The value of AI16Z has increased by a remarkable 36% over the past day, elevating its market capitalization to approximately $1.4 billion. Now, it stands as the second-largest cryptocurrency among AI agent coins, slightly behind VIRTUAL. This growth has piqued interest as technical indicators signal potential benefits and challenges for its future price trend.

As the Relative Strength Index (RSI) suggests a recovery of momentum and the DMI indicates a possible upward trend, it seems that the Exponential Moving Averages (EMA) are yet to fully confirm a bullish signal. The upcoming trading sessions will be crucial in deciding if AI16Z can maintain this momentum and attempt to surpass significant resistance levels, or encounter a potential reversal.

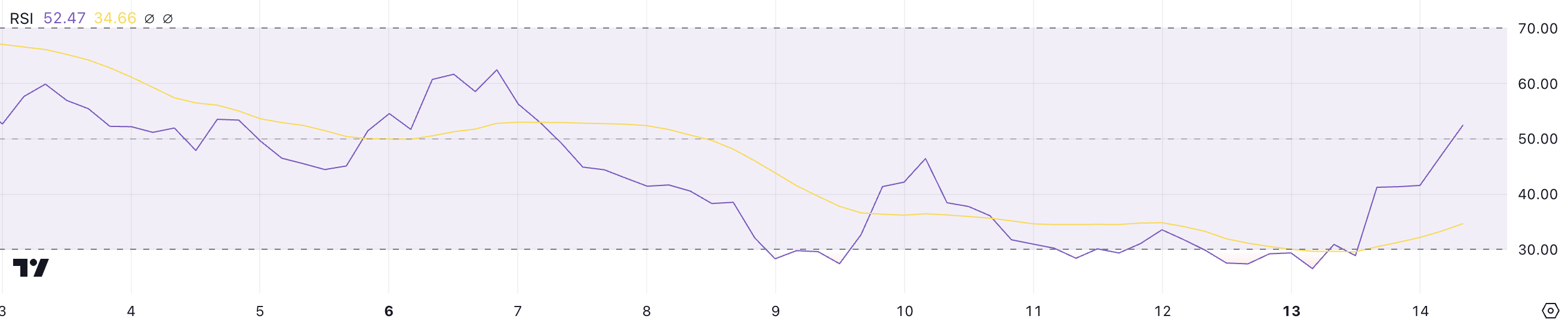

AI16Z RSI Is Recovering from Oversold Levels

AI16Z Relative Strength Index (RSI) surged dramatically to 52.4 from 28.8 within a single day, signaling a substantial change in momentum from an oversold state to a neutral zone. This swift rise reflects increasing buying activity following a prolonged phase of intense selling, implying that the bearish influence might be softening.

In simple terms, the present Relative Strength Index (RSI) indicates a market equilibrium, meaning neither buyers nor sellers have complete control. However, the trend’s upward slope suggests that the optimistic investors (bulls) are gaining more power.

The Relative Strength Index (RSI) assesses how quickly and strongly a financial asset’s price is changing, with values ranging from 0 to 100. When the RSI falls below 30, it usually signals an oversold state, suggesting possible price increases ahead. Conversely, when the RSI exceeds 70, it typically indicates an overbought situation, potentially leading to a price decrease or pullback.

As a crypto investor, I find myself in a neutral-to-bullish position given the AI16Z RSI reading of 52.4. This slight tilt towards bullishness suggests that there might be more price recovery on the horizon, but it’s essential to maintain strong momentum to transition into a robustly bullish phase. Failing to sustain this upward momentum could result in consolidation or even a resurgence of selling pressure.

