The Rise and Fall of Celsius Network

As an analyst who has witnessed the rise and fall of numerous financial institutions over the years, I must say that the story of Celsius Network is one for the books. The rapid ascent of this crypto lending platform was indeed impressive, but its abrupt descent serves as a stark reminder of the risks that come with investing in unregulated markets.

Founded in 2017, Celsius Network emerged as a digital lending platform for cryptocurrencies, providing users with competitive interest rates on their crypto holdings. At its peak, the platform controlled around $25 billion in assets, amassing a significant number of retail investors. However, the downturn in the cryptocurrency market in 2022 triggered a wave of withdrawal requests, eventually leading Celsius to suspend customer withdrawals in June 2022 and file for bankruptcy the following month.

Mashinsky’s Legal Troubles

In July 2023, Mashinsky encountered a seven-count indictment that encompassed accusations of fraud, conspiracy, and market manipulation. The prosecution claimed he deceived investors about the financial stability of Celsius and orchestrated strategies to inflate unfairly the value of their proprietary token, CEL. It was alleged that Mashinsky personally made approximately $42 million through these unscrupulous activities.

To begin with, Mashinsky initially denied guilt, but changed his position at a hearing on December 3, 2024, as reported by Reuters. He acknowledged giving misleading promises about regulatory approvals and concealing his personal sales of CEL tokens. Showing regret, Mashinsky said, “I understand that what I did was wrong, and I want to try to do whatever I can to set things right.

According to the plea deal, Mashinsky could potentially serve up to 30 years in prison. His sentencing is set for April 8, 2025. This case is one of many aimed at curbing fraudulent practices within the cryptocurrency sector, emphasizing the growing need for regulatory oversight and ethical conduct.

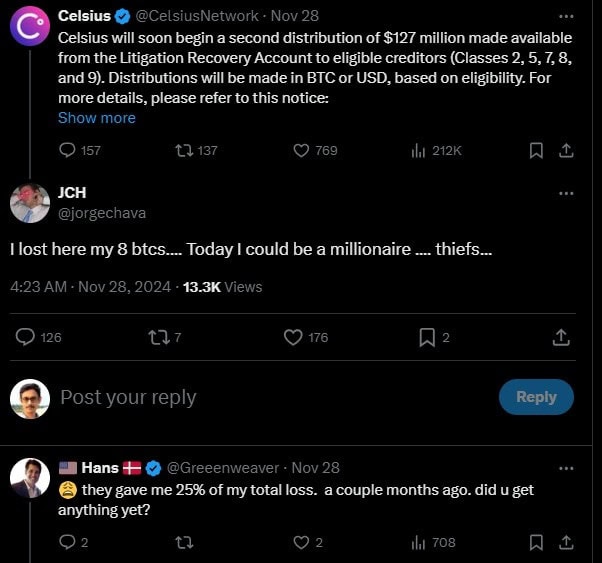

The Aftermath for Celsius and Its Investors

After experiencing bankruptcy, Celsius is working through the intricate process of reorganization while trying to repay affected investors. The company’s collapse serves as a warning about the risks present in the fast-paced crypto lending industry, highlighting the importance of having strong regulatory guidelines to shield investors and uphold market honesty.

Mashinsky’s confession highlights the severe penalties for dishonest actions within the financial industry, emphasizing that deceitful conduct will face serious legal ramifications.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Elder Scrolls Oblivion: Best Battlemage Build

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- ATH PREDICTION. ATH cryptocurrency

- When Johnny Depp Revealed Reason Behind Daughter Lily-Rose Depp Skipping His Wedding With Amber Heard

- 30 Best Couple/Wife Swap Movies You Need to See

- ALEO PREDICTION. ALEO cryptocurrency

- Jennifer Aniston Shows How Her Life Has Been Lately with Rare Snaps Ft Sandra Bullock, Courteney Cox, and More

- Ein’s Epic Transformation: Will He Defeat S-Class Monsters in Episode 3?

2024-12-04 16:24