As a seasoned researcher with over two decades of experience in the financial markets, I have seen my fair share of market cycles and trends. The current surge in altcoins is undeniably intriguing, and it’s not every day that we see 38 out of the top 50 cryptocurrencies outperforming Bitcoin over a 90-day period!

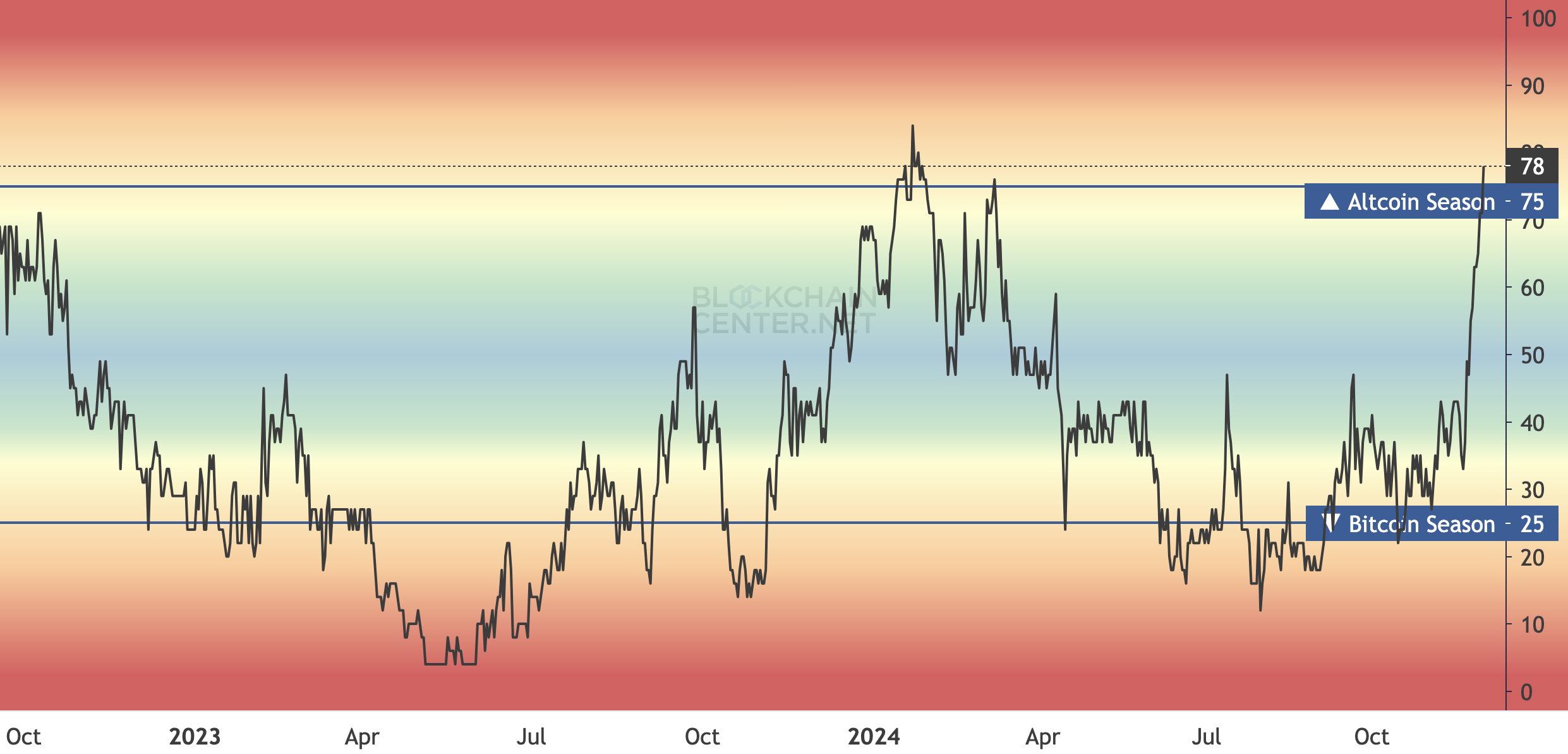

Today, about 76% of the leading 50 cryptocurrencies have surpassed Bitcoin‘s (BTC) performance in the past 90 days. Consequently, the Altcoin Season Index has reached its peak since January.

