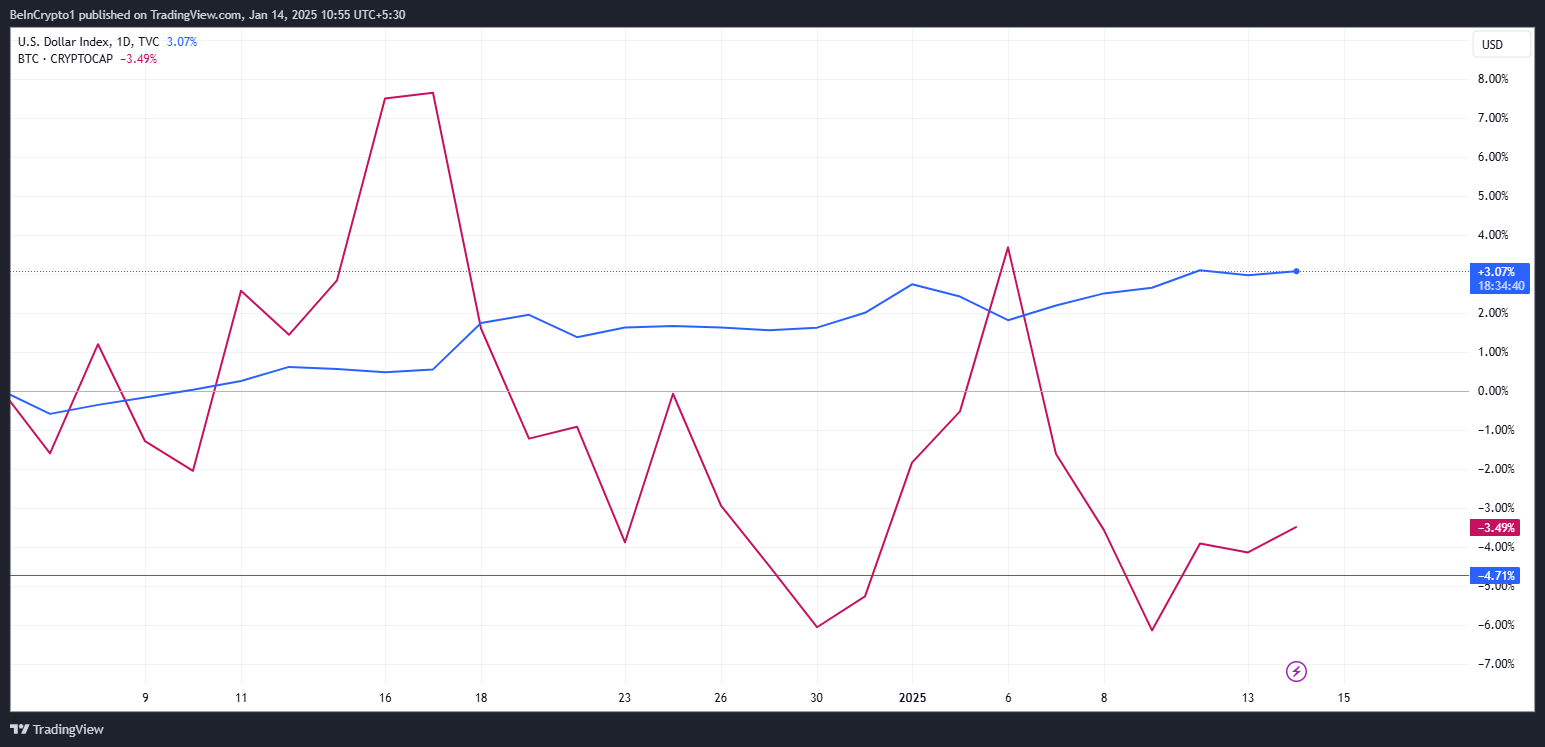

As a researcher observing the cryptocurrency market, I’m closely monitoring Bitcoin (BTC) amidst its current movement. The U.S. Dollar Index (DXY) has recently reached a 26-month peak at 110, which has my attention.

As a researcher, I’ve observed historically that Bitcoin’s performance seems to move in the opposite direction of the U.S. Dollar Index (DXY). This pattern has sparked curiosity and speculation among us about a potentially significant turning point for this digital asset.

Crypto Experts Sound the Alarm As DXY Soars to 110

In his latest update, well-known cryptocurrency instructor Quinten Francois emphasized the historical importance of DXY values. Furthermore, he pointed out a correlation between decreasing DXY and increasing Bitcoin, suggesting that this trend may continue into the year 2025.

“Last time DXY was this high, BTC was at $20,000. Something big is brewing,” he stated.

In the crypto world, there’s an increasing sense of excitement as some believe that the peak of the DXY could signal a rise in Bitcoin. Meanwhile, HZ, a cryptocurrency analyst, has sounded a warning about potential dangers if the DXY continues to climb strongly.

HZ warns that with the DXY at 110, things are risky. A slight increase could lead to market failure. As the dollar rises, it sets off a global credit squeeze, drains liquidity, harms earnings, and devastates emerging markets. If you’re heavily indebted, you’re precariously perched over a trapdoor.

