As a seasoned crypto investor with a knack for spotting market trends and understanding their implications, I find the current state of the altcoin market intriguing. The indicators suggest that we might be on the brink of an altcoin season, a period that has historically offered significant opportunities for growth in the crypto space.

It seems like we’re seeing hints that an ‘altcoin rally’ might be on the horizon, a phase marked by increased prices for various cryptocurrencies compared to Bitcoin. Typically, investors tend to redirect their attention and resources towards alternative coins during such times.

Several important signs suggest a slow but definite change in the market’s behavior, and this examination explores some of these influencing aspects.

Altcoin Season May Be Underway

One such indicator is the increasing trend in TOTAL3, a metric that tracks the total market capitalization of all cryptocurrencies, excluding Bitcoin and Ethereum. As of this writing, it stands at $933 billion, surging by 35% since the beginning of the month. For context, the market capitalization of this group of assets has added $212 billion over the past 22 days.

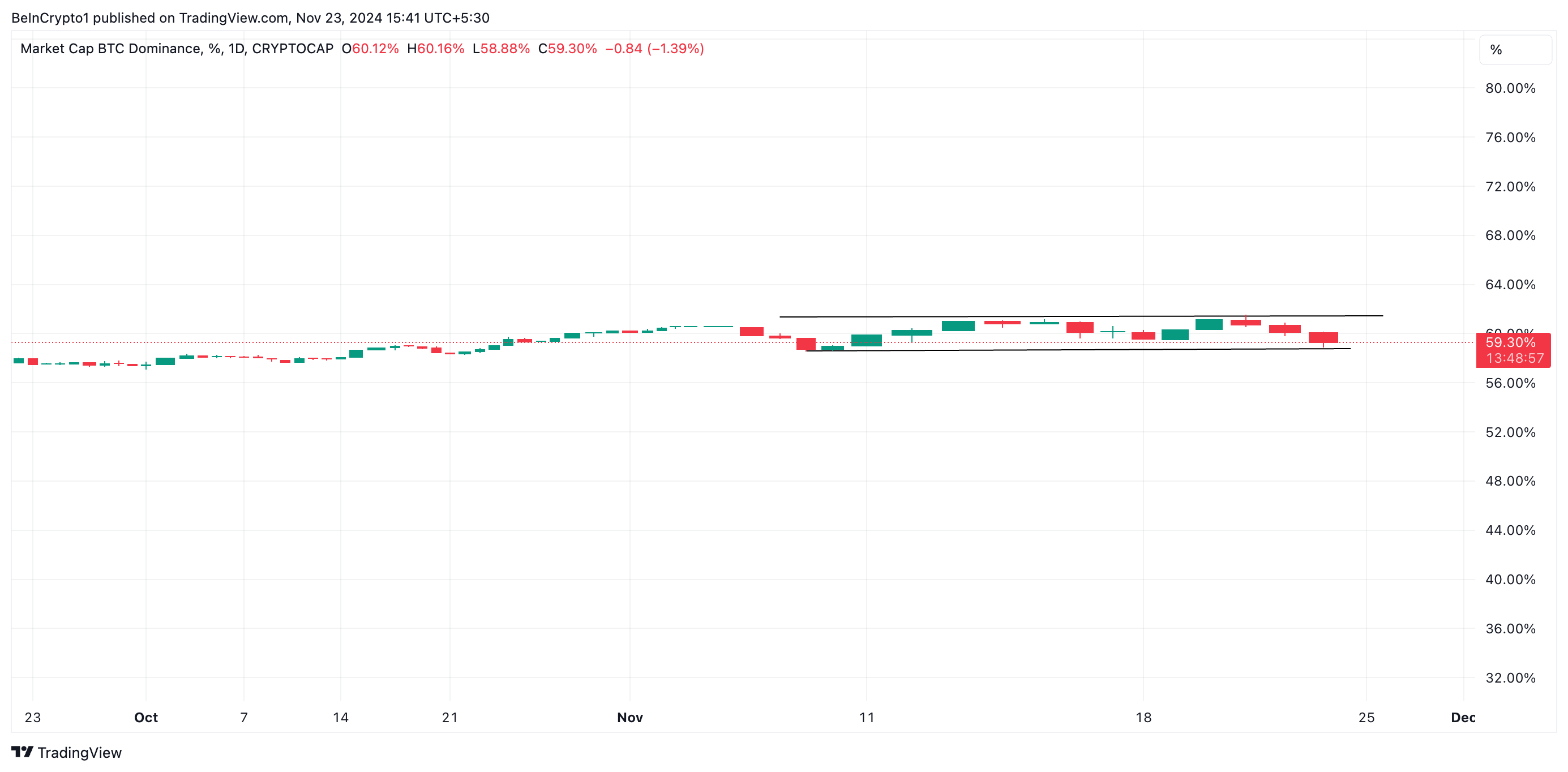

Approaching its peak value of $1.13 trillion, Total3 indicates that investors are increasingly directing their funds towards alternative cryptocurrencies. Of importance is the surge in Total3’s value coinciding with a time when Bitcoin’s dominance is being consolidated (Bitcoin Dominance Index – BTC.D).

