As a seasoned crypto investor with over a decade of experience under my belt, I’ve seen enough market fluctuations to know that every surge comes with its own set of challenges. The recent spike in Algorand’s (ALGO) trading volume and price increase has caught my attention, but it’s the on-chain analysis that’s raising some red flags for me.

While the rising interest and strong bullish momentum are certainly enticing, the shift in large holders’ netflow towards distribution is a cause for concern. This trend could potentially put pressure on ALGO’s price, as these large holders seem to be offloading more than they are buying.

From my perspective, it’s important to remember that the market doesn’t always move in a straight line. The In/Out of Money Around Price (IOMAP) data suggests that ALGO’s price might face significant resistance at current levels, which could lead to a retracement. If this happens, I expect ALGO to pull back to around $0.35.

However, as always in the crypto market, anything can happen. If we see an unexpected surge in trading volume with intense accumulation, ALGO’s price could jump toward $0.50. As they say, the only constant in crypto is change!

Joke: You know what they call someone who doesn’t react to market movements? Not a crypto investor… they’re called everyone else!

In the last 24 hours, Algorand’s (ALGO) trading activity has significantly increased by approximately 130%, causing its token price to reach $0.40. This surge in value has placed around 38% of ALGO holders in a position where they could potentially realize profits if they were to sell their tokens now.

Although this pattern may boost the count of profitable investors, on-chain examination suggests that Algorand’s price might experience a temporary decrease.

Interest in Algorand Rises, but Stakeholders Are Letting Go

On New Year’s Day 2025, Algorand’s price was $0.33. Today, it has climbed up to $0.40, signifying a robust beginning to the year for this cryptocurrency. Currently, Algorand ranks among the top-performing digital assets within the group of the 50 leading cryptocurrencies.

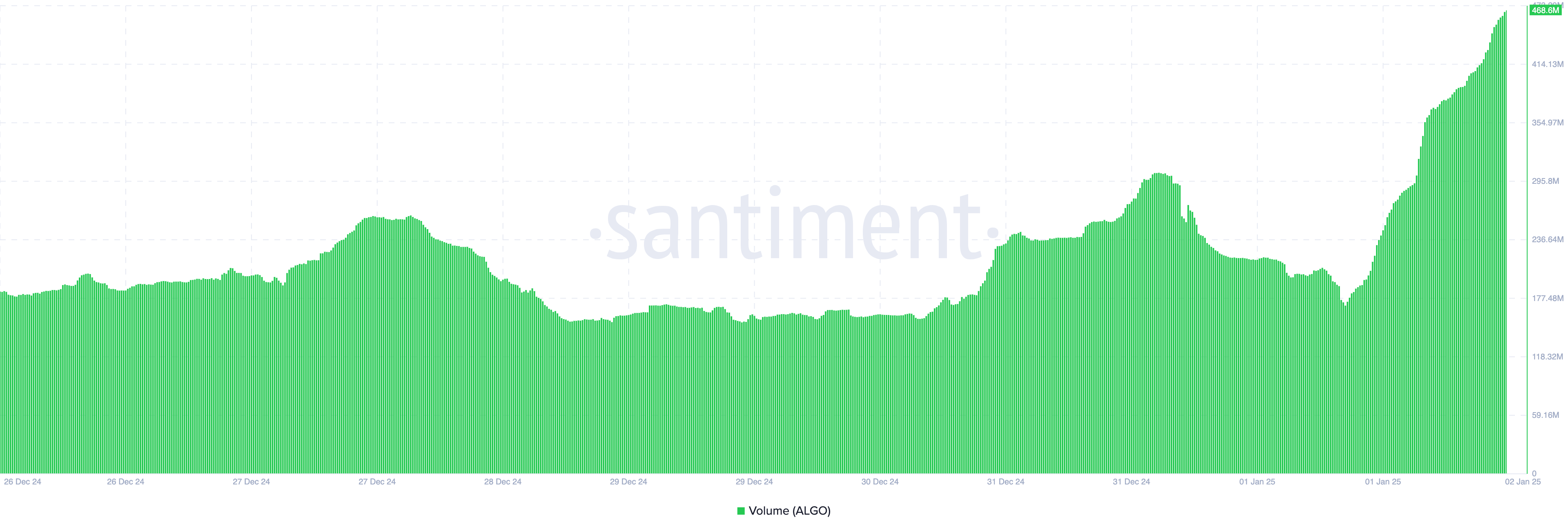

During that timeframe, Algorand’s trading volume surged from approximately $170.67 million to an impressive $468.60 million. This surge suggests a growing interest in the cryptocurrency. Moreover, the simultaneous rise in both volume and price indicates a robust bullish trend, implying that the token’s value may continue to increase.

As increased activity propels Algorand’s current surge, a decrease in activity might signal waning energy. Nevertheless, current indicators hint that Algo’s price could find it challenging to maintain its upward trend in the immediate future.