As a crypto investor, I’ve been buzzing with excitement about this recent development, as it’s fueling a surge of optimism across the market. Many are speculating that the prices of these altcoins might skyrocket in the upcoming months. However, the question remains: is such a scenario realistic?

Altcoins Take Over, but Analysts Differ on Reason for Surge

If you’re new to this, let me explain the Altcoin Season Index. This tool gives live updates based on how the top 50 cryptocurrencies are performing compared to Bitcoin. Usually, a score of 25 indicates that Bitcoin is dominating. This means it has outperformed at least 75% of the top 50 digital currencies.

Conversely, when the Altcoin Season Index exceeds 75, it’s a signal for an altcoin season. This means that most of the top 50 cryptocurrencies generally perform better than Bitcoin during this period. At present, the index is at 78, supporting the belief that altcoins might outperform Bitcoin in the upcoming months.

As a researcher, I’ve observed a significant reading peak in my data, which has not been surpassed since January 22. Over this period, altcoins displayed robust performance until around March, at which point their dominance started to diminish. However, in the current market cycle, BeInCrypto highlights Stellar (XLM), Hedera (HBAR), and Ripple (XRP) as the frontrunners, driving the charge in this sector.

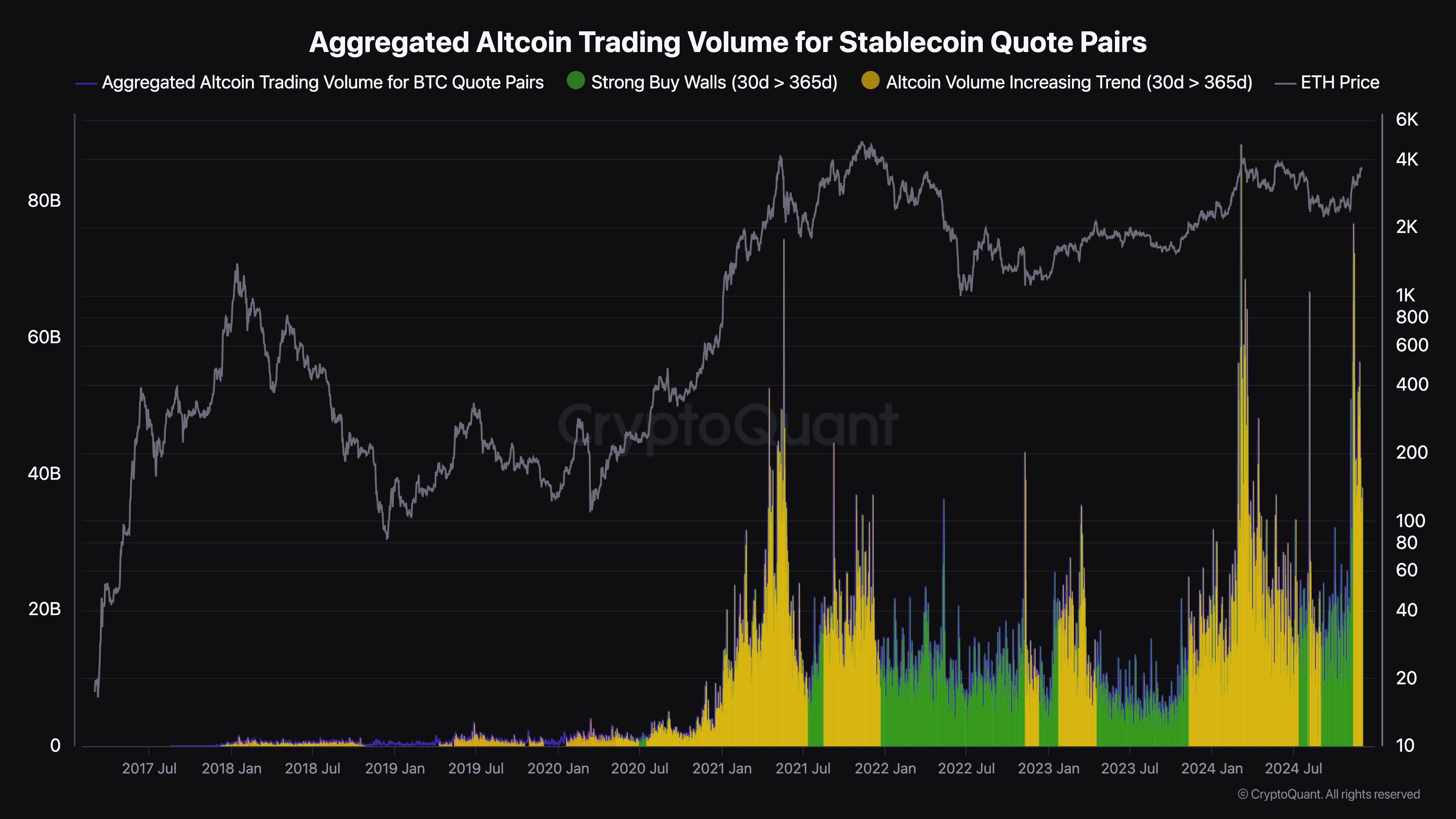

On the contrary, Ki Young Ju, CryptoQuant’s CEO, presented an alternative viewpoint about the ongoing altcoin surge. He suggested that the driving force behind this period may not be primarily due to a shift in liquidity from Bitcoin.

Nevertheless, he pointed out that the primary factor fueling this trend is the growing availability and adoption of stablecoins and their pairings with traditional currencies. This change in direction implies that a substantial influx of fresh capital could potentially have a significant impact on the value of alternative cryptocurrencies.

According to Ki Young Ju, the concept of “alt season” no longer revolves around a shift from Bitcoin to other assets. Instead, the increase in trading volume for altcoins is more likely due to stablecoin and fiat pairings, indicating genuine market growth rather than just a rotation of assets.

As a crypto investor, it’s clear that I have been keeping an eye on Rekt Capital’s analysis. On November 30, the analyst suggested something intriguing: the decline in Bitcoin’s dominance, now hovering around 56%, is a sign that funds are shifting towards Ethereum (ETH) and other alternative coins. This could be an indication of potential growth for these altcoins.

According to Rekt Capital, if Bitcoin’s price remains around $91,000 to $100,000, it could potentially pave the way for Ethereum to gain prominence, which might in turn direct investment towards lesser-known Altcoins.

