The world, as ever, teeters on the edge of reason and chaos. Consider this: OpenAI, that digital Prospero of modern times, has declared its intent to share its enchanted quill with both Microsoft and Alphabet. A curious arrangement, not unlike Faust inviting Mephistopheles to co-author his ledger. The market, ever the credulous spectator, gasps at this pact between titans. But let us peer closer through the fog of speculation.

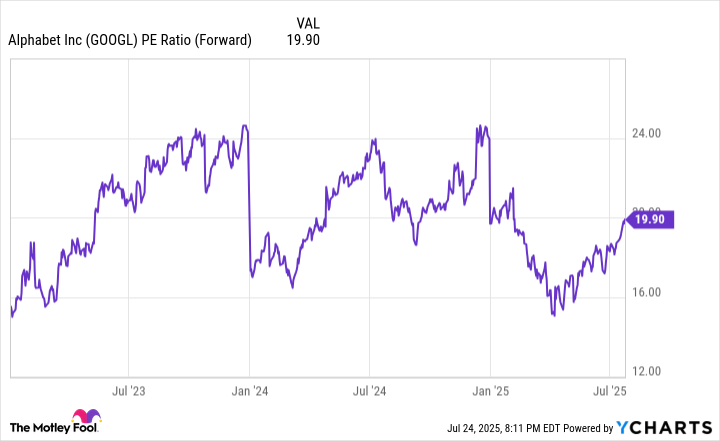

despite Q2’s 32% year-over-year revenue surge and improved 21% operating margin, the stock languishes at 20x forward earnings. The S&P 500, that capricious oracle, demands 23.8x. A paradox worthy of Professor Preobrazhensky’s experiments.

Consider the market’s neurosis: it fears Google Search, that once-invincible monarch, might fade like Chagall’s ghosts into the ether of generative AI. Yet Q2 brought 12% revenue growth, a crown rejuvenated. The crowd’s roar of “10%! 14%! 22% EPS growth!” echoes through the halls of Mountain View, while investors cling to their discount as if it were a talisman against Woland’s black cats.

Google Cloud, still trailing AWS like a younger brother in a Tolstoyan inheritance dispute, possesses margins that could bloom crimson with proper tending. And yet the market, that eternal hypochondriac, diagnoses Alphabet with terminal relevance anxiety. How delightfully human – to fear obsolescence while clutching a device powered by the very engine they doubt.

Herein lies the dividend hunter’s calculus: when the chorus of doubt crescendos, seek the steady heartbeat beneath. Alphabet’s yield may not glitter, but its growth – like Margarita’s flight through Moscow’s night – defies gravity. The confluence of ChatGPT’s migration and Search’s stubborn vitality forms a contraption more wondrous than Professor Challenger’s steam engine. Buy shares while the crowd plays Hamlet to its own indecision. 📈

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- ETH PREDICTION. ETH cryptocurrency

- Gay Actors Who Are Notoriously Private About Their Lives

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- The Weight of Choice: Chipotle and Dutch Bros

- 9 Video Games That Reshaped Our Moral Lens

2025-07-28 14:09