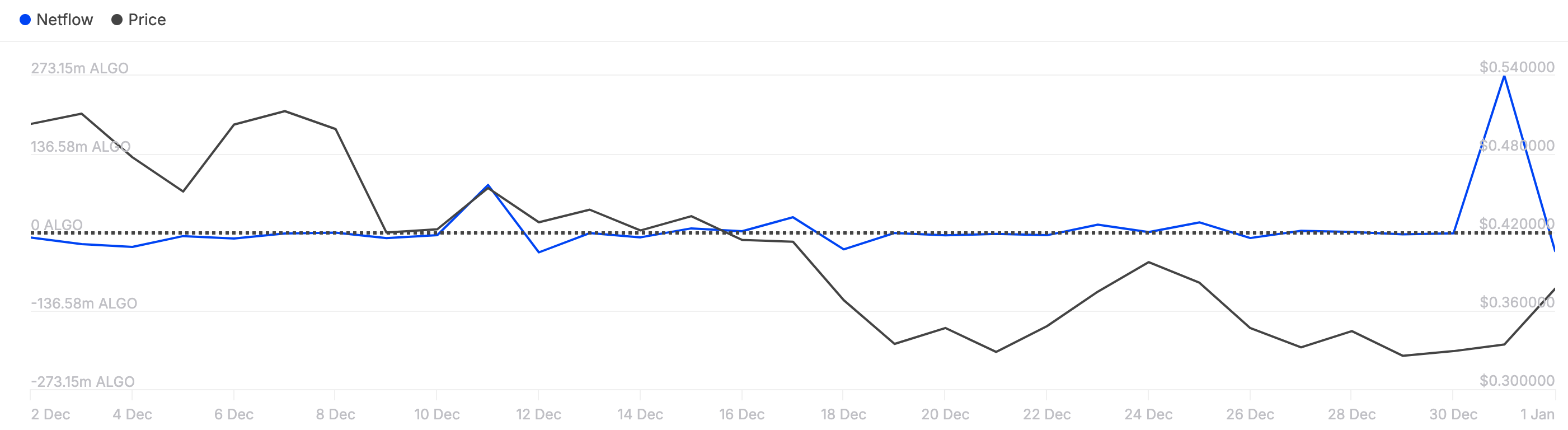

A relevant indicator that coincides with this bias is the change in holdings by significant investors, often referred to as the large holders’ netflow. As per data from IntoTheBlock, this metric, which gauges the difference between buying and selling activities by addresses possessing between 0.1% and 1% of Algorand’s total supply, has recently shifted into negative territory.

When the net flow of tokens held by major investors is greater than zero, it typically means that these investors are amassing more tokens than they’re disposing of. On the other hand, when the net flow is less than zero, it suggests that these investors are unloading more tokens than they’re acquiring.

This change suggests that Algo holders are offloading more of their assets than they’re acquiring. Should this pattern continue, the Algo’s current price of $0.40 might encounter substantial downward force.

ALGO Price Prediction: Retracement Likely

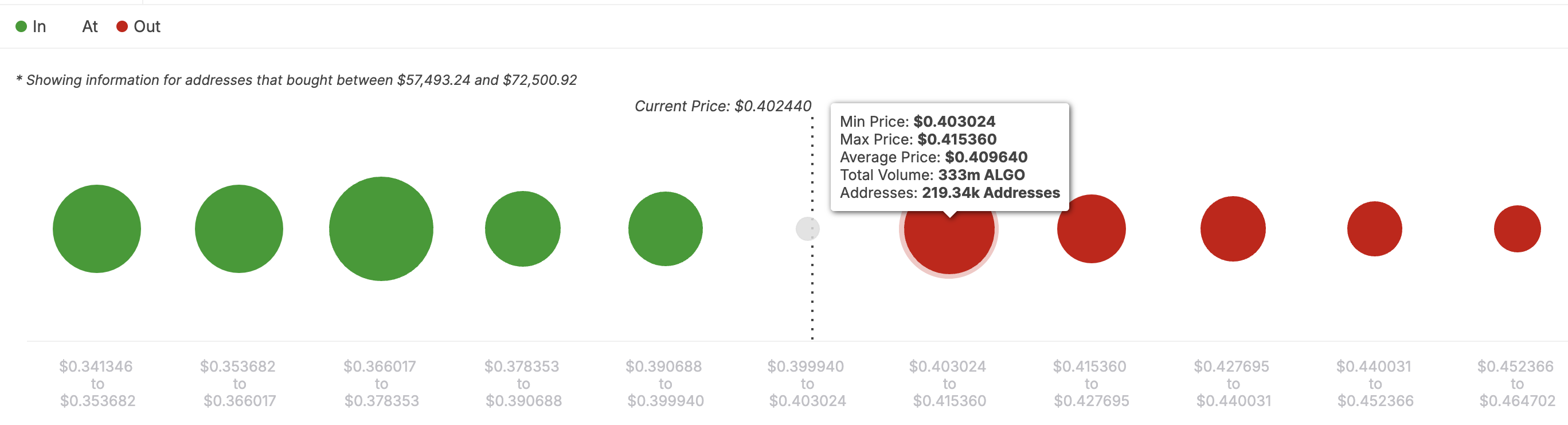

Looking at data from the blockchain, it appears that Algo’s price may not increase significantly as per the In/Out of Money Around Price (IOMAP) analysis. This tool categorizes holders into those making a profit (in-the-money), breaking even (breakeven point), and those losing money (out-of-the-money).

With this information, it’s possible to identify potential support and resistance levels. Generally, areas with higher volume or more addresses indicate stronger support or resistance. As we speak, approximately 146,530 addresses collectively own around 48.64 million Algorand (ALGO) coins that are currently profitable, having been bought at an average price of $0.40.

However, with each Algo costing $0.42, a total of 333 million Algos are held by approximately 219,340 addresses. This suggests that the price of Algorand might encounter substantial obstacles, potentially causing it to drop further.

Based on my past experiences in the cryptocurrency market and my analysis of Algorand (ALGO), I believe that if the current trend continues, ALGO could potentially drop to $0.35. However, if I see a surge in trading volume accompanied by strong accumulation of the coin, I would be optimistic about its price rising towards $0.50 or even higher. It’s important to keep a close eye on market trends and make informed decisions based on reliable data and analysis.

Read More

2025-01-02 22:10