Since November 8, the BTC.D has been fluctuating between approximately 61% and 58%. At present, it’s sitting at 59.30%.

If the value of TOTAL3 increases noticeably when the price action of BTC.D remains stable or slows down, it often suggests an impending period where altcoins might experience a surge in popularity. This implies that investors may be moving their attention from Bitcoin towards other cryptocurrencies, which could result in rising demand and potentially higher prices for these alternative digital assets.

Additionally, according to recent findings from CryptoQuant, a provider of on-chain data, there’s been a surge in the worth of various Layer 1 altcoins following the end of the U.S. presidential elections. This increase suggests that we might be witnessing the beginning of an altcoin rally.

According to CryptoQuant, digital currencies such as XRP, TRON (TRX), TON, Cardano (ADA), and Solana (SOL) have experienced significant price surges due to optimism that the incoming US administration may adopt a more favorable stance towards cryptocurrency.

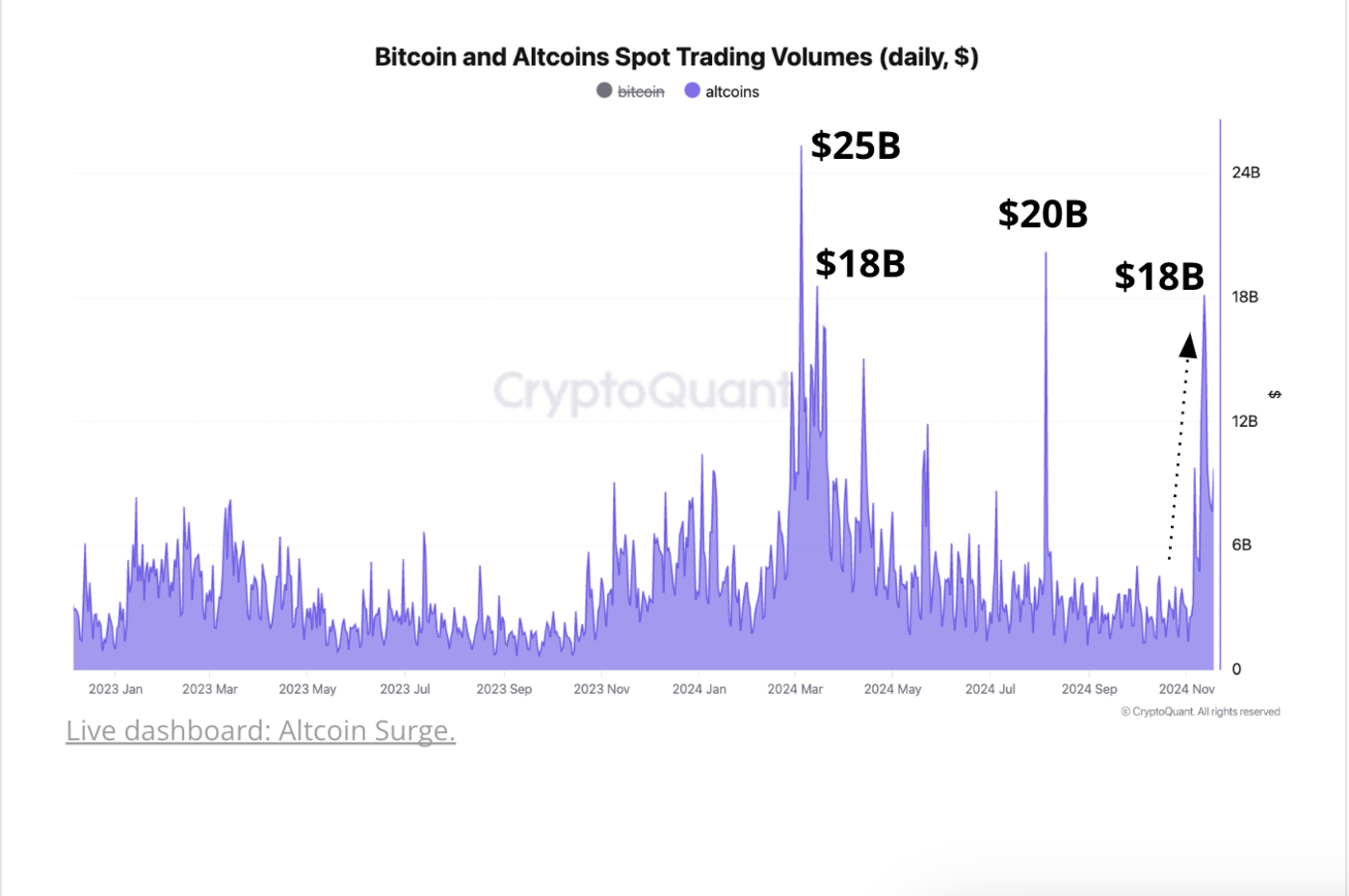

Additionally, CryptoQuant indicates that an increase in trading volume on the spot market has occurred alongside this price rise.

