Observe, if you will, a curious congregation: Messrs. Druckenmiller, Englander, Griffin, Ackman, and the rather flamboyant Laffont. A collection of fortunes, naturally. But what binds these arbiters of capital, beyond the sheer weight of their holdings? The answer, my dear reader, isn’t a shared yachting itinerary, but a quietly accumulating position in a single, shimmering stock: Alphabet (GOOGL +0.63%) (GOOG +0.67%). A rather predictable predilection, one might initially assume, until one begins to dissect the labyrinthine workings of this digital behemoth.

Some, predictably, chase the ephemeral butterflies of growth; others, the solid, earthbound virtues of value. Yet, they all, with a synchronicity that would amuse a flock of starlings, find themselves drawn to the same algorithmic honey pot. Alphabet, you see, is not merely a company; it is a meticulously constructed ecosystem, a digital simulacrum of life itself, where information flows like a subterranean river.

When one utters the name “Alphabet,” the mind, with a regrettable lack of imagination, invariably leaps to Google and YouTube. A perfectly reasonable, yet profoundly incomplete, assessment. The company’s near-monopoly on the organization of human knowledge is merely the glittering façade, the visible tip of a far more substantial iceberg. Consider, if you dare, the sheer scope of its operations: a sprawling network of subsidiaries, each a miniature universe unto itself.

Android, a ubiquitous presence in the palms of billions; Waymo, dreaming of autonomous futures; the acquisition of Wiz, a bolstering of cybersecurity defenses; DeepMind, probing the very limits of artificial intelligence; even ventures into the ethereal realm of quantum computing and the bespoke design of silicon. And let us not forget Intersect, a foray into sustainable energy, a gesture of environmental responsibility, or perhaps, a shrewd anticipation of future regulatory landscapes. These are not isolated ventures, but interconnected nodes in a vast, self-reinforcing network. A digital nervous system, if you will, constantly learning, adapting, and expanding its reach.

The true artistry of Alphabet lies not in its diversification, but in its deliberate, almost obsessive, integration of artificial intelligence across every facet of its operations. Gemini, its latest creation, is not merely a model; it is a conductor, orchestrating a symphony of data, transforming information into insight, and anticipating needs before they are even consciously formed. This is not evolution, my dear reader; it is directed metamorphosis.

What distinguishes Alphabet’s business model is its vertical integration – a rather unromantic term for a profoundly elegant strategy. It’s akin to a master watchmaker crafting every component in-house, ensuring not only precision but also control. This allows the company to circumvent the vagaries of the supply chain, reduce reliance on external vendors, and foster a climate of relentless innovation. It is a self-contained universe, powered by data and driven by an insatiable curiosity.

The various product lines, far from operating in isolation, support and reinforce one another, creating a flywheel effect that accelerates revenue growth and strengthens the durability of earnings and cash flow. It is a virtuous cycle, a digital ouroboros, constantly consuming and regenerating itself. The more data it collects, the smarter it becomes; the smarter it becomes, the more valuable its products become; and the more valuable its products become, the more data it collects. A rather captivating spectacle, wouldn’t you agree?

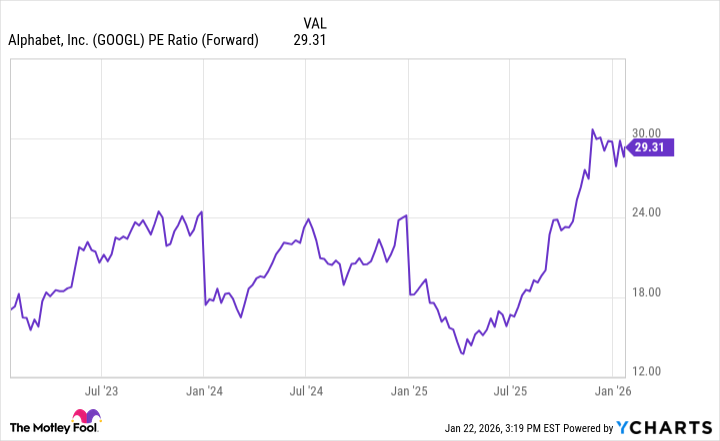

As of this rather unremarkable date (Jan. 22), Alphabet’s forward price-to-earnings multiple of 29 hovers near its zenith during this AI-fueled revolution. A potentially precarious valuation, one might argue. Yet, a closer examination reveals a subtle nuance often overlooked by the less discerning investor. The stock isn’t merely expensive; it’s anticipating a future that many are yet to fully comprehend.

The trends, as depicted above, clearly demonstrate a momentum that is not merely transient. While the stock is no longer a bargain, the influx of institutional capital is telling. Wall Street, it seems, has finally awakened to Alphabet’s pivotal role in the broader AI narrative. The “smart money,” as they say, is anticipating further gains, fueled by the company’s unwavering commitment to AI infrastructure and services.

The recent valuation expansion, while significant, was long overdue. Alphabet is only just beginning to grow into its new profile, supported by the relentless growth of AI-driven revenue and earnings. In my estimation, it is one of the most compelling buy-and-hold AI stocks of the decade – a digital fortress, built on a foundation of data, innovation, and an almost unsettling level of ambition.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Macaulay Culkin Finally Returns as Kevin in ‘Home Alone’ Revival

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Solel Partners’ $29.6 Million Bet on First American: A Deep Dive into Housing’s Unseen Forces

- Where to Change Hair Color in Where Winds Meet

- Crypto Chaos: Is Your Portfolio Doomed? 😱

- Brent Oil Forecast

2026-01-27 22:02