Alphabet (GOOG) (GOOGL), the beloved tech giant that has been tickling our stock portfolios for years, has once again proven to be quite the investment opportunity. We’re talking about a company that owns the world’s largest search engine, Google Search, and is now throwing in some cloud computing magic with Google Cloud, alongside shiny gadgets like smartphones. And if you had the foresight (or dumb luck) to hold onto this stock, congratulations! You’ve made more than a 600% return over the last decade. You should probably have a celebratory toast, but not too much-remember, you’re still holding onto a valuable asset.

But as with all good things, there’s a pesky little hiccup-a U.S. antitrust lawsuit that’s been hanging over Alphabet like an uninvited relative at Thanksgiving dinner. Last year, a judge ruled that Alphabet had a monopoly over Internet search. You know, the whole “we own Google Search, and everyone else can just… well, Google something else” thing. The Justice Department suggested a breakup, which would have included selling off Google Chrome. Talk about breaking up the band, right? Imagine losing your lead singer and guitarist at the same time.

For a while, investors were biting their nails. What would happen to Alphabet’s glorious search business if the government came in with a wrecking ball? But wait, hold your horses! Just last week, things took a turn for the better. No breakup! In fact, Alphabet scored what some are calling a “monster win” (thanks, Dan Ives from Wedbush). But here’s the twist-after a *double-digit* gain this year, is it too late to hop on the Alphabet train? Let’s dive into this situation and see if there’s still time to get in before the ride ends.

Alphabet’s Antitrust Drama: A Real Soap Opera

Let’s rewind a bit and set the stage. For months, Alphabet was sweating bullets over the idea of being forced to break up. Can you imagine? Google Chrome being sold off, Android tossed aside like an unwanted mixtape, and YouTube getting its own solo career. It’s like watching your favorite band break up just before they release their greatest hits album.

But let’s get serious for a second. Alphabet’s ecosystem is its superpower. From Google Search to YouTube to Google Chrome and Android, it all works like a well-oiled machine. And it’s efficient, folks. Efficiency is the name of the game in tech, and this is a game that Alphabet is winning. To break it up? That would be like taking the wheels off your Ferrari. It just doesn’t make sense!

On top of that, Alphabet’s sweetheart deal with Apple-which makes Google the search engine of choice on the iPhone-was also at risk. Alphabet’s Google Services business rakes in 85% of the revenue, so disrupting that setup could have been catastrophic. Imagine your best friend suddenly deciding to pick sides in a two-player game-except you were *both* winning. That was what Alphabet was facing.

But then-cue the drumroll-the court said, “Nope, you don’t have to break up.” Alphabet can keep its Google Chrome and Android. Why? Because, according to the ruling, the plaintiffs were a bit too ambitious. They wanted to force Alphabet to give up key assets like Google Chrome, but the judge wasn’t having it. Instead, Alphabet will now have to share search data with its competitors. It’s like saying, “Alright, you can still be the boss, but you have to play nice with the other kids.”

Ives Raises the Price Target: Not a Bad Idea, Eh?

So here comes our favorite tech analyst, Dan Ives from Wedbush. He’s all fired up about the court ruling, calling it a “monster win” (who wouldn’t be?). Ives also bumped his price target for Alphabet from $232 to $245. There’s no such thing as bad press when you’re in tech, and after this ruling, Alphabet’s stock is looking pretty sweet.

But now, the real question: if you haven’t already bought into Alphabet, or if you’re thinking about adding to your position, is it too late? Sure, the stock has already shot up nearly 50% in the past year, but is there still room to grow?

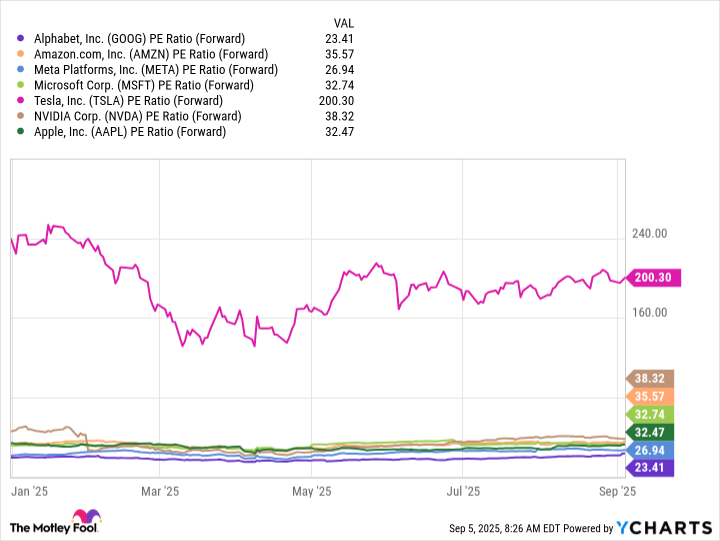

Let’s get nerdy for a second-valuation time! Alphabet is trading at only 23 times its forward earnings estimates, making it the *cheapest* of the so-called Magnificent Seven. Yes, you heard that right-cheapest! Now, you might be asking, “What’s the Magnificent Seven?” Well, they’re the tech stocks that have been driving the overall market gains. They’re the Avengers of the stock world, and Alphabet is a key player.

What the Valuation Tells Us: More Room to Grow

Here’s the thing-this valuation suggests that Alphabet is far from done. Despite the impressive stock gains, this company has a lot of runway left. Why? Well, thanks to the court ruling, Alphabet can continue to grow its search business without worrying about being chopped up into little pieces. And if you haven’t noticed, Alphabet is already positioning itself as a major player in the AI revolution. Google Cloud, which is now packing a punch in the AI space, has seen its revenue soar. With the AI market expected to reach trillions in the coming years, Alphabet is *ready* to ride that wave.

In short, Alphabet is still a tech stock that any serious investor should consider. Even after its recent climb, it’s still got room to run. So if you’re looking to buy and hold, you’ve got plenty of time to hop on the train, and now you don’t have to worry about the antitrust cloud hanging over your head. It’s full steam ahead!

So, don’t wait too long-this monster win might be just the beginning. And remember, this is the stock market, where the only thing that’s certain is uncertainty. Keep your eyes peeled, folks!

🚀

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ‘Zootopia+’ Tops Disney+’s Top 10 Most-Watched Shows List of the Week

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- When Wizards Buy Dragons: A Contrarian’s Guide to TDIV ETF

- The Best Actors Who Have Played Hamlet, Ranked

2025-09-08 12:05