Analysis Hints at Higher Highs for Alts Market Cap

The analysis of TOTAL2, which gauges the total market capitalization of the leading 125 alternative cryptocurrencies, indicates a potential bullish trend emerging as a ‘bull flag’ is shaping up in its 3-day chart.

A bull flag is a chart pattern that suggests an upcoming bullish movement in the market. It’s formed when there are two rallies separated by a brief period of sideways movement or consolidation. The initial rally, referred to as the “flagpole,” represents a strong surge in buying activity overpowering selling activity. After this, there’s a pullback that forms a ‘flag’ shape with sloping trendlines running parallel to each other. This ‘flag’ suggests that the market may continue its upward trend following the consolidation phase.

Given this setup, it’s plausible that TOTAL2 will significantly increase beyond $1.45 trillion. If this happens, numerous altcoins could potentially break past their record-high values.

If the dominance of Bitcoin rises again to 60%, the period for altcoins might recede, potentially making this prediction inaccurate.

Currently, a well-known cryptocurrency expert named Doctor Profit is expressing his belief that an altcoin boom is approaching. In a recent article on platform X, he forecasted that the latter part of this year and the first quarter of 20245 may see increased prices for altcoins.

As a researcher, I’ve been closely observing the market trends, and I can’t help but notice a bullish signal in the increasing institutional investments in Ethereum. Additionally, whispers within the industry hint at potential plans by asset managers such as BlackRock and JP Morgan to launch an XRP Exchange-Traded Fund (ETF). If this comes to fruition, it could significantly boost the altcoin market, particularly XRP.

As a crypto investor, I’m buzzing with excitement over the latest gossip making waves. It seems that BlackRock and JPMorgan might be preparing to introduce an XRP Exchange-Traded Fund (ETF), and if these rumors are true, it’s not just significant – it’s colossal! We find ourselves on the precipice of Altseason, and those who choose to remain unaware could risk getting left behind in the dust.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- 30 Best Couple/Wife Swap Movies You Need to See

- Ncuti Gatwa Exits Doctor Who Amidst Controversy and Ratings Crisis!

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- USD ILS PREDICTION

- 9 Kings Early Access review: Blood for the Blood King

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- All 6 ‘Final Destination’ Movies in Order

- Tyla’s New Breath Me Music Video Explores the Depths of Romantic Connection

2024-12-02 14:59