Artificial intelligence, that most overhyped of modern obsessions, has become as inescapable as a bad hat at a garden party. One might find oneself amused, not least by the stampede of investors rushing to drape themselves in the garish robes of “AI stocks”-a sartorial choice rarely conducive to long-term prosperity.

Yet amid this cacophony of speculation, one name stands out not for its noise, but for its quiet mastery of the game. Alphabet, that most elegant of technocrats, has long been conducting its symphony of innovation in the background while others prance about on the stage. It is, quite simply, the only stock offering AI growth, profitability, and a valuation that hasn’t been inflated by the same air that fills a dirigible.

A Full-Stack Aristocrat

While many have only recently discovered the joys of neural networks, Alphabet has been sipping its tea and watching the show for years. A full-stack AI company, it operates with the poise of a seasoned hostess: DeepMind for the intellectual fireworks, Google Cloud for the infrastructure (and the occasional lucrative contract with Meta, one imagines with a raised eyebrow), and Gemini to charm the consumer-facing crowd.

Google Cloud, that oft-overlooked cousin at the family dinner, is now the heir apparent. Its recent $10 billion deal with Meta is less a contract and more a coronation. One might forgive Amazon and Microsoft their smugness-though not for long.

The Art of Making Money

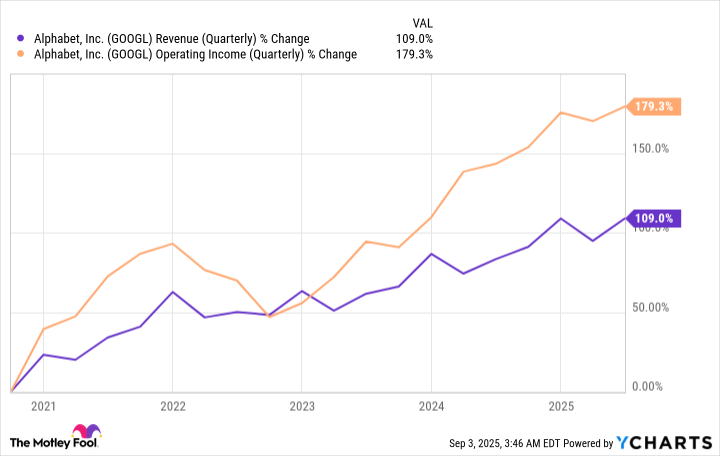

Alphabet’s financials read like a well-tailored suit: understated, precise, and utterly unflappable. Its Q2 revenue of $96.4 billion is not a roar but a sigh-though one with the weight of 14% year-over-year growth. Google Services, that most reliable of partners, continues to fund the champagne flows, while Google Cloud’s 32% surge suggests the future is not only arriving but doing so with a tray of canapés.

Operating income of $31.3 billion is a figure that would make lesser companies blush. Over five years, Alphabet has doubled its earnings with the same ease one might double a recipe for scones. A dividend, though modest (0.40%), is the cherry on a cake that’s already quite delicious.

A Bargain in Disguise

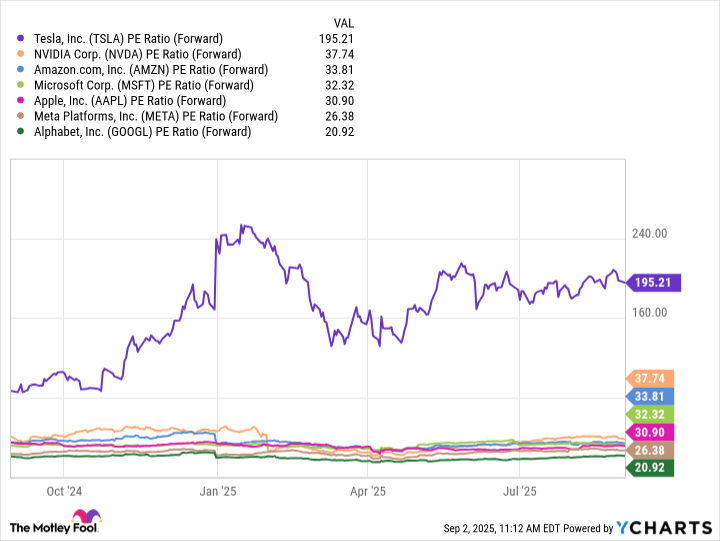

Valuation? Why, it’s as simple as comparing the P/E ratios of one’s peers. At 20.9, Alphabet’s forward P/E is a whisper in the operatic chorus of the “Magnificent Seven.” One might even call it a steal-though to do so would be to speak too plainly for a man of Coward’s detachment.

For the patient investor, Alphabet is less a gamble and more a well-mannered invitation. Its market dominance, cash flow, and AI prowess are not merely advantages-they are the very definition of them. The only question is whether one has the wit to recognize it before the crowd does. 😉

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Why Nio Stock Skyrocketed Today

- The Weight of First Steps

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Opendoor’s Stock Takes a Nose Dive (Again)

2025-09-06 17:45