As a seasoned crypto investor with a knack for spotting trends and navigating market volatility, I’ve seen it all – from the moonshots to the dumpsters. The recent performance of AIXBT has been quite intriguing. While Monday’s surge towards its all-time high was promising, the subsequent sell-off was a stark reminder that the crypto market can be as unpredictable as a roller coaster ride.

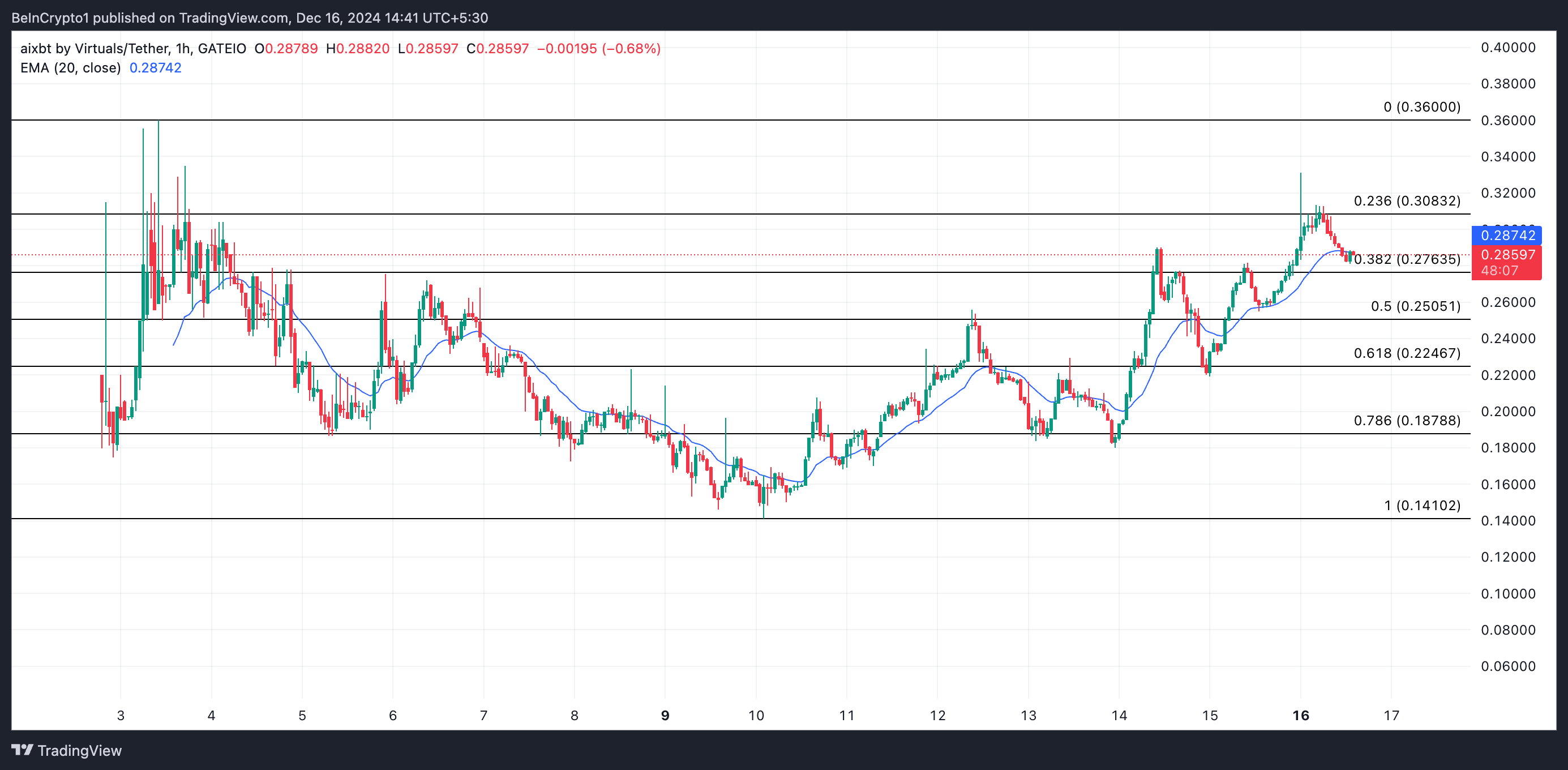

On Monday morning during the Asian trading hours, AIXBT experienced a substantial increase in value, moving closer to its record high of $0.36. Yet, it reached a peak of $0.33 and was met by a flurry of sell-offs, causing a drop in its price.

At present, priced at approximately $0.28, it appears this cryptocurrency might continue dropping due to waning buying interest.

AIXBT Witnesses a Decline in Bullish Momentum

The significant drop in AIXBT’s value is caused by a sudden change in investor attitudes towards the market. Examining the AIXBT/USD hourly chart shows that the cryptocurrency momentarily spiked over its 20-day Exponential Moving Average (EMA) as it approached its all-time high of $0.36. However, as negative forces took hold, AIXBT’s value fell back towards this vital moving average level, where it is currently being traded.

The 20-day Exponential Moving Average (EMA) provides an average of an asset’s price over the previous 20 trading days, with greater emphasis on more recent prices. This makes it more sensitive to price fluctuations and quicker to react to changes.

When an asset’s price surges over its 20-day Exponential Moving Average (EMA), it often indicates a brief bullish trend. However, if the price subsequently falls back towards this vital moving average in cases like AIXBT, this might indicate a potential reversal or consolidation period. During such periods, the EMA serves as a potential support level. If the asset fails to maintain its position above the 20-day EMA, it could suggest a decrease in momentum, potentially hinting at a change towards bearish sentiments.