The daily trading volume of altcoins saw a significant surge following the U.S. presidential election, peaking at an all-time high of $18 billion on November 11, marking the highest level since early August. Before this spike, the trading volume had been relatively quiet since May.

The Altcoins May Need Some More Time

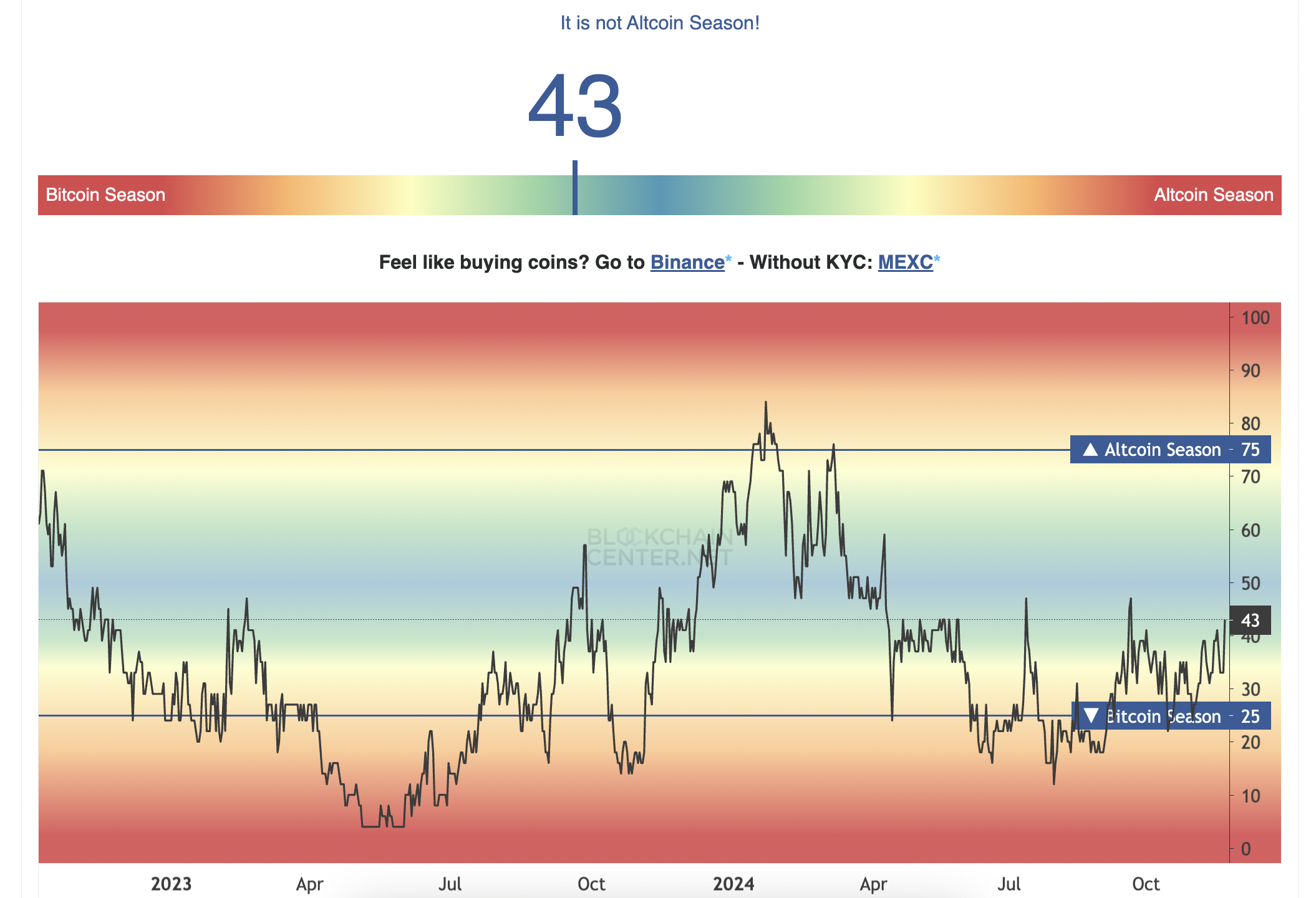

In simpler terms, based on data from various indicators, there’s a strong possibility that an altcoin rally might occur soon. However, it’s crucial to remember that this prediction will only be confirmed if at least three-quarters (75%) of the top 50 alternative cryptocurrencies show better performance against Bitcoin over a span of three months.

On the other hand, information provided by Blockchain Center shows that just 43% of leading altcoins managed to outperform Bitcoin during the last 90 days, which is significantly less than the needed 75%. This suggests that we are not yet at the point where an altcoin boom (altcoin season) can be declared officially.

Read More

- USD ILS PREDICTION

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- 30 Best Couple/Wife Swap Movies You Need to See

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- Everything We Know About DOCTOR WHO Season 2

- 9 Kings Early Access review: Blood for the Blood King

- Honkai: Star Rail – Hyacine build and ascension guide

- All 6 ‘Final Destination’ Movies in Order

- Every Minecraft update ranked from worst to best

2024-11-23 19:33