This disparity showcases the intricacies and ambiguities that are characteristic of altcoins within the larger digital currency market.

This difference highlights the complications and risks associated with altcoins, which are a significant part of the overall cryptocurrency world.

A Stagnant Market or a Slow Rebuild?

Ki Young Ju, the CEO of CryptoQuant’s on-chain analytics firm, presents a rather bleak outlook for the altcoin market. In his latest analysis, he portrays it as a competition between players where the winnings are largely self-contained, with minimal fresh capital flowing into the field. Bitcoin‘s market value has more than doubled since 2021, but the total market cap of altcoins remains below their previous record highs, according to Ju. He underscores that only a small number of altcoin projects with robust use cases and captivating stories are expected to survive in this scenario.

The combined value of all cryptocurrencies other than Bitcoin and Ethereum, often referred to as Total3, is approximately $943 billion right now. This amount is noticeably lower compared to its record high of $1.1 trillion reached during a surge in late 2024. The fact that this figure hasn’t grown much recently suggests a shortage of new investments, with experts observing that most trading within the altcoin market tends to recirculate rather than signaling broader market expansion.

Stablecoins and ETFs Redefining Altseason Dynamics

Ju posits a change in the usual pattern of altcoin cycles, where money moves from Bitcoin earnings into lesser cryptocurrencies. He instead proposes that future altcoin expansion might hinge on the availability of stablecoin liquidity and an uptick in stablecoin trading pairs. This increase in stablecoin trading pairs, he argues, demonstrates real demand as opposed to capital being recycled.

Moreover, he points out a structural issue: The growth of Exchange-Traded Funds (ETFs) for Bitcoin and Ethereum has resulted in an isolated investment landscape. Money invested in these ETFs tends not to be directed towards smaller alternative coin projects, thus limiting the sector’s expansion even further.

Citi Analysts Offer Optimism

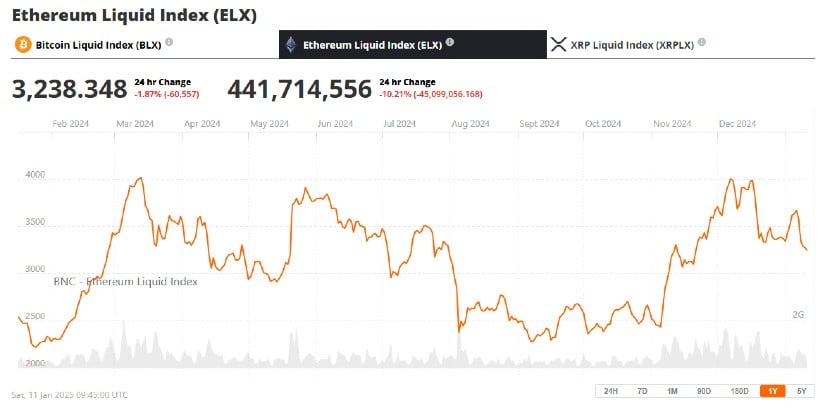

Despite CryptoQuant’s cautious stance, analysts from Citi are looking forward to a more optimistic picture for altcoins in the year 2025. They highlight Ethereum’s growing influence, reinforced by its presence in spot ETFs, and predict that the prosperity of leading cryptocurrencies might eventually rub off on lesser-known assets such as Ripple (XRP), Solana (SOL), and Tron (TRX). In fact, Ethereum’s price skyrocketed by 59% in December 2024, underscoring its resilience.

In a similar vein, Ripple’s XRP is gaining ground as a strong candidate among top-performing assets by 2025. It has skyrocketed approximately 300% in the past 90 days. With President Trump seemingly backing it, and an XRP Exchange-Traded Fund (ETF) highly likely in 2025, XRP stands out among altcoins as one of the few that could potentially surpass Bitcoin’s performance.

Citi analysts link Bitcoin’s impressive 116% yearly increase in 2024 to significant triggers, such as the acceptance of spot Bitcoin ETFs, a mid-year halving occurrence, and positive political shifts in the U.S. Their perspective is that these events set the stage for a potential “altcoin season” as investors broaden their portfolios.

Emerging Narratives and Investment Trends

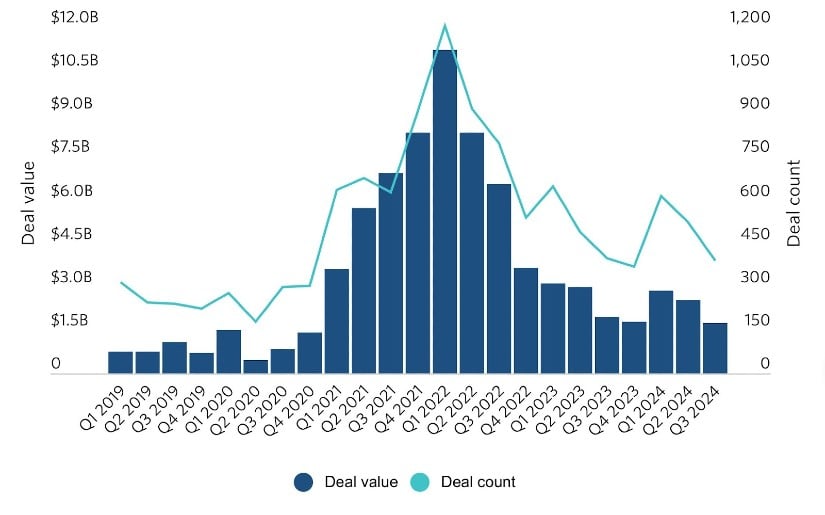

In spite of present challenges, fresh ideas and venture capital investments could significantly alter the altcoin market. As per Pitchbook’s reports, fundraising in crypto soared to $2.4 billion through 518 deals in Q1 2024, marking a 40.3% jump in investment compared to the preceding quarter. Particularly noteworthy is the surge of interest in AI-related projects, which garnered $106 million in funding during Q3 2024, with a pre-money valuation of $1.1 billion.

These advancements underscore a growing interest in fledgling initiatives, emphasizing the necessity of compelling stories and solid foundations – aspects that both analysts from CryptoQuant and Citibank acknowledge are indispensable for lasting prosperity.

A Complex Road Ahead

As the discussion unfolds, it’s evident that the market for alternative cryptocurrencies (altcoins) is encountering both obstacles and possibilities. On one hand, issues like stagnation and restricted investment inflows are pressing matters of concern. However, on the positive side, evolving trends in stablecoin liquidity, potential ETF listings, and increasing venture capital activity may pave the way for a more dynamic altcoin environment in the coming years. The key question is whether these developments will manifest swiftly enough to generate a substantial transformation by 2025.

It appears that according to current news reports, Bitcoin and Ripple (XRP) are expected to lead the way in the coming years up to 2025, and likely to deliver strong results.

Read More

- Gold Rate Forecast

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Tom Hiddleston and Wife Zawe Ashton Announce Second Pregnancy, Know Couple’s Relationship Timeline

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- Resident Evil 9: Requiem Announced: Release Date, Trailer, and New Heroine Revealed

- Summer Game Fest 2025 schedule and streams: all event start times

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

2025-01-12 15:46