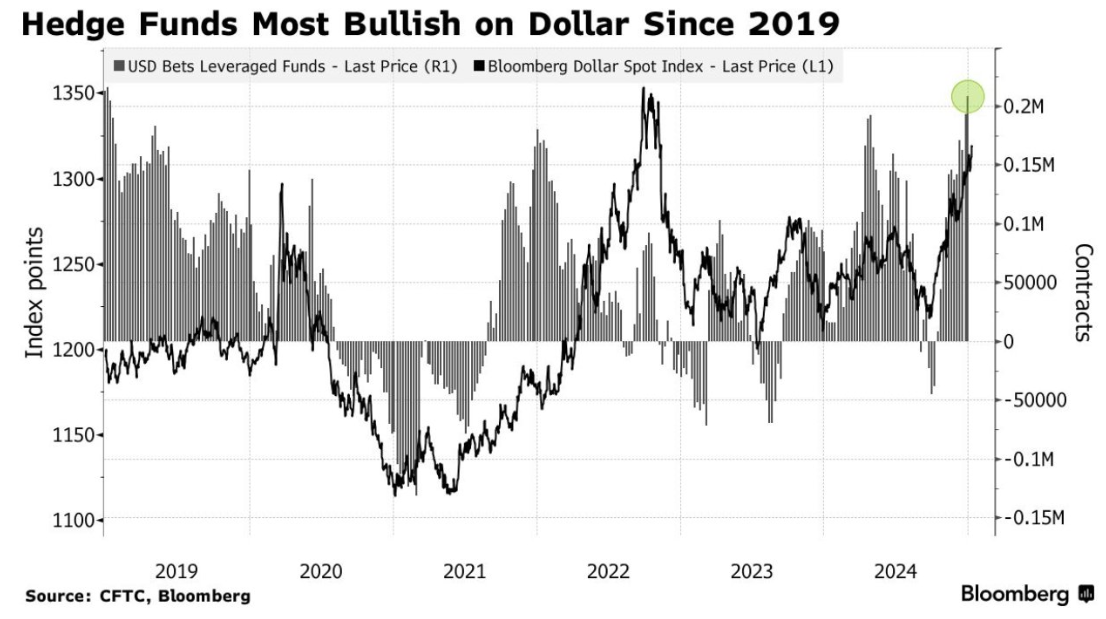

Contributing to the conversation, it’s worth noting that, according to Barchart, hedge funds have shown an increasing optimism towards the U.S. dollar since early 2019. This positive outlook suggests that the dollar is becoming increasingly attractive as a secure investment option amidst ongoing global economic instability.

Bitcoin and Risk Assets Face Key Tests

In the meantime, it’s worth noting that Capital Hungry, a market research company, suggested that the rise in the DXY is partly due to concerns about tariffs. Moreover, they emphasized that forthcoming economic data would play a significant role in determining the market trend.

If the PPI decreases on Tuesday or if the CPI remains unchanged on Wednesday, there might be a bearish correction in the short term for the DXY (US Dollar Index), which could lead to an increase in US equities and other risk assets. This is according to Capital Hungry’s forecast.

In simpler terms, if certain factors play out as expected, Bitcoin might maintain its position above $94,000 and possibly rise to $99,000 in the near future. But if the U.S. Dollar index shows stronger growth than anticipated, it could disrupt this situation, causing Bitcoin prices to drop instead.

The fluctuations in the DXY have far-reaching impacts that go beyond just cryptocurrencies. A robust dollar may place stress on emerging economies and global financial systems, possibly leading to economic downturns. Conversely, a softening of the DXY could offer respite for risky investments such as Bitcoin.

In August, the DXY reached its lowest point for 2024, which happened during a period when Bitcoin prices were surging. This event further supports the idea that these two assets often move in opposite directions. Should the dollar index start to decline from its current peak, experts predict Bitcoin might see another wave of price increases.

The enthusiasm in the cryptocurrency market is strengthened by institutional advancements. Notably, Capital Hungry points out BlackRock’s recent introduction of a Bitcoin ETF (exchange-traded fund). This new ETF could have a substantial impact on Bitcoin’s direction. The increasing participation of established financial giants like BlackRock in the cryptocurrency market is viewed as a significant validation of Bitcoin’s credibility and potential for widespread acceptance.

As a crypto investor, I find myself standing at a pivotal juncture in the digital currency landscape. The future steps of Bitcoin, a cornerstone of our crypto market, appear to be influenced significantly by the movements of the DXY (U.S. Dollar Index). The next major shift in Bitcoin could very well be guided by the trajectory this index takes.

As an analyst, I’m observing that the current downtrend in the dollar index might be putting pressure on risk assets. However, should this trend reverse, it could potentially pave the way for a significant increase in the value of Bitcoin.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Summer Game Fest 2025 schedule and streams: all event start times

- Every Fish And Where To Find Them In Tainted Grail: The Fall Of Avalon

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Elden Ring Nightreign update 1.01.1 patch notes: Revive for solo players, more relics for everyone

- ‘This One’s About You’: Sabrina Carpenter Seemingly Disses Ex-Boyfriend Barry Keoghan in New Song Manchild

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

2025-01-14 10:25