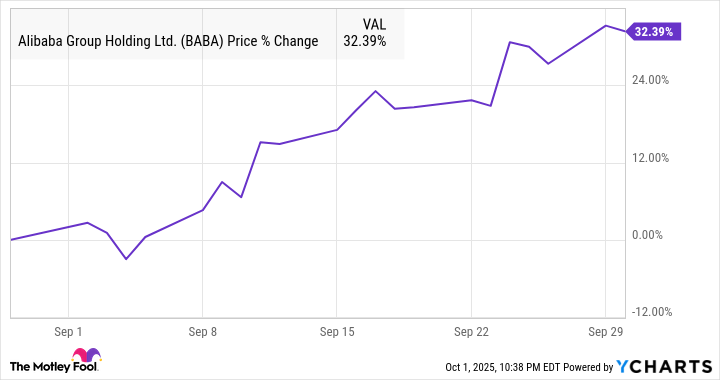

The stock market, that grand theater of human folly and fortune, witnessed a particularly theatrical performance last month when Alibaba’s shares executed a 32% pirouette upward. One might say the company has traded its proverbial begging bowl for a champagne flute, now brimming with the effervescent promises of artificial intelligence.

Moreover, the reappearance of Founder Jack Ma at corporate headquarters has all the makings of a Shakespearean reconciliation scene – minus the poison, naturally. His renewed presence suggests the frost between him and Beijing has thawed to a temperature suitable for tea rather than icy recriminations.

Consider this: after years of being the belle who stayed home while the tech ball raged on, Alibaba has returned to the ballroom with a gown stitched from AI algorithms and data threads. Investors, ever fickle in their affections, now find themselves whispering sweet nothings to a company previously left on the proverbial porch.

S&P Global Market Intelligence, that most serious of financial oracles, records the stock’s moonlit promenade upwards. The chart below captures this ascent with all the drama of a Wagnerian opera, though mercifully shorter and without the Valkyries.

Surfing the Algorithmic Swell

September proved a veritable carnival for AI stocks, where even the staid Oracle found itself tossing confetti into the air. Yet Alibaba, ever the showman, managed to juggle several glittering baubles at once: a 20% spike in Taobao’s daily users, whispered rumors of homegrown AI chips, and a new partnership with Nvidia that makes one think of Voltaire and Frederick the Great exchanging pleasantries.

The Information, that modern oracle of Silicon Valley, revealed Alibaba’s attempt to circumvent export restrictions – a task requiring nearly as much ingenuity as Oscar Wilde’s attempts to navigate Victorian morality. Meanwhile, Bloomberg reported Ma’s reemergence with the subtlety of a peacock strutting through a library.

China Unicom’s order for AI chips arrived like a bouquet at one’s feet, while the September 24 announcements – new AI model, global data centers, increased spending – created the financial equivalent of a fireworks display over Kew Gardens.

The Future as Seen Through Rose-Tinted Spectacles

The AI locomotive shows no inclination to decelerate, and Alibaba has secured itself a first-class carriage. Trading at a mere 21 times earnings, this stock wears its modest valuation with the quiet dignity of a Rothschild at a country fair. Compared to its gilded American counterparts, it’s the literary equivalent of a Penguin Classic priced at a penny.

Should the algorithmic gods continue their favor, Alibaba’s ascent may prove less a passing fancy than the opening act of a grand opera. After all, in the theater of modern finance, only the adaptable survive – and preferably those who own their own data centers.

One might say Alibaba has mastered the art of timing: when the world turned to AI for salvation, it simply removed its mask and revealed itself as the very deity everyone had been seeking. 🚀

Read More

- Top 15 Insanely Popular Android Games

- Gold Rate Forecast

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Silver Rate Forecast

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Why Nio Stock Skyrocketed Today

2025-10-02 17:37