As per information from on-chain data and social media reports by Coin Telegraph, the recently launched project named FOCAI quickly reached a market capitalization of $50 million. However, due to worries about trading methods and doubts concerning the token’s authenticity, its price and valuation have since dropped.

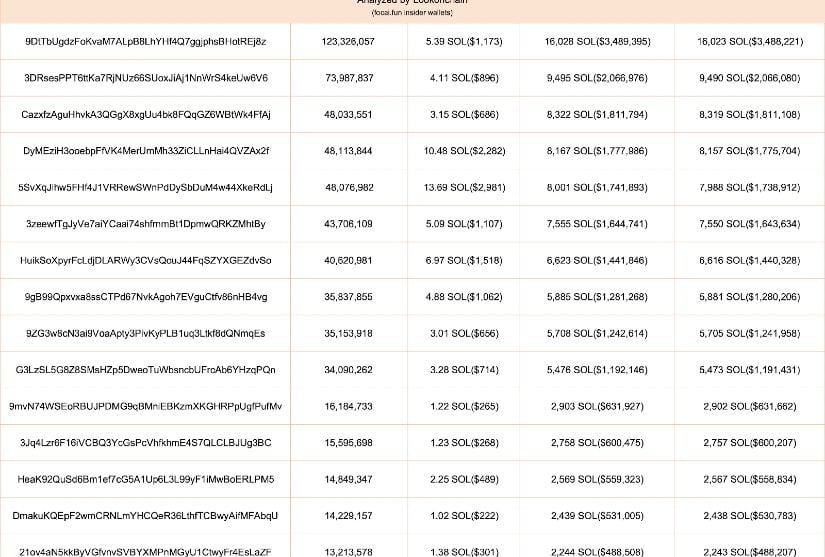

According to recent on-chain analysis shared on platform X, at least 15 wallets that may be connected to the project’s inner circle spent approximately $14,600 (equivalent to 67.16 SOL) to acquire about 60.5% of the FOCAI token’s total supply, which totals 605 million tokens. These purchases were made on the Solana-based decentralized exchange, Raydium. Subsequently, these tokens were sold for a staggering 94,175 SOL, or around $20.5 million, leading many blockchain analysts to estimate that the suspected insiders realized a profit of approximately $20.48 million from this transaction.

A subsequent clarification from the analytics department indicates that the acquisitions were not limited to typical buyers; instead, they were carried out by members of the FOCAI team using multiple wallets. This revelation has ignited strong criticism throughout the crypto community on X, as users question the validity and magnitude of the reported profits. A popular post on social media shows how a single account transformed an initial investment of approximately $1,168 into an astonishing $3.47 million within a mere three hours.

The initial public offering of FOCAI saw an impressive start, reaching a market value of $50 million within just 11 minutes. The trading volume surged to $48.2 million in the first 47 minutes, indicating substantial initial enthusiasm for this AI-focused token. Yet, the prices dropped substantially following allegations of insider trading; at present, FOCAI’s price is around $0.327, and its market capitalization has decreased to approximately $32.7 million.

The legitimacy of FOCAI was questioned more strongly when a cryptocurrency expert labeled it as a possible scam on platform X. According to the analyst’s findings, the codebase of FOCAI seems to be heavily based on an already existing token named Eliza, with very little original blockchain functionality added or modified. The report argues that while FOCAI’s marketing emphasizes AI and blockchain technology, there is a lack of technical proof to support these claims. Furthermore, the report points out inconsistencies or incompleteness in documentation across different languages, as well as missing economic models for the token and unclear smart contract implementations.

The conclusions drawn are similar to other critics’ concerns. They mention that the codebase shows signs of being extensively copied, and it seems there are no significant security safeguards in place. Moreover, there appears to be a lack of evidence suggesting a genuinely decentralized design. The revelation of what looks like an inside tactic for amassing and later reselling most FOCAI tokens has only served to intensify skepticism about the project’s openness. This, in turn, sparks questions regarding the fairness and true level of decentralization during the token’s launch.

According to figures from Pump.fun, it appears that many traders involved in FOCAI didn’t make substantial profits, suggesting that these types of strategies often favor a select few.

Read More

- Does Oblivion Remastered have mod support?

- Thunderbolts: Marvel’s Next Box Office Disaster?

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- 30 Best Couple/Wife Swap Movies You Need to See

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Elder Scrolls Oblivion Remastered: Best Paladin Build

- Demon Slayer: All 6 infinity Castle Fights EXPLORED

- DODO PREDICTION. DODO cryptocurrency

2025-01-06 15:18