Last year, I posited that Alphabet – a rather grand name for a collection of servers and clever algorithms, wouldn’t you agree? – presented a “once-in-a-decade opportunity.” A phrase, I admit, lifted shamelessly from a particularly persuasive goblin broker I once encountered.1 I believed the market had, shall we say, miscalculated its worth, failing to appreciate its potential in the burgeoning field of artificial intelligence. And, rather gratifyingly, it seems I wasn’t entirely wrong. Those who took the plunge at the start of ’25 are currently enjoying a rather substantial increase in their fortunes – approximately 65%, give or take a dragon’s hoard.

But we are now firmly in ’26, and the world of finance, much like the Discworld, operates on momentum. Past performance is, as the wizards are fond of saying about prophecies, a guide, not a guarantee. So, where does Alphabet, this digital behemoth, go from here? Let’s examine the runes, shall we?

Some of the Wind Has Gone From Its Sails

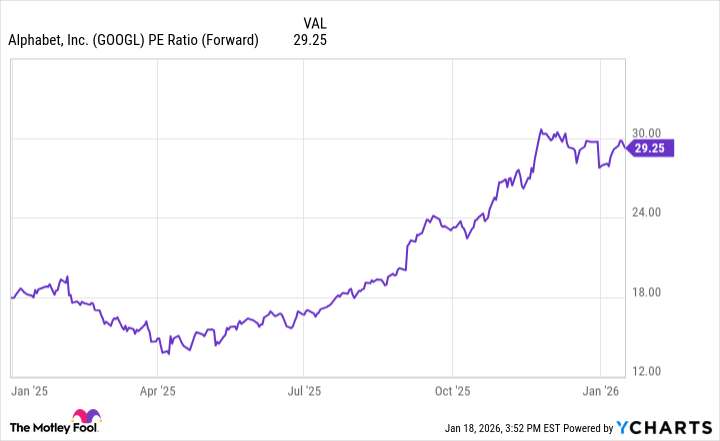

One of the primary drivers of Alphabet’s ascent in ’25 was its relative undervaluation compared to the market as a whole (represented by the S&P 500, or as I prefer to think of it, the Index of Slightly Less Miserable Companies) and its peers in the tech sector. There were several contributing factors, not least of which was a certain skepticism surrounding its position in the generative AI landscape. However, Alphabet, through a combination of shrewd investment and, dare I say, genuine innovation, emerged as a leader. That undervaluation, alas, is no longer the case.

Currently, Alphabet trades at around 30 times forward earnings – roughly the same as its rivals. This isn’t necessarily a bad thing, mind you. It simply means the easy money has been made. We’re no longer dealing with a hidden gem, but a well-polished artifact. Consequently, I don’t anticipate Alphabet delivering the same level of spectacular returns in ’26. The stock’s valuation, you see, is approaching the point where further gains will require actual, sustained growth – a concept many companies seem to find utterly baffling.

Alphabet’s AI Dominance: Still Budding, Not Bloomed

At the start of ’25, the prevailing wisdom was that Alphabet was lagging behind in the AI race. Now, it’s widely regarded as a leader, thanks largely to the impressive capabilities of Gemini. It has quickly become a favorite among those who regularly dabble in the digital arts of artificial intelligence, and investors are taking note. There’s still considerable room for its generative AI dominance to expand, and I suspect Alphabet has a few tricks up its sleeve. Furthermore, investors haven’t fully appreciated the potential of generative AI, and some of the features that could be unveiled in ’26 may prove to be genuinely disruptive.

Another factor that drew me to Alphabet last year was its ongoing research into quantum computing. They’ve made significant progress in this area, although the true impact on the business won’t be felt until at least 2030.2 It’s a long-term play, certainly, but one with potentially enormous rewards. There’s still quantum computing-related upside to Alphabet’s stock, which makes it worth holding onto, even if you have to wait a decade to see it materialize.

For ’26, I predict that Alphabet will continue to outperform the market, but not by the same astronomical margin as in ’25. As a result, it remains a solid investment, and if you haven’t already acquired any shares, now is not a terrible time to do so. Just don’t expect to retire to a tropical island overnight. The world, sadly, rarely works that way.

1

This goblin, a Mr. Grimsnatch, specialized in “opportunities” involving enchanted turnips and the questionable financial instruments of the Ramtops. I learned a valuable lesson that day: always read the small print, and never trust a broker with unusually pointed teeth.

2

Quantum computing, for the uninitiated, involves harnessing the bizarre properties of subatomic particles to perform calculations that are impossible for conventional computers. It’s a bit like trying to herd cats, but with more lasers and significantly higher electricity bills.

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- EUR UAH PREDICTION

- DOT PREDICTION. DOT cryptocurrency

- Silver Rate Forecast

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2026-01-22 14:22