion XRP, a move as subtle as a bull in a china shop. 🐂

If XRP defies these dour predictions and rises 8% to $3.50, shorts will endure nearly $500 million in liquidations-a fate cruel enough to warrant sympathy, even from the most hardened cynic. Conversely, a drop to $3.00 would punish longs to the tune of $370 million. Truly, XRP is a coin caught between hope and despair, much like a gambler eyeing his last chip. 🎲

Thus concludes our little tour of altcoins teetering on the edge of ruin-or triumph, depending on your perspective. Whether they soar or sink remains to be seen, but rest assured, the spectacle will be nothing short of entertaining. After all, isn’t that why we’re here? To watch, to wager, and occasionally, to weep? 😢🎉

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- Games That Faced Bans in Countries Over Political Themes

- ETH PREDICTION. ETH cryptocurrency

- Gay Actors Who Are Notoriously Private About Their Lives

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- USD PHP PREDICTION

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

2025-08-11 23:20