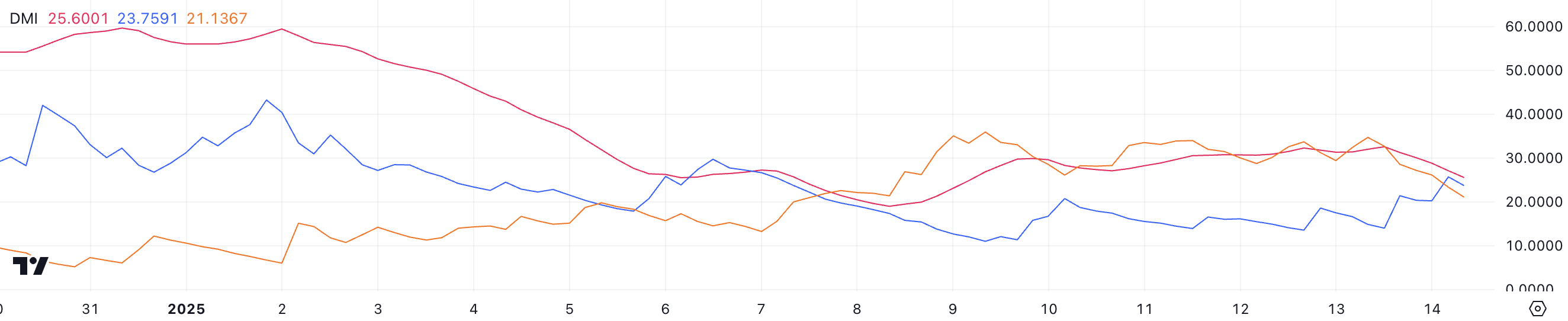

DMI Chart Shows an Uptrend Is Trying to Emerge for AI16Z

16Z AI Diagram illustrates that its Average Directional Movement Index (ADX) has decreased from 32.5 to 25.6, indicating a weakening in the overall trend’s strength. Although an ADX above 25 generally suggests a market with a strong trend, this decline implies that the current trend may be losing its momentum.

Even though the ADX has moved slightly below its previous levels, it’s important to note that it still exceeds the significant limit. This indicates that a trend is ongoing, but it may be experiencing some weakness compared to its past strength.

The Average Directional Index (ADX) gauges the intensity of a trend without specifying its direction. A reading below 20 suggests a weak or nonexistent trend, whereas values above 25 indicate a robust trend. In terms of AI16Z, the +DI, symbolizing bullish pressure, has increased from 14 to 30 (approximately), signaling an escalation in buying momentum as artificial intelligence-related coins attempt to regain ground following significant price corrections.

Currently, the negative directional indicator (DI) has decreased substantially from 34.7 to 21, suggesting less bearish influence. This decrease suggests that buyers are taking over and if the Average Directional Index (ADX) remains steady or rises, it could signal an upward trend for AI16Z’s price. Conversely, if the ADX continues to fall, it might point towards consolidation rather than a powerful uptrend.

AI16Z Price Prediction: EMA Lines Could Indicate The Next Steps

AI16Z’s price chart indicates that its short-term moving averages are lower than the long-term ones, often indicating a downturn. Yet, the fact that these lines are rising hints at an effort to establish an upward trend.

If the current upward trend continues, the AI16Z price might challenge its next resistance at approximately $1.39. Should it surpass this barrier, it could pave the way for additional growth, possibly escalating the price to reach $1.74. This optimistic outlook could materialize swiftly as the crypto AI agent narrative regains traction.

Conversely, if the upward trend doesn’t solidify, the price of AI16Z may pull back to retest the support level at $0.98.

If this support level is breached, the price could fall to $0.75, leading to a deeper decline.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Elder Scrolls Oblivion: Best Battlemage Build

- To Be Hero X: Everything You Need To Know About The Upcoming Anime

- When Johnny Depp Revealed Reason Behind Daughter Lily-Rose Depp Skipping His Wedding With Amber Heard

- ALEO PREDICTION. ALEO cryptocurrency

- Jennifer Aniston Shows How Her Life Has Been Lately with Rare Snaps Ft Sandra Bullock, Courteney Cox, and More

- 30 Best Couple/Wife Swap Movies You Need to See

- Revisiting The Final Moments Of Princess Diana’s Life On Her Death Anniversary: From Tragic Paparazzi Chase To Fatal Car Crash

- Who Is Emily Armstrong? Learn as Linkin Park Announces New Co-Vocalist Along With One Ok Rock’s Colin Brittain as New Drummer

2025-01-14 23:27