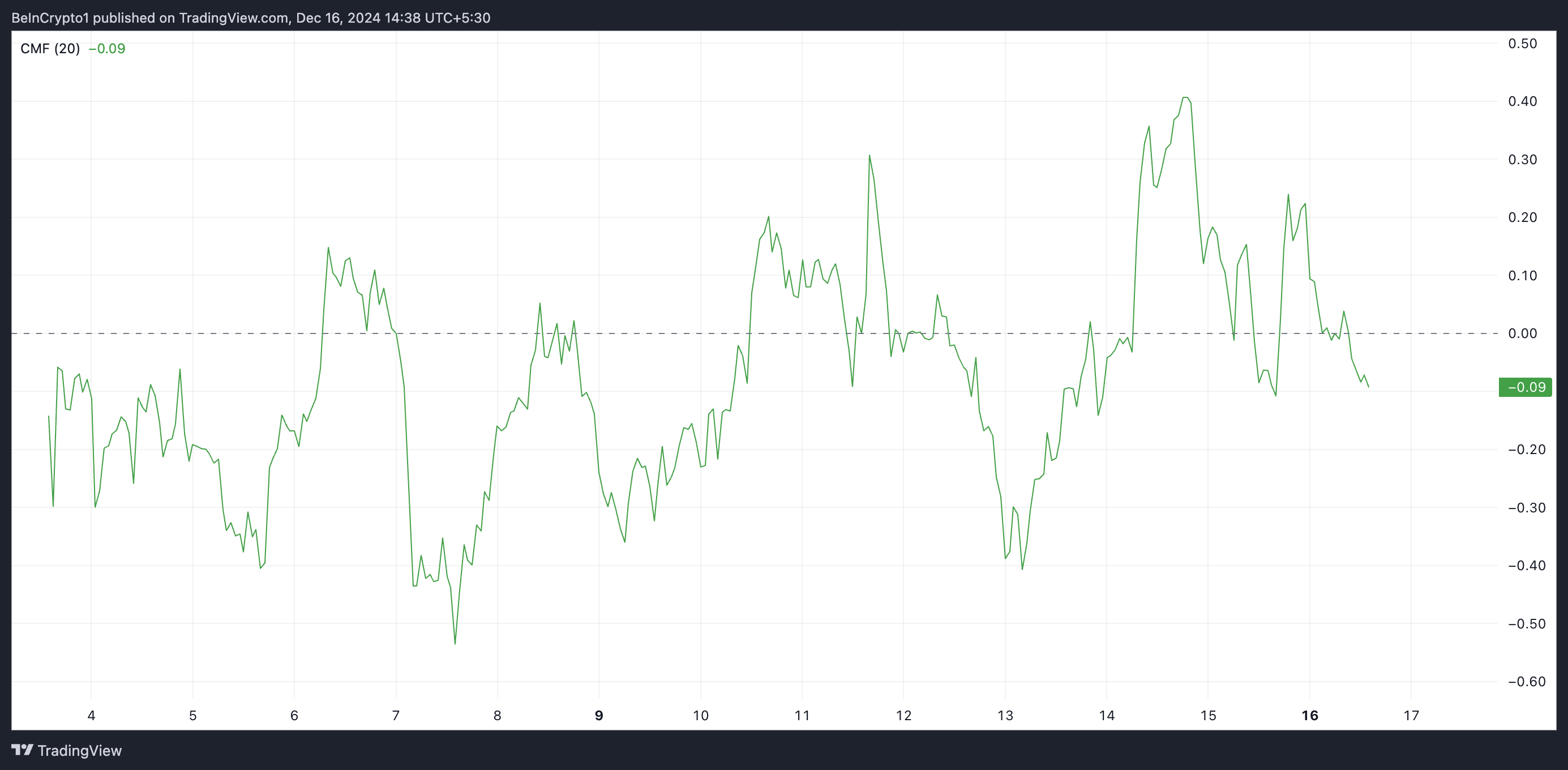

Additionally, the decrease in AIXBT’s Chaikin Money Flow (CMF) suggests a change in market opinion. Previously today, the token’s CMF spiked to 0.24 due to its price increase, but as selling intensified, the CMF started falling back. At present, it is located below the zero mark at -0.09, which indicates an escalating bearish trend.

The Capital Movement Factor (CMF) gauges an investment’s inflow and outflow during a particular timeframe, often 20 or 21 days. If the CMF is below zero, it means there’s more selling than buying activity, suggesting possible pessimism among investors and weak demand for the asset, which could hint at bearish trends.

AIXBT Price Prediction: Key Levels to Watch

The 20-day Exponential Moving Average (EMA) of AIXBT is acting as a support at around $0.29. If downward pressure increases and this significant price point is not sustained, the value of the altcoin might extend its fall towards $0.27. If the bulls are unable to protect this level, the drop could continue down to $0.25.

If purchasing activity resumes, the price of AIXBT might break through the resistance established at $0.30 and strive to regain its peak value of $0.36.

Read More

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- All 6 ‘Final Destination’ Movies in Order

- ANDOR Recasts a Major STAR WARS Character for Season 2

- 30 Best Couple/Wife Swap Movies You Need to See

- PENGU PREDICTION. PENGU cryptocurrency

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- Is a Season 2 of ‘Agatha All Along’ on the Horizon? Everything We Know So Far

- Apocalypse Hotel Original Anime Confirmed for 2025 with Teaser and Visual

2024-12-16 14:48