As a seasoned crypto investor with over a decade of experience under my belt, I’ve seen my fair share of bull runs and bear markets. The recent surge in Algorand’s (ALGO) network activity has caught my attention, but not quite in the way some might expect.

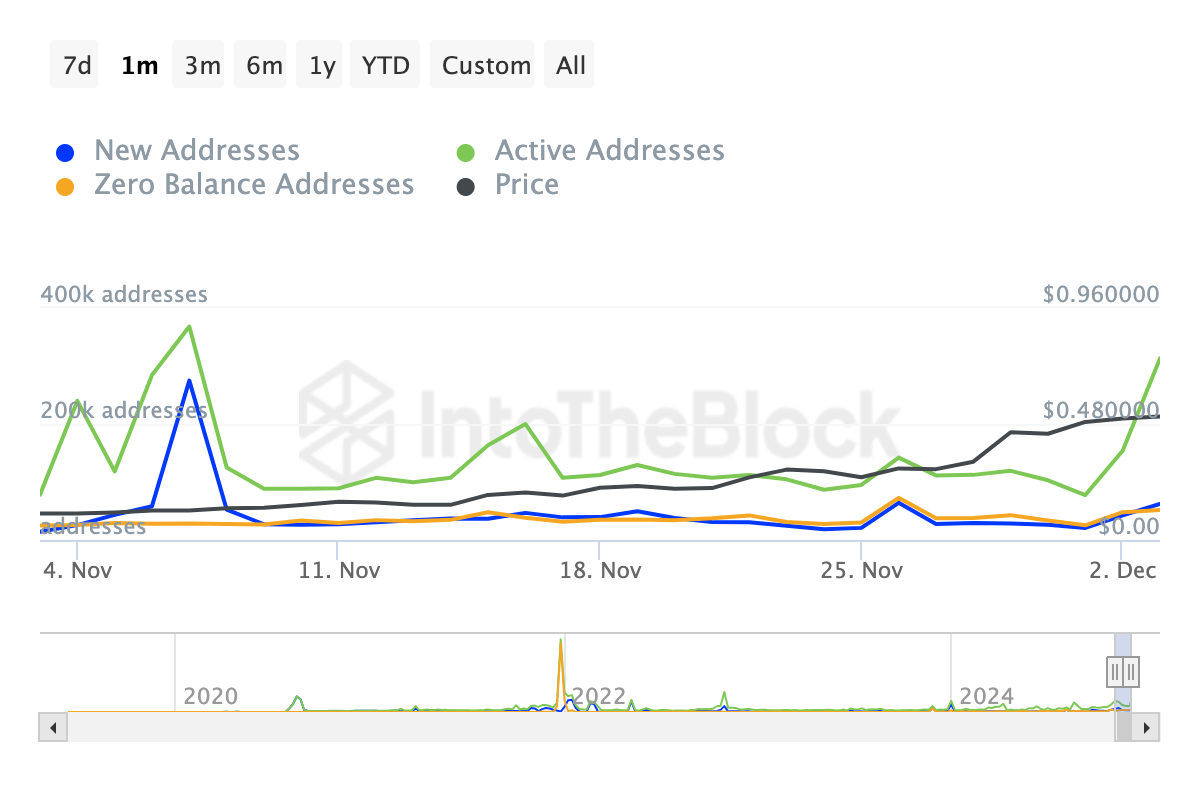

Over the past month, the value of Algorand’s token (ALGO) has risen an impressive 360%, driven largely by the overall surge in altcoins. This price jump has led to a significant spike in daily active addresses on the Algorand network, reaching its peak since November 7.

As a data analyst, I often observe that an increase in active addresses tends to suggest a positive price trend. Yet, upon closer examination of the current situation, it appears there might be reasons why this typical bullish indication could be misleading.

Algorand Network Activity Rises

As per IntoTheBlock’s report, there are currently around 427,230 actively used Algorand wallets that have successfully executed transactions. For those who might not be aware, ‘active addresses’ represent the count of distinct wallets engaged in transactions on a blockchain network.

This measurement takes into account both parties involved – senders and recipients. An uptick in this value suggests growing user interaction, which generally signals optimistic trends given the market dynamics, unless the price movement contradicts it. Conversely, a decrease in active addresses implies decreased user engagement, a sign of pessimism or bearish tendencies.

If an increase in active addresses is to suggest a positive trend for a cryptocurrency like Algo, it should mirror its price growth. However, over the past 24 hours, Algo’s price has actually dropped by 10%. This means that while network activity might be on the rise, it may not necessarily support a continued upward trajectory. But remember, this is just one aspect to consider; other factors could potentially influence Algo’s future price movements as well.

