Okay, so last January, I told everyone to go all-in on Nvidia and Meta. You know, the usual “buy low, sell…eventually” advice. The thinking was simple: Nvidia makes the brains for all the robots that are going to take our jobs, and Meta… well, Meta is still figuring out what it is, but they have a lot of cash. Turns out, the market is a fickle beast. Both stocks went up, but not in a coordinated, pleasing-to-the-eye way. It’s like trying to get your kids to agree on a movie. One was the overachiever, the other…let’s just say it needed a little encouragement.

Nvidia popped a respectable 39% in 2025. Good job, Nvidia. Meta managed 13%. Which, in a normal year, would be fine. But last year, the S&P 500 decided to have a rave and climbed over 16%. So, Meta was… lagging. Still, I’m sticking with my picks. Think of it as a long-term commitment. Like a bad marriage, but with potentially better returns.

Nvidia

Honestly, what I wrote about Nvidia a year ago still applies. It’s like a rerun, but with slightly higher stakes. Their graphics processing units are still the gold standard for training AI. It’s the difference between using a slide rule and a supercomputer. And they’re launching the Rubin platform. Apparently, it lets companies train AI with fewer processors. Which is great, because processors are expensive. And frankly, who wants to count that many processors? It’s exhausting.

Wall Street was predicting 52% revenue growth for Nvidia. Now they’re predicting 52% again. It’s like they’re stuck in a time loop. The stock is trading at 40 times forward earnings, which is cheaper than it was before. So, that’s good. It’s like finding a slightly less expensive avocado. Still expensive, but a win nonetheless. In short, nothing’s changed except the price. It’s a no-brainer. Buy it. Before I do.

Meta Platforms

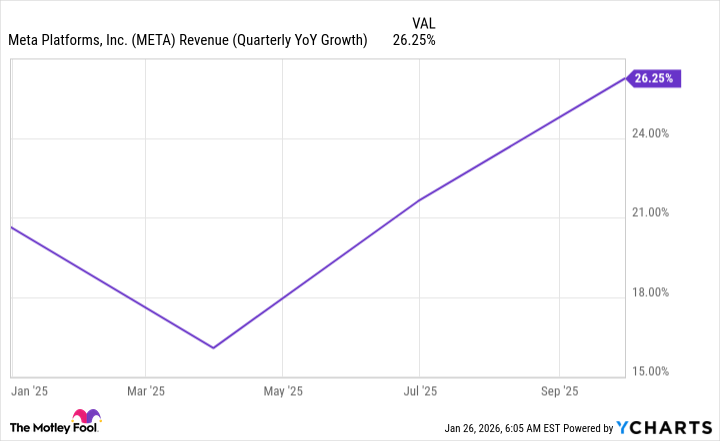

Meta’s base business did surprisingly well in 2025. Revenue up 26%? That’s…impressive. It’s like they accidentally stumbled into profitability. But the real drama is the spending. They’re throwing money at data centers like they’re trying to build a digital fortress. Wall Street is getting nervous. Which is understandable. It’s like watching someone play high-stakes poker with your retirement fund.

The stock is down 15% from its high. Which, let’s be honest, is just a fancy way of saying it’s having a bad day. The valuation is reasonable at 22 times expected earnings. But the market wants to know if all this AI spending will actually pay off. If it does, the stock could soar. If not, it’ll be stuck in a lower valuation range. It’s a classic risk-reward scenario. Like ordering the lobster at a roadside diner. Could be amazing. Could be…regrettable.

I still think Meta is a good buy at this price. It’s like scooping up a bargain. You might have to wait for it to rebound, but hey, patience is a virtue. Especially when you’re dealing with the stock market. And honestly, what else are you going to do with your money? Buy more avocados?

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Wuchang Fallen Feathers Save File Location on PC

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Crypto Chaos: Is Your Portfolio Doomed? 😱

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- 17 Black Actresses Who Forced Studios to Rewrite “Sassy Best Friend” Lines

- ‘Bad Guys 2’ Tops Peacock’s Top 10 Most-Watched Movies List This Week Again

- The Best Single-Player Games Released in 2025

- Brent Oil Forecast

2026-01-29 20:12