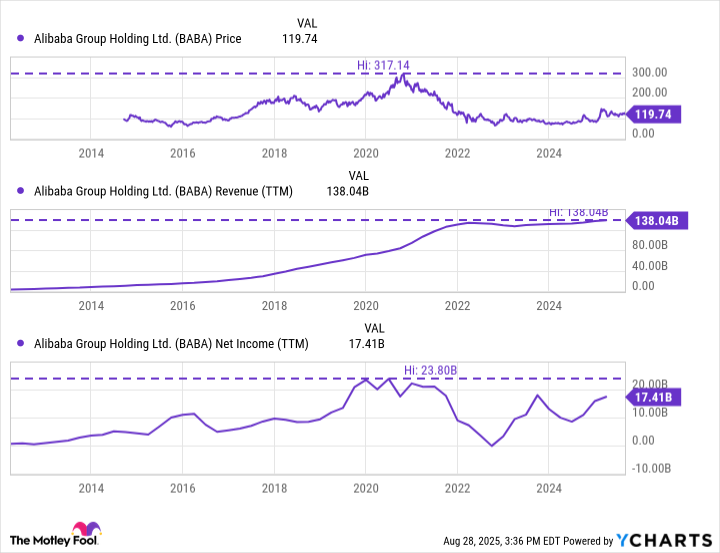

It is a truth universally acknowledged, that a company in possession of rising sales, must be in want of a stable stock price. The affairs of Alibaba Group (BABA) have, of late, been a subject of much speculation among its shareholders. Though the market has not always been kind, the company’s revenues have continued to ascend, albeit with a certain degree of reluctance since 2020. To the discerning investor, this peculiar state of affairs suggests a transformation from a paragon of growth to a more modest, yet potentially prudent, value proposition.

Not all was lost in 2020 for Alibaba

During the tumult of the pandemic, e-commerce flourished, and Alibaba, with its established reputation, reaped the benefits. The fabled Singles Day event of that year yielded a sum of $74 billion, a figure that would have made even the most reserved of society ladies blush with astonishment. Yet, as the world resumed its customary rhythm, the company found itself entangled in a web of regulatory scrutiny, culminating in a fine of $2.8 billion. The founder, Jack Ma, whose influence had once been as commanding as a well-timed social maneuver, now found himself the subject of increased attention from authorities, a development that cast a shadow over the company’s prospects.

Though growth since 2020 has been modest, Alibaba’s sales continue to climb, and its net income remains but a fraction below its former heights. The stock, however, lags far behind, having fallen over 60% from its pandemic peak. This disparity has brought its price-to-earnings ratio to a mere 15.6, a figure that, in the parlance of the market, might be deemed most advantageous for those seeking a suitable match among undervalued assets.

The future, though uncertain, holds promise. Analysts anticipate a 6% rise in sales this year, with an additional 8% expected thereafter. Earnings per share are projected to reach $62.47 this year, climbing to $75.19 next. Such figures, while not without their challenges, suggest that Alibaba may yet find itself in a position to offer dividends to those patient enough to await them.

After its stock reached its zenith in 2020, Alibaba’s prospects underwent a marked shift. Yet, with shares trading at a fraction of their former value, and earnings anticipated to rise, the company presents an intriguing opportunity for the contrarian investor. To the dividend hunter, it is a matter of discerning whether this is a temporary setback or the beginning of a more prosperous chapter.

📈

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Why Nio Stock Skyrocketed Today

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- EUR UAH PREDICTION

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

2025-09-02 17:56