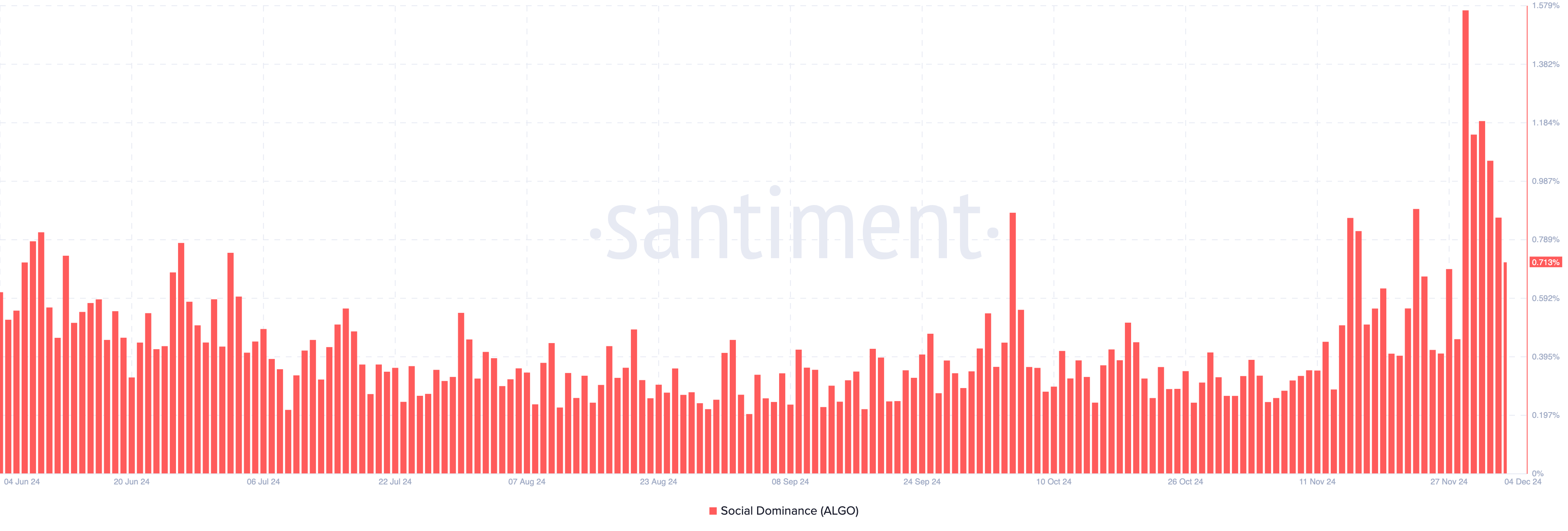

One other metric suggesting that ALGO’s price might find it challenging to recover is social dominance. Social dominance refers to the share of discussions related to a cryptocurrency compared to other assets in the top 100.

As the rating of the metric rises, it tends to spark more talks about the altcoin. Typically, this heightened interest results in a surge of demand, leading to a rise in its value.

In contrast to Santiment’s findings, Algorand’s influence in the crypto space has decreased significantly. From holding 1.56% dominance on November 30, it now stands at just 0.71%. Given this trend, there’s a possibility that ALGO’s value may continue to decrease.

ALGO Price Prediction: Altcoin Could Go Lower

At present, ALGO’s value stands at $0.51. On a 4-hour timeline, it seems that the altcoin may dip beneath its 20-period Exponential Moving Average (EMA).

In simpler terms, the Exponential Moving Average (EMA) follows the price fluctuations of an asset over a specific timeframe. If the price goes above the EMA, it indicates a bullish trend. However, when Algorand’s price is dropping, this could signal a significant adjustment or correction in the token’s value.

Should Algorand be verified as accurate, its value may decrease to approximately $0.38. Yet, if there’s a surge in buying interest and the cryptocurrency manages to hold above the Exponential Moving Average (EMA), this prediction might not materialize. Instead, we could see its worth potentially rising to $0.61.

Read More

- Gold Rate Forecast

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Tom Hiddleston and Wife Zawe Ashton Announce Second Pregnancy, Know Couple’s Relationship Timeline

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- Resident Evil 9: Requiem Announced: Release Date, Trailer, and New Heroine Revealed

- Summer Game Fest 2025 schedule and streams: all event start times

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

2024-12-04 21:35