Earnings season is upon us, and I’m not sure if I’m more excited or terrified. But here’s the thing-Alphabet (GOOG, GOOGL) has been on a tear since July, and I can’t stop watching. A judge decided not to break up Alphabet’s core business. Which, honestly, feels like the universe giving me a middle finger after I bet against them. Shares are up 30% since Q2. For a company that’s the fourth-largest in the world, that’s like winning the lottery but with more spreadsheets. It’s the fourth-largest company, crossed $3 trillion. I’m not sure if that’s a milestone or a warning sign, but here we are.

I think management’s Q3 outlook could be another catalyst. Buying before Oct. 29 feels like betting on a horse that’s already sprinting. But let’s not pretend I’m not curious to see if the party keeps going.

1. Persistent advertising growth

Google’s search engine was supposed to be dead, but here it is, thriving. They’ve integrated AI into search, which is like adding a new ingredient to a recipe everyone thought was already perfect. And it’s not hurting their revenue. That’s the real magic. Management says the AI search overview monetizes just as well as the old version. Which is either brilliant or a scam. Probably both.

If Alphabet reports growing Google Search revenue, it’ll feel like watching a phoenix rebuild itself from the ashes of my skepticism. I’m not saying it’s a sure thing, but I’d rather be on the train than waiting at the station.

2. Rising cloud computing demand

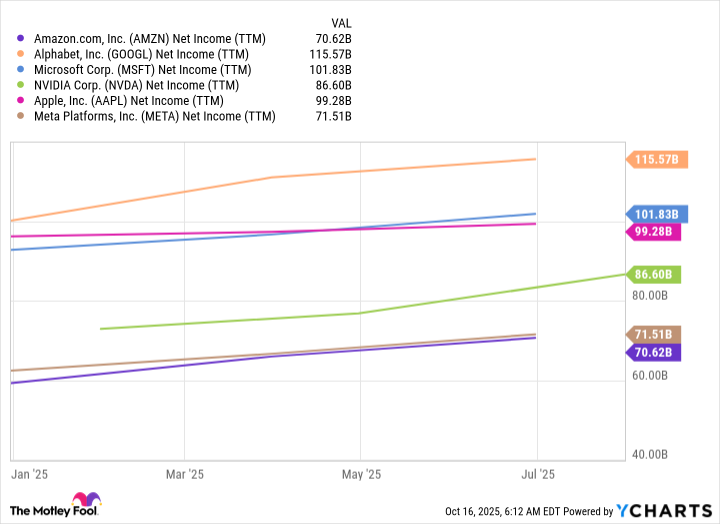

Google Cloud is growing at 32% year-over-year. That’s not just a number-it’s a middle finger to the skeptics. They’ve landed clients like OpenAI and Meta. It’s like the underdog story, but with more data centers. The operating margin? Up from 11% to 21%. If that trend continues, it’s not just a win for Alphabet-it’s a win for anyone who likes to feel smart about their investments.

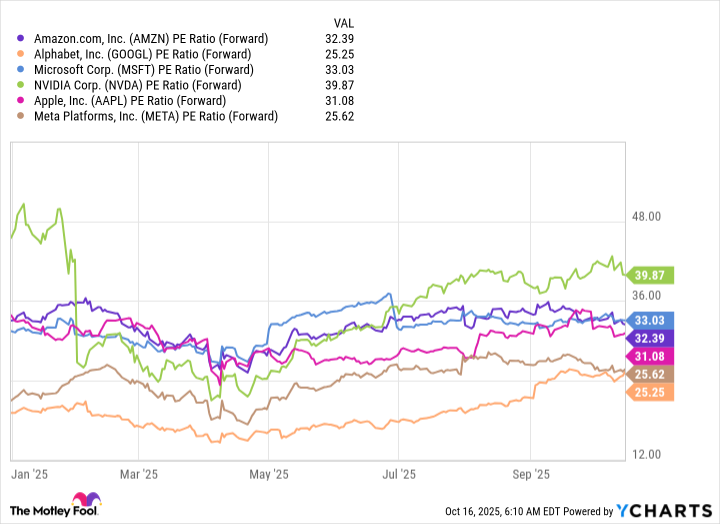

3. Alphabet has a reasonable valuation

Despite its run, Alphabet still trades at a discount to Microsoft and Apple. It’s like finding a discount on a luxury car, but you’re not sure if it’s a deal or a trap. If all companies were valued equally, Alphabet would be the world’s largest. Which is either a testament to its power or a reminder that the stock market is run by people who hate logic.

But here’s the kicker: Alphabet has the cash flows to buy back stock, invest in AI, or acquire a business. Which means even if the stock tanks, there’s a decent chance it’ll bounce back. Or not. But I’m not here to make guarantees-just to point out the odds.

Alphabet is a paradox: a giant with growth potential, a stock that’s both overvalued and undervalued depending on who you ask. I’m not saying it’s perfect. I’m just saying I’d rather be wrong about it than miss out. And if you’re thinking of buying, Oct. 29 is the deadline. But remember-even the best investments can be a gamble. Just don’t bet your life savings on it. Unless you’re feeling lucky.

📈

Read More

- Building 3D Worlds from Words: Is Reinforcement Learning the Key?

- Gold Rate Forecast

- Securing the Agent Ecosystem: Detecting Malicious Workflow Patterns

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Wuthering Waves – Galbrena build and materials guide

- The Best Directors of 2025

- Games That Faced Bans in Countries Over Political Themes

- TV Shows Where Asian Representation Felt Like Stereotype Checklists

- 📢 New Prestige Skin – Hedonist Liberta

- SEGA Sonic and IDW Artist Gigi Dutreix Celebrates Charlie Kirk’s Death

2025-10-20 13:58